URD 2023

-

This Universal Registration Document was filed on 11 March 2024 with the AMF, as competent authority under Regulation (EU) 2017/1129, without prior approval pursuant to Article 9 of the said regulation.

The Universal Registration Document may be used for the purposes of an offer to the public of securities or admission of securities to trading on a regulated market if completed by a securities note and, if applicable, a summary and any amendments to the Universal Registration Document. The whole is approved by the AMF in accordance with Regulation (EU) 2017/1129.

This document is a translation into English of the Annual Financial Report/Universal Registration Document of the Company issued in French and is available on the website of the Issuer.

The Universal Registration Document is a copy of the official version of the Universal Registration Document which has been prepared in XHTML format and is available on the Issuer’s website.

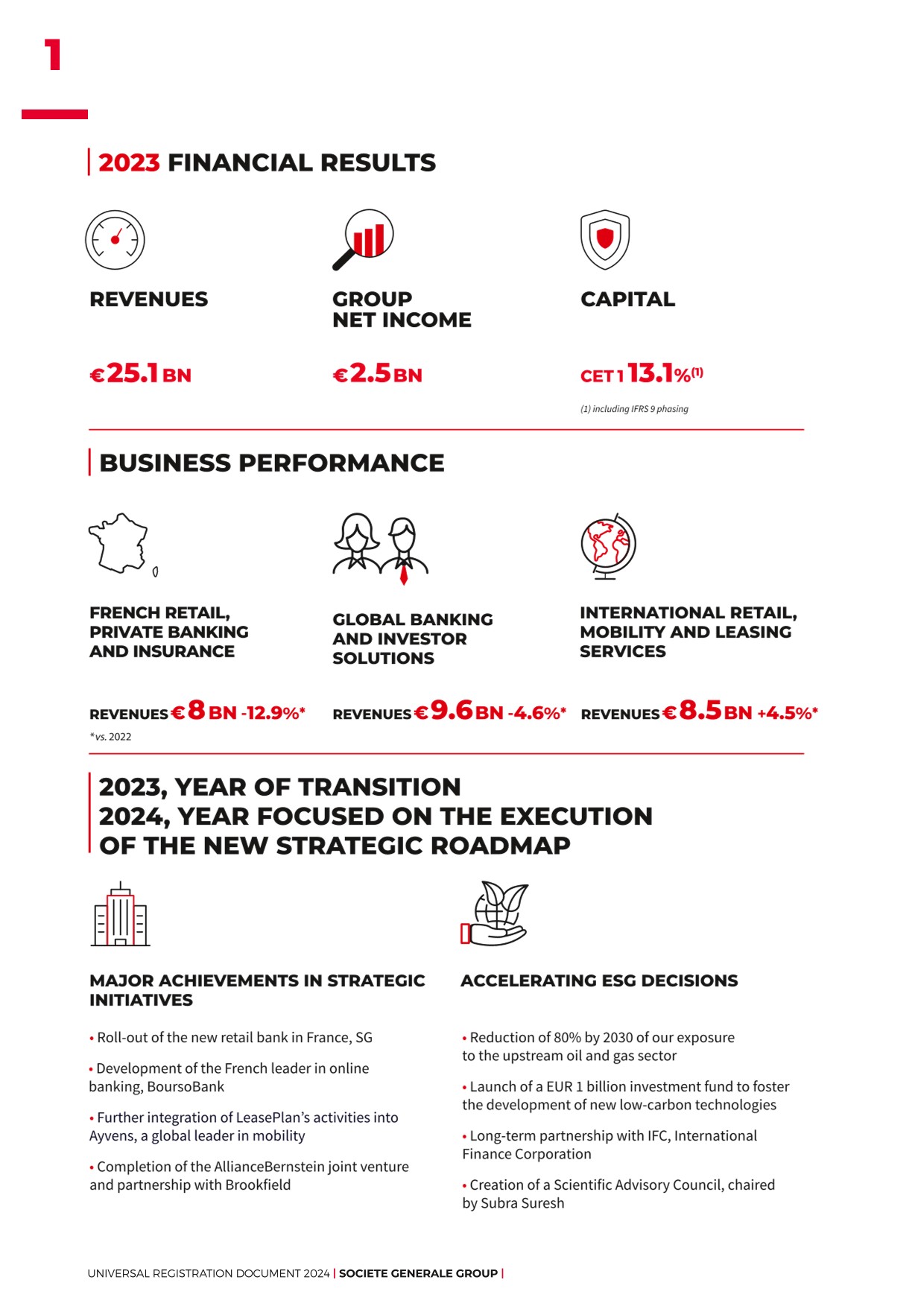

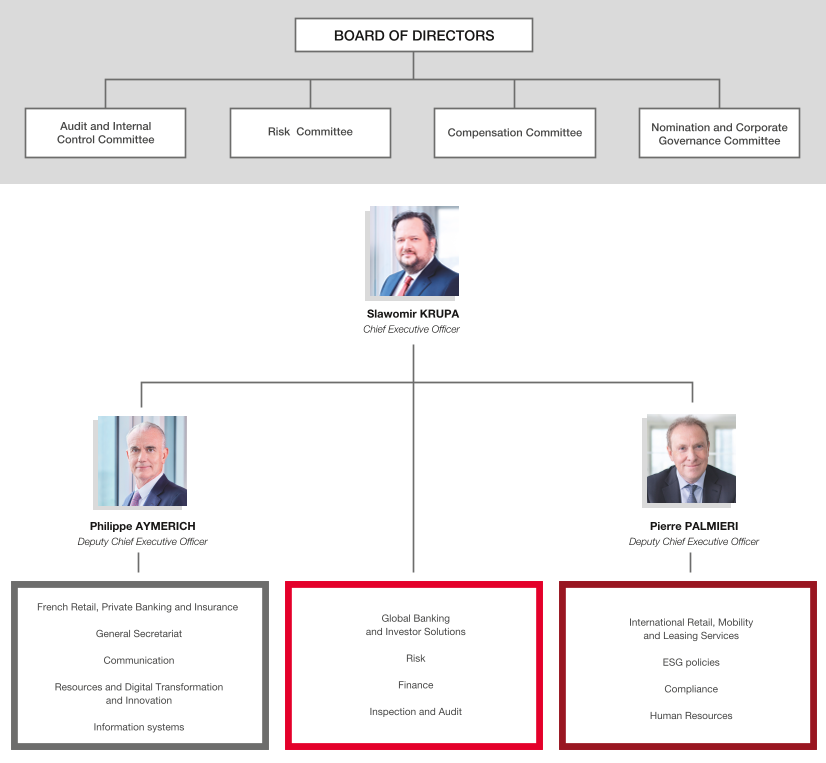

2023 was a year of managerial transition with Slawomir Krupa being appointed Chief Executive Officer of the Group on 23 May. The transition at the top management of the Group had been carefully prepared, under the aegis of the Board of Directors and its Nomination and Corporate Governance Committee. As soon as he was appointed, Slawomir Krupa put in place a new General Management and an experienced and gender-balanced Executive Committee which were immediately operational, and prepared a new strategic and financial plan that was presented last September with a view to making Societe Generate a top-tier, rock-solid and sustainable European bank.

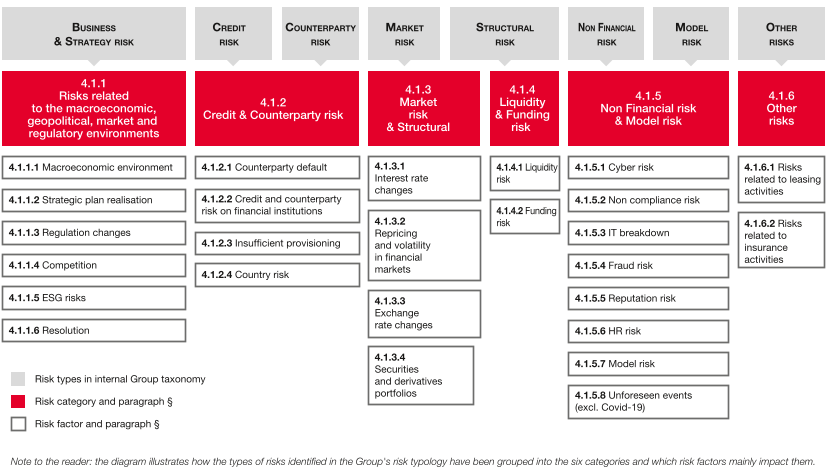

Being a rock-solid and sustainable bank is first and foremost about setting a goal for lasting strength and performance by adapting our business model, by optimising capital management and improving operational efficiency, while maintaining a disciplined and strict approach to risk. This is key to boosting our long-term flexibility and competitiveness.

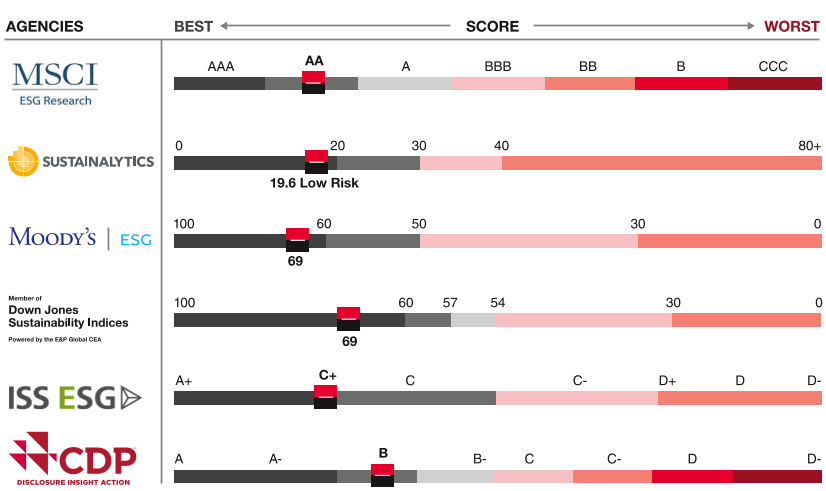

Accelerating our ESG ambitions is also a cornerstone of Societe Generale’s sustainable development strategy. The ESG expertise built by our Group over many years is well recognised. Supporting our clients on their decarbonisation pathway is an even more critical priority at a time when the economic risks associated with climate transition are intensifying. The pro-active commitments that we have made and the milestones achieved are well recognised by the main extra-financial rating agencies that have placed the Group among the top-ranking global banks.

2023 was also filled with strategic achievements such as the emergence of SG, the new retail bank in France, which involved the successful migration of information systems, and the creation of Ayvens, a global leader in sustainable mobility following ALD’s acquisition of LeasePlan. We also made significant strategic headway in the other Group businesses, notably by laying the groundwork to form the joint venture with AllianceBernstein in the cash equities and equity research business, and further developing the exceptional momentum at BoursoBank, which took the number of individual clients to over 6 million January 2024.

From the financial perspective, the results were contrasted, marked by very solid performances in Global Banking and Investor Solutions and International Retail Banking, the negative impacts of rising interest rates in French Retail Banking, which only started to ease in the fourth quarter of 2023, and by LeasePlan’s higher-than-expected integration costs. But it is important to emphasise that our disciplined management of costs, risks and capital have helped make the Bank more robust.

As our Group prepares to celebrate its 160th anniversary, the Board of Directors is confident of the ability of General Management and the Group’s staff to commit to serving clients, shareholders and the various stakeholders to embark on the new chapter that is opening up for Societe Generale, with the purpose of building together a better and sustainable future. ■

2023 was marked by the launch of a new strategic roadmap for Societe Generale designed to strengthen our Group by building on our solid foundations, with the aim of solidifying our position among Europe’s top-tier banks and creating long-term value for our various stakeholders.

From the moment we took office on 24 May 2023, the entire new Group management team and I immediately concentrated on our short-term priorities and on finalising the medium-term strategic roadmap that we presented last September.

After a 2023 of transition and transformation for our Group, a year that was both challenging in terms of performance and resolute in rolling out our strategic initiatives, 2024 will be a year focused on the execution of the Group’s new strategic medium-term plan.

Our strategy announced at the Capital Markets Day event is based on two key ambitions: rock-solid strength and sustainability. This means enhancing our commercial performance by paying constant attention to customer satisfaction and anticipating their needs, managing our capital selectively and proactively, and making structural cost reductions by improving efficiency and simplifying our organisation. This also means continuing our disciplined approach to risk management and fostering innovation. We have set interim targets for 2024 that will put us well on track to reach our medium-term targets by 2026.

2024 will also be crucial for achieving new milestones in our various strategic initiatives. Accelerating the rollout of our new retail banking model and winning new clients at BoursoBank will enable us to strengthen our positions in the French banking market. The creation of our joint venture with AllianceBernstein and our partnership with Brookfield will broaden our offering to corporate banking clients and investors. The further integration of Leaseplan’s activities into Ayvens will establish us as a world leader in mobility. We will also push further ahead with our portfolio review to focus on our core businesses and simplify the Group’s business model.

Maintaining our leadership in the ESG universe is clearly more than ever a linchpin of our strategy. The Group has accelerated its ESG ambitions for environmental transition to increase sustainable finance and reinforce our contribution to environmental imperatives and to the UN’s Sustainable Development Goals. We were again a pioneer in that domain and took ground-breaking and leading decisions based on our resolve to heavily reduce exposure to the oil and gas sector, define new decarbonisation targets for our businesses, and support development of new low-carbon technologies and solutions. To increase our positive impact, we signed new partnerships with The Ocean Cleanup and the International Finance Corporation (IFC), a member of the World Bank Group. Determined to lead by example, we also made another strong commitment to diversity, appointed the Chairman to our new Scientific Advisory Council and expanded our philanthropy programme. Societe Generale was the recipient of IFR’s prestigious Bank for Sustainability award in recognition of our leadership in this field. The rollout of our ESG ambitions is a major imperative and a continuous process.

With all the teams of SG, we are writing a new chapter in the history of our Group in a committed and responsible way. Leveraging a 160-year legacy through which we have assisted millions of clients, we can look confidently to the future. We have solid and differentiating assets that enable us to play an essential role, support major transitions of our stakeholders, help our clients’ ideas flourish, and assist their development and projects. Our contribution to their growth and to the achievement of their potential is, and will continue to be, a source of pride to us ■

-

Key figures

and profile of Societe Generale1.1History

On 4 May 1864, Napoleon III signed Societe Generale’s founding decree. Founded by a group of industrialists and financiers driven by the ideals of progress, the Bank’s mission has always been “to promote the development of trade and industry in France”.

Since its beginnings, Societe Generale has worked to modernise the economy, following the model of a diversified bank at the cutting edge of financial innovation. Its retail banking branch network grew rapidly throughout the French territory, increasing from 46 to 1,500 branches between 1870 and 1940. During the interwar period, the Bank became the leading French credit institution in terms of deposits.

At the same time, Societe Generale began to build its international reach by financing infrastructure essential to the economic development of a number of countries in Europe, Americas and North Africa. This expansion was accompanied by the establishment of an International Retail Banking network. In 1871, the Bank opened its London branch. On the eve of World War I, Societe Generale had a presence in 14 countries, either directly or through one of its subsidiaries. This network was subsequently expanded by opening branches in New York, Buenos Aires, Abidjan and Dakar, and by acquiring stakes in financial institutions in Central Europe.

Societe Generale was nationalised by law on 2 December 1945 and played an active role in financing the reconstruction of France. The Bank thrived during the prosperous post-war decades and contributed to the increased use of banking techniques by launching innovative products for businesses, including medium-term discountable credit and lease financing agreements, for which it held the position of market leader.

Societe Generale demonstrated its ability to adapt to a new environment by taking advantage of the banking reforms that followed the French Debré Acts of 1966-1967. While continuing to support the businesses it partnered, the Group lost no time in focusing its business on individual clients. In this way, it supported the emergence of a consumer society by diversifying the credit and savings products it offered private households.

In June 1987, Societe Generale was privatised with a successful stock market launch and shares offered to Group staff. The Group developed a universal banking strategy, in particular through its Corporate and Investment Banking activities, to support the worldwide development of its clients. In France, it expanded its networks by founding Fimatex in 1995, which later became Boursorama and now BoursoBank, currently France’s leading online bank, and by acquiring Crédit du Nord in 1997. Internationally, it established itself in Central and Eastern Europe through Komerčni banka in the Czech Republic and BRD in Romania while consolidating its growth in Africa, notably in Morocco, Côte d’Ivoire, and Senegal. Building on the professionalism of its teams and the relationship of confidence developed with its clients, the Bank continues its process of transformation by adopting a sustainable growth strategy driven by its core values of team spirit, innovation, responsibility and commitment.

In 2023, the Group completed two major strategic projects: the launch of the new French Retail Banking, SG, resulting from the merger of the two Societe Generale and Crédit du Nord networks, and the creation of Ayvens, a leader in sustainable mobility resulting from the acquisition of LeasePlan by ALD Automotive.

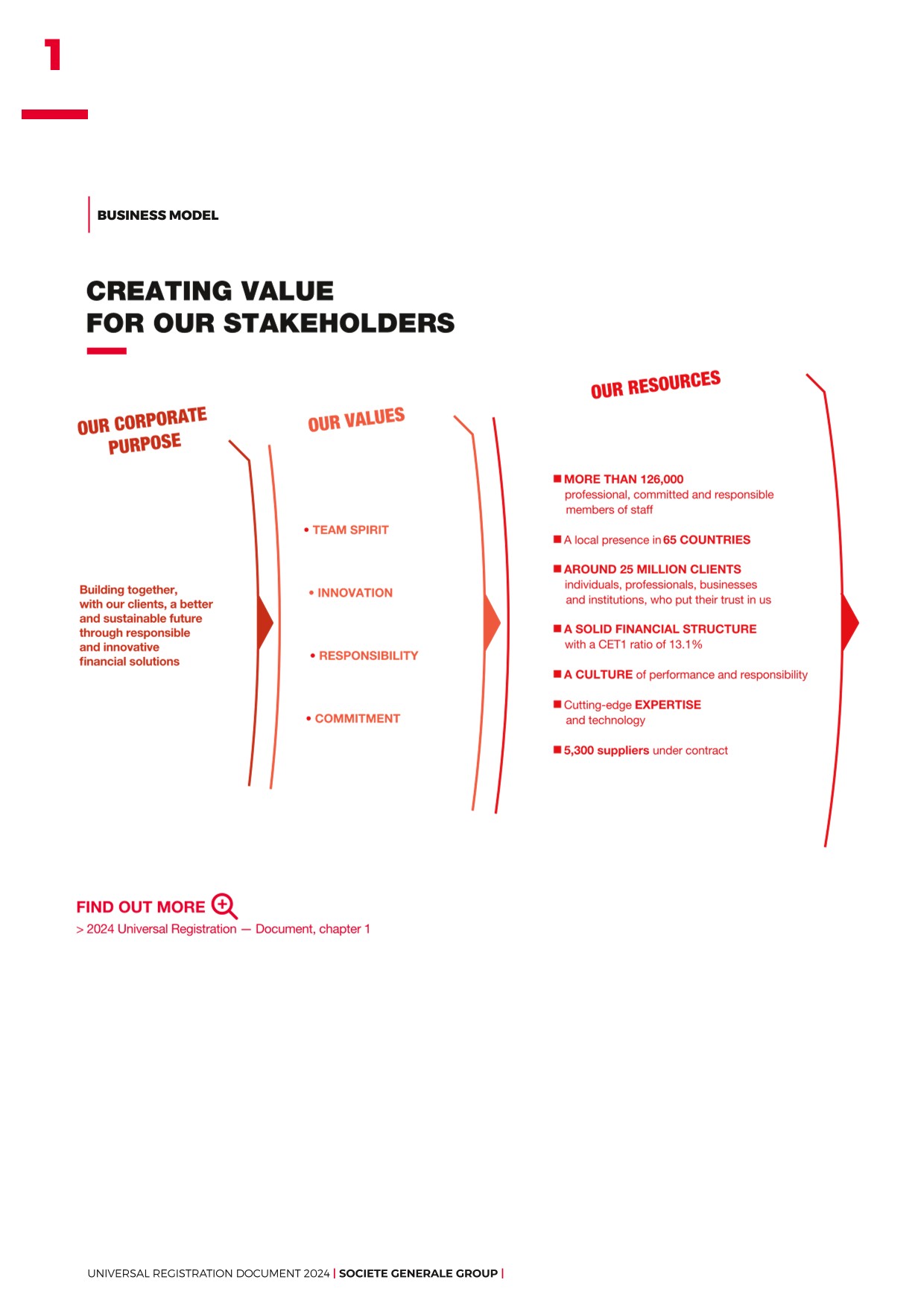

The Group currently employs more than 126,000 people(1) in 65 countries.

-

1.2Profile of Societe Generale

Societe Generale is a top-tier European Bank with more than 126,000 employees serving around 25 million clients in 65 countries across the world. We have been supporting the development of our economies for nearly 160 years, providing our corporate, institutional, and individual clients with a wide array of value-added advisory and financial solutions. Our long-lasting and trusted relationships with the clients, our cutting-edge expertise, our unique innovation, our ESG capabilities and leading franchises are part of our DNA and serve our most essential objective – to deliver sustainable value creation for our various stakeholders.

-

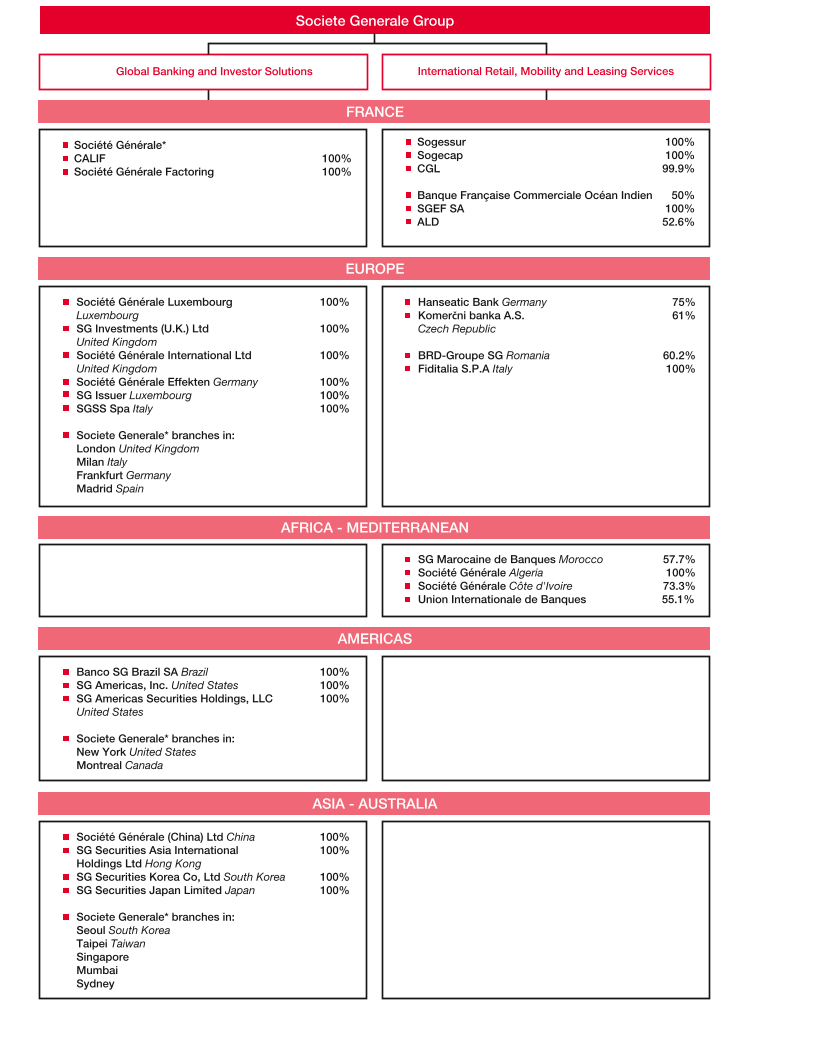

- ■Global Banking and Investor Solutions, a top-tier wholesale bank offering tailored-made solutions with distinctive global leadership in Equity Derivatives, Structured Finance and ESG;

- ■International Retail, Mobility and Leasing Services, comprising well-established universal banks (in Czech Republic, Romania and several African countries), Ayvens (the new ALD - LeasePlan brand), a global player in sustainable mobility, as well as specialised financing activities.

Committed to building together with its clients a better and sustainable future, Societe Generale aims to be a leading partner in the environmental transition and in sustainability overall.

The Group is included in the principal socially responsible investment indices: DJSI (Europe), FTSE4Good (Global and Europe), Bloomberg Gender-Equality Index, Refinitiv Diversity and Inclusion Index, Euronext Vigeo (Europe and eurozone), STOXX Global ESG Leaders indexes, and the MSCI Low Carbon Leaders Index (World and Europe).

KEY FIGURES

Results (In EURm)

2023

2022

2021

2020

2019

Net banking income

25,104

27,155

25,798

22,113

24,671

o.w. French Retail, Private Banking and Insurance

8,023

9,210

7,777

7,315

7,746

o.w. Global Banking and Investor Solutions

9,640

10,108

9,530

7,613

8,704

o.w. International Retail, Mobility and Leasing Services

8,507

8,139

8,117

7,524

8,373

o.w. Corporate Centre

(1,066)

(302)

374

(339)

(152)

Gross operating income

6,580

9,161

8,208

5,399

6,944

Cost/income ratio

73.8%

66.3%

68.2%

75.6%

71.9%

Operating income

5,555

7,514

7,508

2,093

5,666

Group net income

2,493

1,825

5,641

(258)

3,248

Equity (In EURbn)

Group shareholders’ equity

66.0

67.0

65.1

61.7

63.5

Total consolidated equity

76.2

73.3

70.9

67.0

68.6

ROTE

4.2%

2.5%

11.7%

-0.4%

6.2%

Common Equity Tier 1(1)

13.1%

13.5%

13.7%

13.4%

13.3%

Risk Weighted assets (In EURbn)

388.8

362.4

363.4

351.9

345.0

- ( 1 ) Figures based on CRR2/CRD5 rules, including IFRS 9 phasing.

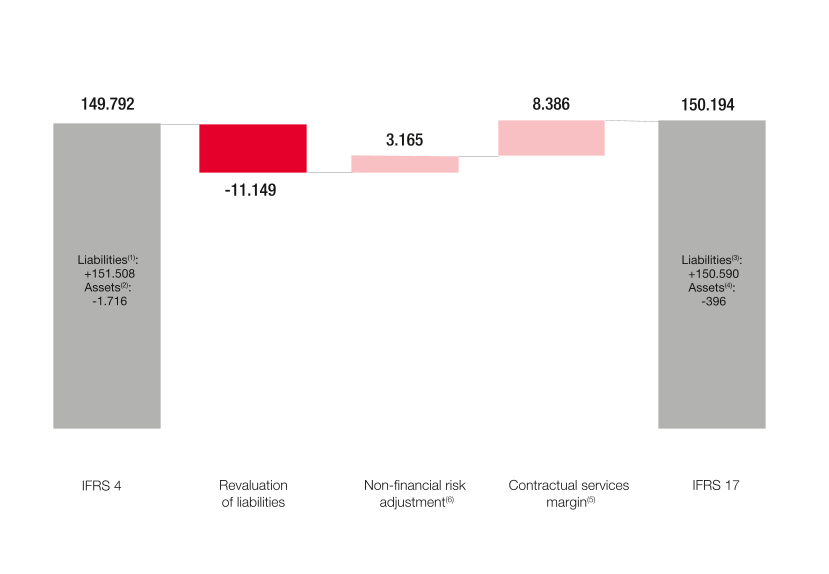

Note: 2022 figures restated in compliance with IFRS 17 and IFRS 9 for insurance entities. Definitions and potential adjustments presented in section 2.3.6 / Definitions and methodology, alternative performance measures on pages 2.3.6.

-

1.3A clear strategy for a sustainable future

The Group’s ambition is underpinned by a clear strategy and roadmap for a sustainable future: to become a rock-solid bank that fosters solid and sustainable performances that contribute to sustainable development objectives.

To further strengthen the Bank's financial profile is a core priority for the Group. This will notably be achieved by continuing to improve the Group's capital ratio, with a target CET1 ratio of 13% under Basel IV set for 2026. To achieve this target, the Group will allocate and use its capital effectively, improve operational efficiency and simplify its portfolio based on a consistent, integrated and synergy-centric business model leveraging its core franchises, while maintaining best-in-class risk management.

The Group intends to leverage high-performance, sustainable businesses with a robust diversified banking model suited to the needs of around 25 million corporate, institutional and individual clients, structured around three core businesses:

- ■French Retail, Private Banking and Insurance;

- ■Global Banking and Investor Solutions;

- ■International Retail, Mobility and Leasing Services.

In French Retail, Private Banking and Insurance, the Group intends to take advantage of the new operating model of its new SG network to boost synergies with the Insurance and Private Banking activities while improving operating efficiency, and accelerate BoursoBank's development with the aim of reaching 8 million clients by 2026 and enhancing long-term value creation. Leveraging a high-impact value offer, the Group intends to be the partner of choice for businesses, professionals and high net worth clients, as well as for digital clients, and at the same time be a responsible bank for its various counterparties.

For the Global Banking and Investor Solutions businesses, the Group is pursuing with the strategy initiated in 2021 that seeks to further enhance the sustainability and profitability of its model. Building on its positioning as a top-tier European player and trusted partner for its global banking clients, the Group intends to unlock greater value from its leading franchises, notably through innovative action, while continuing to improve operating efficiency and optimising its resources, particularly capital. Recent partnerships with AllianceBernstein and Brookfield are merely two examples of the Group’s ability to create innovative solutions to broaden the offering and value proposition for its clients.

The International Retail, Mobility and Leasing Services' main objective is to deliver sustainable performances that exceed the cost of capital, notably by implementing a more compact and efficient model that also offers first-rate client experience. The Group is aiming to become a world leader in the mobility ecosystem through its mobility and leasing activities, chiefly through Ayvens, following the finalisation of ALD's acquisition of LeasePlan.

The Group’s main priority is to press further ahead with its commercial development, furnishing quality service, value-added and innovation to enhance client satisfaction. Its aim is to become a trusted partner for its clients, making sound use of its digital capabilities to provide them with responsible and innovative financial solutions. To this end, the Group is pursuing various digital transformation and operational efficiency initiatives.

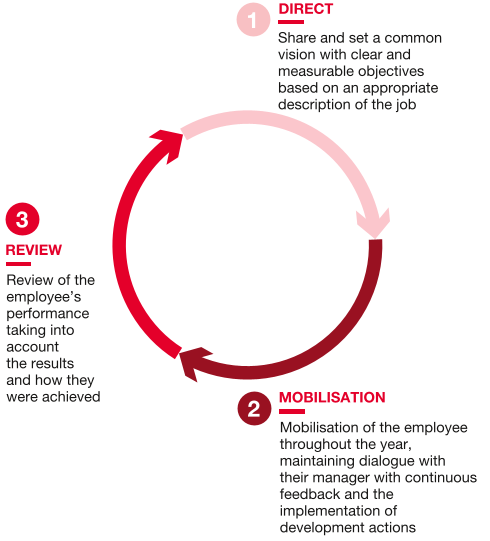

Another priority for the Group is to foster a culture of performance and accountability. To this end, it has set targets to increase its employee engagement score, reduce the gender pay gap and promote diversity in senior leadership roles. The Group has also adjusted its financial reporting principles to embed greater accountability.

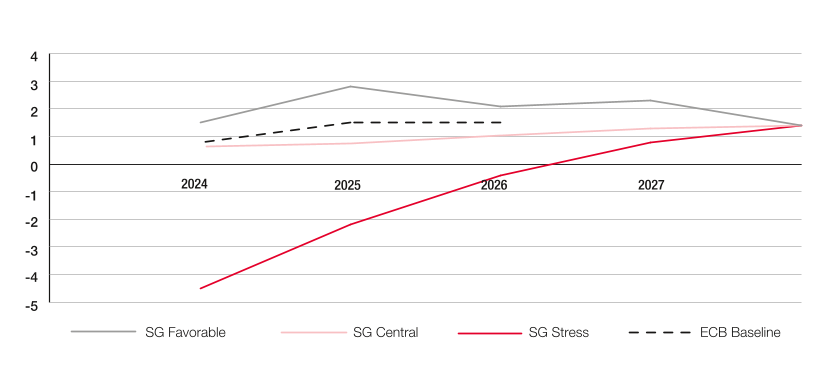

The Group is fully committed to the strategic initiatives presented in September 2023 and has set the following main financial targets:

- ■a robust CET1 ratio at 13% under Basel IV in 2026;

- ■average annual revenue growth of between 0% and 2% over 2022-2026;

- ■increased operational efficiency, with a cost-to-income ratio below 60% in 2026;

- ■cost of risk within the 25-30 basis-point range over 2024-2026;

- ■return on tangible equity (ROTE) between 9 and 10% in 2026;

- ■a Liquidity Coverage Ratio (LCR) of at least 130% and a Net Stable Funding Ratio (NSFR) of at least 112% throughout the cycle;

- ■a Non-Performing Loans (NPL) ratio target of 2.5-3% in 2026;

- ■a leverage ratio of 4-4.5% throughout the cycle;

- ■an MREL ratio equal to at least 30% of risk-weighted assets (RWA) throughout the cycle;

- ■application of a sustainable distribution policy, based on a payout ratio range between 40% and 50% of reported net income(2) with a balanced distribution mix between cash dividends and share buybacks from 2024 onwards.

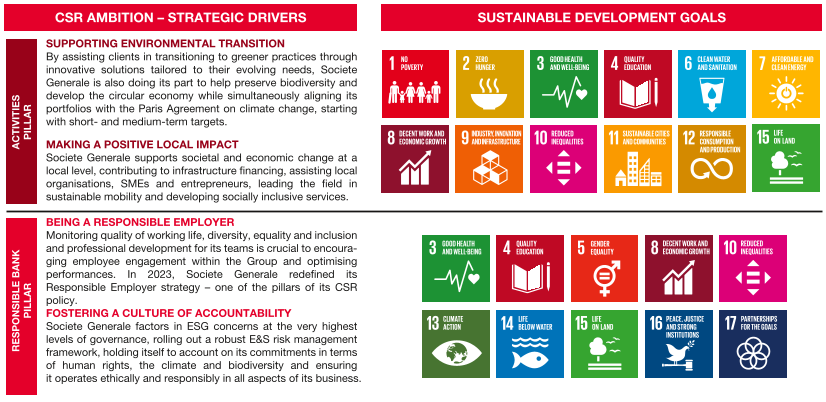

Being an ESG leader

In a world faced with climate change, environmental imperatives and shifting societal norms, a a bank like Societe Generale has a crucial role to play. Mindful of its corporate purpose, Societe Generale has placed ESG concerns front and centre of its ambition to become a rock-solid and top-tier sustainable European bank.

Transitioning to sustainable, low-carbon economies presents complex and multifarious challenges for all economic operators. Tackling them requires a holistic approach that looks beyond the economic effects to also encompass the strategic, technological, geopolitical and social impacts of the transition. The Group firmly believes in the need to work together on this. It is committed to supporting its clients in their transition process and to working hand in hand with its various stakeholders.

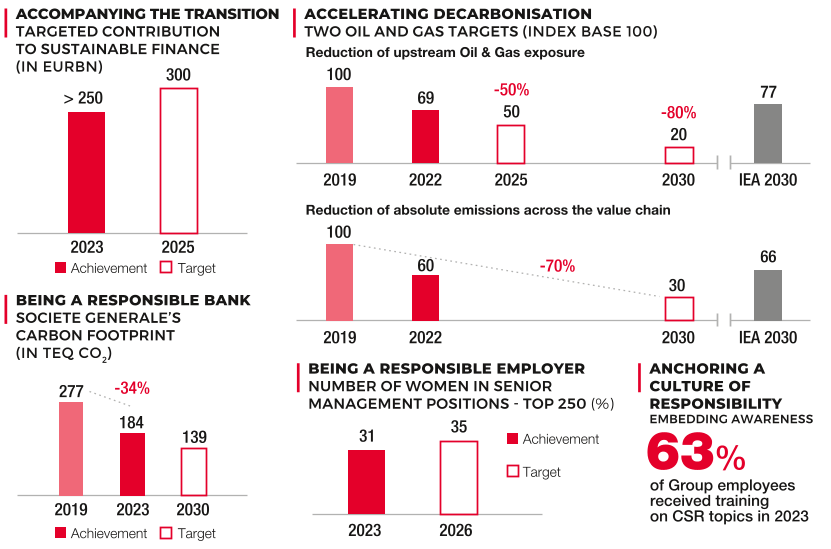

As part of these efforts, Societe Generale has pledged EUR 300 billion to develop sustainable finance out to 2025 and offers its clients a range of financing and investment solutions designed their changing needs. Naturally, the Group must also look inwards if it is to live up to its promise of supporting clients in their transitions and satisfying stakeholder expectations: it continues to pursue its own transition and factors environmental and social considerations into decision-making processes Group-wide.

When presenting its 2026 strategic plan in September 2023, the Group highlighted a series of far-reaching measures to reaffirm its commitment as a top-tier operator in the transition to a sustainable world. ESG considerations are of critical importance and form the linchpin of the Group’s roadmap and the strategic trajectories of its various businesses.

The Group also announced that it is accelerating the decarbonisation of its activities with O&G exploration and production reduction targets and diligent decarbonisation of emission-intensive sectors. As a founding member of the Net Zero Banking Alliance (NZBA), launched in 2021 as part of the United Nations Environment Programme Finance Initiative (UNEP-FI) which is composed today of 130 banks, the Group has already set alignment targets for nine sectors out of 12 to align its financing portfolios with trajectories compatible with the Paris Agreement’s climate goals, starting with short- and medium-term targets.

The three core themes of the Group’s environmental strategy are supporting clients in their transitions, managing the climate impact of its own activities and addressing environmental risk factors. This entails adapting its businesses, capitalising on its sector-specific expertise to offer clients customised support and develop innovative solutions. Not satisfied with simply financing existing technologies, the Group intends to position itself as a partner for emerging operators who are developing new technologies and experimenting with new ways of doing business.

This has prompted the Group to increase investment in groundbreaking partnerships and solutions to amplify its impact. And it is not doing so alone: aware of the value of international cooperation and outside expertise, it is strengthening its partnership with the International Finance Corporation (IFC) – a member of the World Bank Group – on sustainable finance projects. It has also announced the creation of a Scientific Advisory Council to contribute expert opinions on topics relating to climate, nature, social issues and sustainable development. Another announcement concerns the launch of a new EUR 1 billion transition investment fund to support transition champions, green technologies, nature-based solutions and impact finance projects. The fund offers further opportunities for positive action, notably by supporting new actors in the transition sector.

Last, embedding a culture of accountability and being a responsible employer are also priorities for the Group. In terms of gender diversity, it has decided to allocate EUR 100 million to reduce the pay gap between men and women. Also working along these lines, Societe Generale aims to get women into at least 35% of its Top 250 senior managerial positions worldwide by 2026.

The Group is deeply committed to the United Nations’ Sustainable Development Goals. This is reflected in the four strategic themes of its CSR ambition, each of which contributes to a number of the SDGs. The first two themes – Environmental Transition and Positive Local Impact – form the pillars of the Group’s transition efforts. The other two – Responsible Employer and Culture of Accountability – form the framework of responsible banking.

The Group’s businesses have all included ESG in their strategic roadmaps. Leveraging its regional footprint, French Retail Banking's ambition is to furnish support to its individual, corporate and local authority clients in their environmental transitions by developing a comprehensive range of ESG solutions. Likewise, Global Banking and Investor Solutions intends to remain the most innovative provider of ESG solutions. Meanwhile, International Retail Banking is seeking to position itself as a leader in ESG across all its regions worldwide. Last Ayvens, the Group’s new vehicle leasing subsidiary, is focusing on three ways to advance sustainable mobility: advising clients on greener mobility options, facilitating the switch to EVs and offering integrated Mobility-as-a-Service (MaaS) solutions.

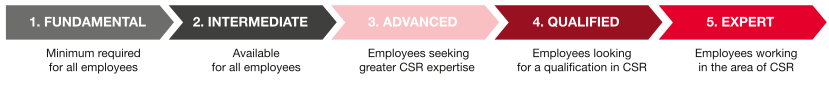

Addressing these new challenges demands wide-sweeping change within the Group. CSR can no longer be the sole preserve of experts; a major considerable awareness-raising and upskilling campaign is required to tackle the challenges of transition. As such, the Group is rolling out an extensive in-house training programme.

As a responsible bank, the Group is maintaining its target to cut own-account CO2 emissions by -50% by 2030. This awareness of its responsibilities is also reflected in the Societe Generale Foundation’s work, with plans to boost sponsoring of cultural, educational and into-work initiatives.

The Group’s capacity for innovation across all businesses, its commitment to international coalitions to establish new standards and a firm grasp of its responsibilities as a bank are essential to consolidating the Group's leadership position. The strong commitments made in its 2026 strategic plan, the operational implementation of its CSR ambition and its ESG risk factor management are helping the Group move forward with its transformation, develop new processes and solutions to effect change and dial up its transition efforts.

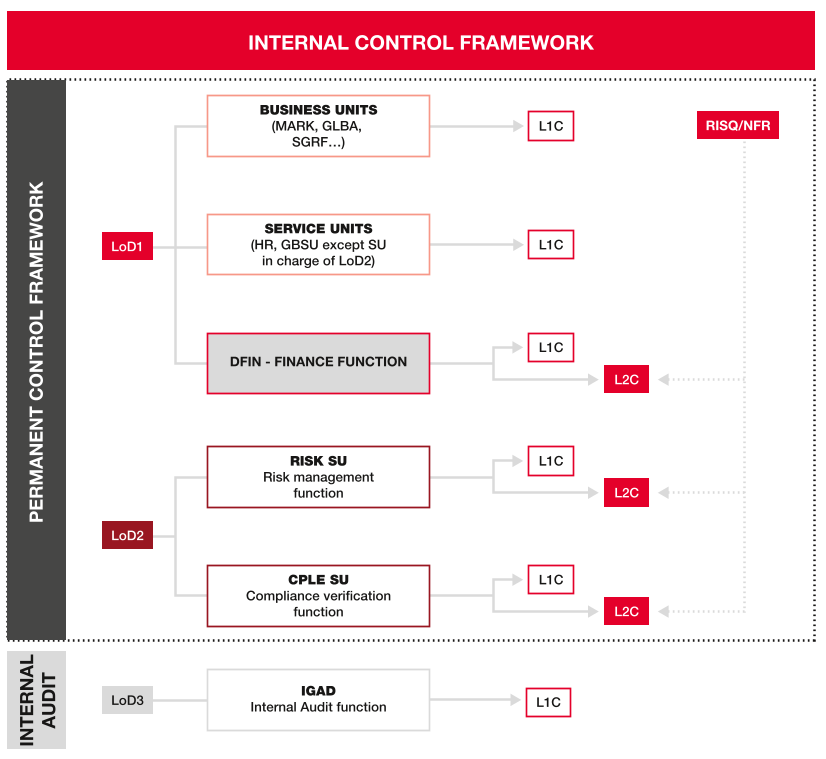

The Group's aim is to remain a pioneer in this field, preparing for the future by developing expertise in areas such as the circular economy, nature conservation and water management. It continues to foster a Group-wide culture of responsibility and to strengthen its internal control framework, especially its Compliance operations, to meet the banking industry’s highest standards. It has now completed the rollout of its Culture & Conduct programme, embedding rules of conduct and strong shared values throughout the entire organisation.

-

1.4The Group’s core businesses

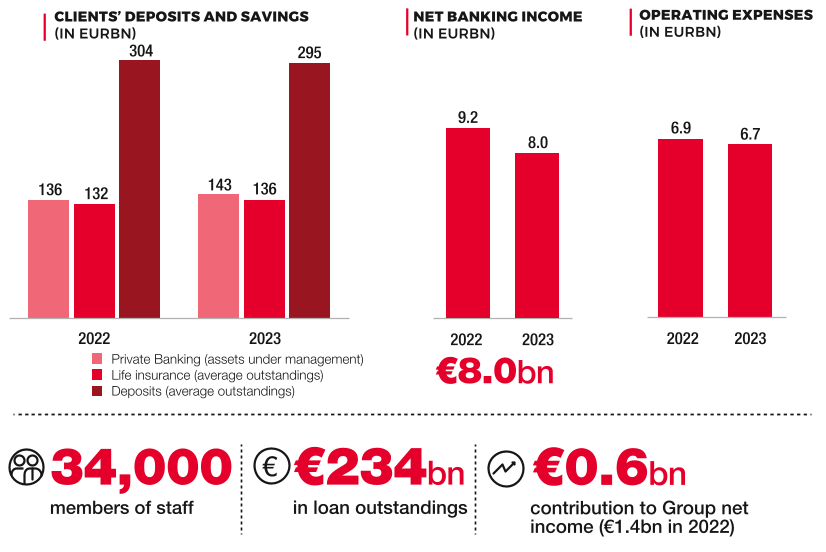

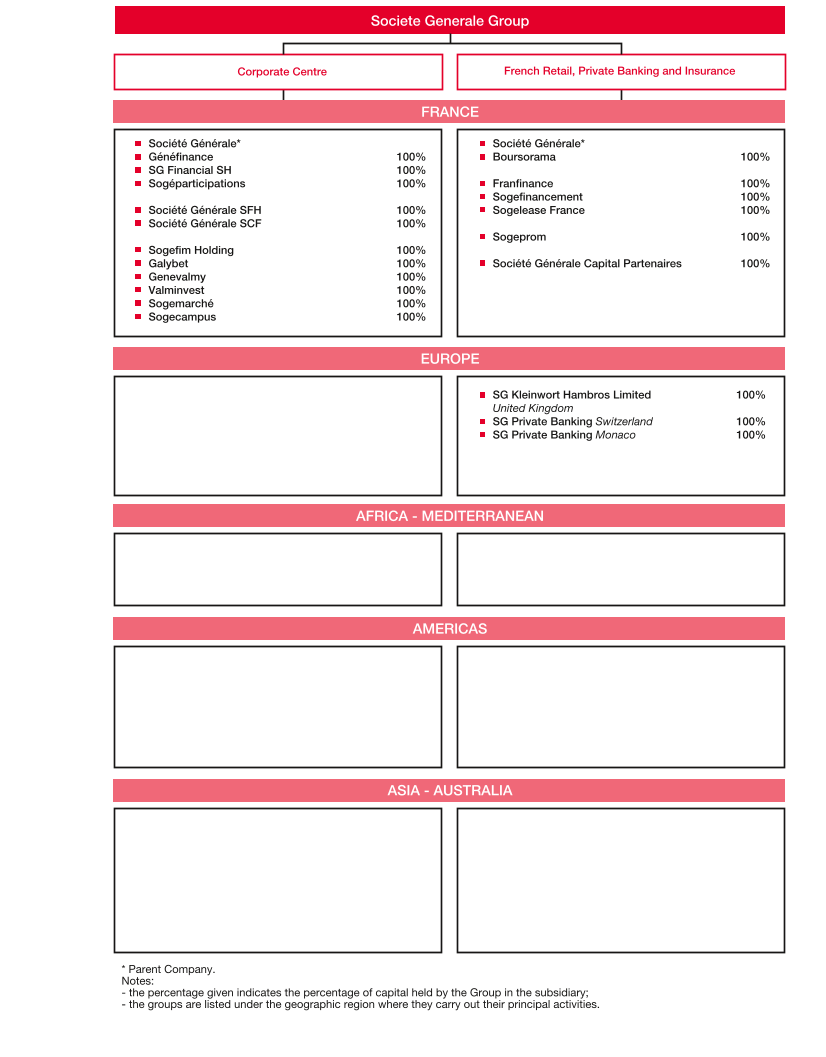

1.4.1French Retail, Private Banking and Insurance

In May 2023, French Retail Banking activities (SG Network and BoursoBank) were housed together with those of Private Banking and Insurance under the one banner in a bid to optimise synergies between businesses and offer a large suite of products and services adapted to the needs of a diversified client base – retail, professional and corporate clients, as well as non-profits and municipalities – seeking varied expertise.

- ■the creation of the new bank SG resulting from the successful merger between the Societe Generale network and Crédit du Nord. After a large-scale IT migration process in the spring of 2023, the new relational model is being rolled out by strengthening our regional foothold, expertise and responsiveness. It is also capitalising on a strengthened CSR commitment;

- ■the number of Boursorama (now BoursoBank) clients reaching the 5 million mark;

- ■solid commercial and financial performances from the Private Banking and Insurance businesses that give further value to our suite of products and services with clients of the Retail Banking networks.

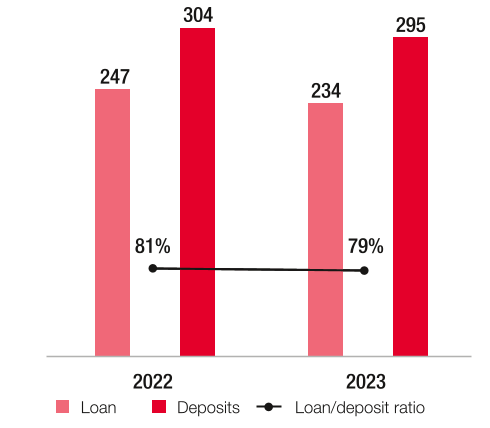

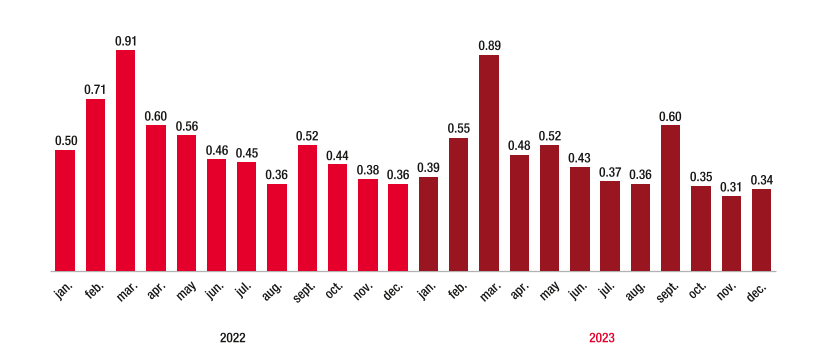

Our networks continue to support the economy and assist our clients with their financing projects despite a decrease in average loan outstandings in the networks from EUR 247 billion in 2022 to EUR 234 billion in 2023 in a context of climbing interest rates. At the same time and amid intense competition particularly in the corporate segment, deposit outstandings decreased by -3% to EUR 295 billion at the end of December 2023.

SG Network in France

The SG Network France offers solutions tailored to the needs of nearly 9 million individual, professional, non-profit and corporate clients, representing EUR 217 billion in annual average outstanding deposits and EUR 201 billion in outstanding loans in 2023.

- ■around 1,700 main branches located predominantly in urban areas where a large proportion of national wealth is concentrated;

- ■an exhaustive and diversified range of products and services, ranging from savings vehicles and asset management solutions to corporate finance and payment means;

- ■a comprehensive and innovative omnichannel system offering Internet, mobile, phone and service platforms.

The system is the result of the legal merger of the French Retail Banking networks of Societe Generale and Crédit du Nord on 1 January 2023.

The migrations of Crédit du Nord’s IT system towards Societe Generale’s information system were successfully carried out in a two-stage process during the first quarter of 2023 and on schedule.

The strategic objectives set out in the programme to bring the networks closer together focus on four major areas:

- ■a bank with a local foothold across 11 regions: decisions will be predominantly taken at regional level and on an increasing basis directly in agencies and business centres;

- ■a more responsive, accessible and efficient bank with the launch of programmes to simplify internal procedures and optimise customer pathways;

- ■a bank that gears itself more to the specific needs of each client category: a bank that offers expertise, with resources increasingly focused on the specific requirements of the various client categories, notably with the creation of a wealth management bank, across-the-board presence of a dedicated advisor for professional clients – covering both their personal and professional banking needs – and more experts throughout France to deal with the full scope of their savings, insurance and advisory concerns.

- In 2023, Societe Generale continued to expand its network and increase its service offering in response to clients’ requirements. These efforts have focused in particular on increasing the use of electronic signatures and the continued development of digital applications for retail, private banking, professional and corporate markets;

- ■a responsible bank: the Societe Generale network makes sustainable development the linchpin of its strategy. It offers to support all clients in their energy transition: in each region, a regional CSR manager provides expertise to SMEs, non-profit organisations and local authorities, offering a comprehensive range of advice and financing solutions designed with benchmark partners.

- Retail clients could also avail themselves in 2023 of an energy renovation programme that includes diagnosis, building work and financing, on top of a dedicated range of savings products. Irrespective of their profile, the Bank also offers to measure clients’ greenhouse gas emissions, in partnership with Carbo.

BoursoBank

Boursorama is a subsidiary of Societe Generale, and a pioneer and leader in France for its three main businesses: online banking, brokerage and online financial information at boursorama.com, ranked No. 1 for economic and stock market news. An online bank accessible to all, without any revenue or financial wealth prerequisites, BoursoBank’s promise is the same as it was when it was first created, which is to simplify clients’ lives at the most competitive price and furnish the best service possible to boost their purchasing power.

At end-2023, BoursoBank served 5.9 million clients, which is a +26% increase in the space of a year, after a 41% rise in 2022. This growth has been matched by an increase in the bank’s total outstandings of EUR 6 billion over the period, for a total of around EUR 71 billion at end-December 2023, including approximately EUR 15 billion in loans, around EUR 34 billion in current accounts, around EUR 13 billion in off-balance sheet savings (life insurance) and around EUR 9 billion in share securities).

- ■the number of BoursoBank clients passing the 5 million mark midway through the year. Most of the targets of the prior strategic plan were met two and half years ahead of schedule;

- ■rebranding in October, making the bank’s name simpler. Boursorama Banque is now known as BoursoBank, but the portal name will remain boursorama.com;

- ■profitability of almost EUR 50 million in the second quarter, lending weight to the underlying economic model;

- ■B Corp certification, an international standard attesting to the fact that Societe Generale meets social and environmental performance, transparency, and accountability standards towards the public.

Over and above its successful mainstream banking offer, BoursoBank provides an increasingly wide range of products and services that in 2023 included the launch of:

- ■Banque au Quotidien: the launch of a BoursoPrime service which enables clients who subscribe to the offer to make use of the multiple advantages on all aspects of the offer, notably a cashback offer on all bankcard (CB) expenditure;

- ■savings: against the backdrop of increasing interest rates, a term account and a second savings account were launched (Bourso+). Cumulative net inflows on these two products totalled around EUR 6 billion in 2023;

- ■loans: an “ecoresponsible” mortgage loan offer was launched;

- ■a more comprehensive Beyond the Bank offer was introduced that generates larger business volumes via The Corner platform that again doubled in 2023 to reach EUR 300 million.

Boursorama was voted the least expensive bank for the 16th consecutive year (source: Le Monde/Panorabanque 2023) and France’s preferred bank for digital banking (source: Opinionway 2023). The online bank was ranked No. 1 on app stores, with a rating of 4.9/5 on iOS and 4.8/5 on Android. It boasts a Net Promoter Score of +36 for the sector (source: Bain and Company – January 2023).

Its online portal, www.boursorama.com, is consistently ranked the No. 1 website for online financial and economic information, and receives around 50 million visits a month for almost 300 million page views (Source ACPM – September 2023).

BoursoBank generally attracts young clients – the average age is 35 – who are city dwellers, who work and are financially stable. The average client outstanding is around EUR 13,000 (savings and loans). Against an overall backdrop of accelerated growth, the acquisition of private banking clients also continues to rise amid a rapid acceleration in growth. BoursoBank also continues to push ahead with optimisation and rationalisation efforts. It notably registered an annual decrease in IT costs per client of around 20%, whereas its headcount has increased by a mere 6% per year since 2017, in contrast to the number of clients by employee which has increased on average by almost 30% per year.

Societe Generale Private Banking

Societe Generale Private Banking has an extensive foothold in Europe and offers global financial engineering and wealth management solutions, in addition to global expertise in structured products, hedge funds, mutual funds, private equity funds and real estate investment solutions. It also offers clients access to capital markets.

Since January 2014 and in conjunction with the French Retail, Private Banking and Insurance core business, Societe Generale Private Banking has extensively modified its relationship banking model in France by extending its services to all individual clients with more than EUR 500,000 in their accounts.

Societe Generale Private Banking also created a Wealth Investment Services centre of expertise in 2022, thereby becoming a genuine one-stop shop that houses unique expertise within the Group to design investment and open-architecture solutions. It consolidates the management and structuring skills offered by Investment Management Services, the Market Solutions teams in charge of market solutions and the management entities of SG 29 Haussmann(5) in France and SGPWM(6) in Luxembourg that have been housed in Societe Generale Private Banking following the Lyxor disposal at the end of 2021.

2023 was dominated by the legal and IT merger of the Societe Generale retail bank and Crédit du Nord. As a result, Societe Generale Private Banking welcomed new clients from Crédit du Nord in France and in Monaco in its network. The project enabled Private Banking to strengthen its local foothold and also capitalise on its national reputation.

Societe Generale Private Banking’s offering is available from three main centres: SGPB France, SGPB Europe (Luxembourg, Monaco and Switzerland) and Kleinwort Hambros (London, Jersey, Guernsey and Gibraltar). At the end of 2023, Private Banking held EUR 143 billion in assets under management.

Societe Generale was the recipient of around 30 awards in 2023 acclaiming the quality of its service and the depth of its high-value offering (Euromoney, Private Banker International, WealthBriefing, etc.).

Societe Generale Assurances

Societe Generale Assurances lies at the core of Societe Generale Group’s development strategy, in synergy with its retail banking, private banking and financial services businesses. Societe Generale Assurances also pursues the expansion of its distribution model through the development of external partnerships.

Societe Generale Assurances offers a full range of products and services to meet the needs of individual, professional and corporate clients in Life Insurance Savings, Retirement Savings and Personal Protection businesses.

Leveraging the expertise of its 3,000 employees (FTE), Societe Generale Assurances combines financial strength with dynamic innovation and a sustainable development strategy to be a trusted partner for its clients. Gross premiums stood at EUR 13 billion in 2023, with the share of unit-linked (UL) funds totalling 38%. Outstandings in life insurance investment solutions reached EUR 136.2 billion at end-2023, up by 3.5%, of which UL funds accounted for 38%. Business is increasing in the personal protection and property and casualty lines, with growth accelerating by 3.6% compared to 2022.

In 2023, Societe Generale Assurances pushed ahead with its bid to assist and protect the clients of Group networks by stepping up the development of digital sales tools and its phygital dimension. It also accelerated the pace of digital client journeys by optimising data and client behaviour knowledge.

Societe Generale Assurances also continued diversifying its business model, which is a proven high-potential growth driver in both the life insurance and personal protection areas, in synergy with the Group’s other businesses, such as Ayvens, BoursoBank and with external partners.

As one of the dominant players in the retirement savings market in France, Societe Generale Assurances offers cross-business products to meet the needs of individual clients, corporate clients and their employees through customised solutions, simple and easy-to-use digital pathways, innovative and tailor-made services and bespoke assistance.

The financial strength of Societe Generale Assurances was confirmed by S&P Global Ratings which upgraded Sogécap’s long-term credit rating from BBB+ to A-, and the hybrid debt issue rating from BBB to BBB+.

Societe Generale Assurances actively endorses a policy to strengthen its CSR commitments, vowing to make Corporate Social Responsibility (CSR) a differentiating factor in its strategy. It has divided its policy into three areas: Being a Responsible Insurer, Being a Responsible Investor and Being a Responsible Employer. A host of actions have been rolled out both in relation to the Group’s investment policy – signing the Finance for Biodiversity Pledge, limiting non-conventional oil and gas funding, developing green investments and creating an energy efficiency plan – and to the products on offer, such as a responsible UL offering, giving the “Positive Insurance” certification to ten of its protection products. In addition, the Group has embedded the ESG dimension into all its activities making it the bedrock underpinning all its activities and processes (“ESG by design”).

-

Group management report

2.1Societe Generale Group’s main activities

-

2.2Group activity and results

Definitions and details of methods used are provided on page 2.3.6 and following.

Information followed by an asterisk (*) is indicated as adjusted for changes in Group structure and at constant exchange rates.

2022 data in this document are restated in compliance with IFRS 17 and IFRS 9 for insurance entities 2022 data are restated in compliance with IFRS 17 and IFRS 9 for insurance entities (see Note 1.4 of the consolidated financial statements, page Note 1.4 and following).

Analysis of the consolidated income statement

(In EURm)

2023

2022

Change

Net banking income

25,104

27,155

-7.6%

-8.2%*

Operating expenses

(18,524)

(17,994)

+2.9%

+0.6%*

Gross operating income

6,580

9,161

-28.2%

-25.8%*

Net cost of risk

(1,025)

(1,647)

-37.8%

-30.8%*

Operating income

5,555

7,514

-26.1%

-24.8%*

Net income from companies accounted for by the equity method

24

15

+60.0%

+26.8%*

Net profits or losses from other assets

(113)

(3,290)

+96.6%

+96.6%*

Impairment losses on goodwill

(338)

0

n/s

n/s

Income tax

(1,679)

(1,483)

+13.2%

+15.9%*

Net income

3,449

2,756

+25.2%

+28.4%*

o.w. non-controlling interests

956

931

+2.7%

+7.1%*

Group net income

2,493

1,825

+36.6%

+39.1%*

Cost-to-income ratio

73.8%

66.3%

Average allocated capital

56,396

55,282

ROTE

4.2%

2.5%

Net banking income

Revenues in French Retail, Private Banking and Insurance contracted by -12.9% relative to 2022, mainly due to the negative impact from short-term hedges taken before the period of rising interest rates that occurred as of 2022.

Activity at Global Banking and Investor Solutions decreased by -4.6% despite solid revenues of EUR 9.6 billion in 2023. Global Markets and Investor Services contracted by -6.3% vs. 2022 owing to an unfavourable base effect compared with a record year for market activities in 2022. The Financing and Advisory busines posted high revenues of EUR 3,341 million in 2023, down slightly by -1.4% vs. 2022.

Revenues for International Retail, Mobility and Leasing Services rose by +4.5% vs. 2022 on back of stable activity levels in International Retail Banking despite the disposal of the business in Russia and a sharp increase in Mobility and Leasing Services actitivities (+9.3%) that was driven by the LeasePlan integration in ALD.

Revenues for the Corporate Centre totalled EUR -1,066 million in 2023 compared with EUR -302 million in 2022, notably due to the impact of the unwinding of hedges on TLTRO operations and non-recurring items.

Operating expenses

In 2023, operating expenses totalled EUR 18,524 million, up by a moderate +2.9% vs. 2022. They include EUR 617 million for the integration of LeasePlan's activities and EUR 730 million in transformation costs. At constant perimeter, operating expenses rose by a very moderate +0.3% in spite of the inflationary context.

Cost of risk

The Group’s provisions on performing loans amounted to EUR 3,572 million, down EUR -197 million relative to 31 December 2022, notably linked to the strong decrease in the Russian offshore exposure.

The gross coverage ratio stood at 2.9%(1) at 31 December 2023. The net coverage ratio on the Group’s doubtful loans stood at around 80%(2) at 31 December 2023, after taking into account guarantees and collateral.

At 31 December 2023, the Group sharply reduced its offshore exposure to Russia to around EUR 0.9 billion of EAD (Exposure at Default) compared with EUR 1.8 billion at 31 December 2022 (-50%). The maximum risk exposure on this portfolio is estimated at around EUR 0.3 billion before provision. Total provisions stood at EUR 0.2 billion at end-2023. The onshore residual exposure is marginal at around EUR 15 million and relates to the integration during the year of LeasePlan activities in Russia.

Operating income

Operating income totalled EUR 5,555 million in 2023 compared with EUR 7,514 million in 2022 (-26.1%).

Impairment losses on goodwill

In 2023, a goodwill impairment of around EUR -340 million was recorded on Africa, Mediterranean Basin and Overseas Territories, and on Equipment Leasing activities.

Net income

-

2.3Activity and results of the core businesses

2.3.1Results by core businesses

(In EURm)

French Retail, Private Banking and Insurance

Global Banking

and Investor SolutionsInternational Retail, Mobility

and Leasing ServicesCorporate

Centre

Group

2023

2022

2023

2022

2023

2022

2023

2022

2023

2022

Net banking income

8,023

9,210

9,640

10,108

8,507

8,139

(1,066)

(302)

25,104

27,155

Operating expenses

(6,708)

(6,896)

(6,787)

(6,832)

(4,765)

(3,957)

(264)

(309)

(18,524)

(17,994)

Gross operating income

1,315

2,314

2,853

3,276

3,742

4,182

(1,330)

(611)

6,580

9,161

Net cost of risk

(505)

(483)

(30)

(421)

(486)

(705)

(4)

(38)

(1,025)

(1,647)

Operating income

810

1,831

2,823

2,855

3,256

3,477

(1 334)

(649)

5,555

7,514

Net income from companies accounted for by the equity method

7

8

7

6

10

1

0

0

24

15

Net profits or losses from other assets

10

57

0

6

(11)

11

(112)

(3,364)

(113)

(3,290)

Impairment losses on goodwill

0

0

0

0

0

0

(338)

0

(338)

0

Income tax

(213)

(489)

(517)

(538)

(823)

(838)

(126)

382

(1,679)

(1,483)

Net income

614

1 407

2 313

2 329

2 432

2 651

(1 910)

(3 631)

3 449

2 756

o.w. non-controlling interests

4

1

33

36

826

730

93

164

956

931

Group net income

610

1,406

2,280

2,293

1,606

1,921

(2,003)

(3,795)

2,493

1,825

Cost-to-income ratio

83.6%

74.9%

70.4%

67.6%

56.0%

48.6%

73.8%

66.3%

Average allocated capital(1)

15,449

15,592

15,426

16,176

9,707

9,670

15,814

13,844

56,396

55,282

RONE (businesses)/ROTE (Group)

3.9%

9.0%

14.8%

14.2%

16.5%

19.9%

4.2%

2.5%

-

2.4Extra-Financial Report

Drivers of positive transformation

The environmental transition

- •Accelerating decarbonisation

- -Oil & Gas: sharply accelerated reduction

- --80% exposure to the upstream sector between 2019 and 2030, with an intermediary target of a -50% reduction in 2025.

- --70% absolute reduction in greenhouse gas (GHG) emissions across the entire oil and gas chain by 2030 vs. 2019.

- -Highest emitting sectors: 9 NZBA sectors out of 12 New targets set for the automotive, steel, cement, commercial real estate, maritime transport and aluminium sectors.

- -Publication of the Climate and Alignment Report.

- -Oil & Gas: sharply accelerated reduction

- •Stepping up our efforts to protect nature

- -Integrating nature-related considerations into E&S impact management and materiality assessment.

- -Signature of a five-year partnership agreement with The Ocean Cleanup.

- •Building solutions

- -Rethinking our business to accompany clients with their transition.

- -EUR 1 billion transition investment fund focused on the transition actors, green technology, nature and impact.

- -Supporting “emerging champions”.

- Three investments in 2023 INNOENERGY, PARTECH and POLESTAR.

- First round of ESG start-ups accepted in our Global Markets Incubator.

Positive impact on local communities

- •Providing support at local level

- -SG network: creation of a retail bank that is firmly anchored in the local community and with a Chief CSR Officer appointed in each region.

- -New offerings: Solar Pack and HelloWatt for home energy revovation.

- -Supporting female entrepreneurs locally

- -Promoting awareness to make a difference: Positive Impact Week in 22 towns and cities in France.

- •Infrastructure financing

- -Recognised expertise in project financing.

- -Investing in the AFRIGREEN fund: financing access to water and light in Africa.

- •At the cutting edge of sustainable mobility

- -Ayvens, an agent of sustainable mobility.

- -Mobility-as-a-Service and multimodal mobility.

- -Global partnership with CHARGEPOINT, a charging station operator.

- -Initiatives to finance sustainable transport in emerging economies in 2023.

- •Building a social and inclusive range of products and services

- -Distributor of state-guaranteed student loans in France (Bpi France).

- -BOOST: non-banking services platform accessible to young people.

RESPONSIBLE BANK

Responsible employer

Empowering all our employees to fulfil their potential

- •No forced departures under the transformation plan for Societe Generale in France (excluding subsidiaries).

- •17.5% increase in staff committed to 32 reskilling modules in 2023 vs. 2022

- •More than 80% of Group employees have completed at least one ESG training course since 2021.

Offering an appropriate, fulfilling and motivating working environment

- •Provide the conditions for an equitable and inclusive culture:

- -renewed the 2023-2025 three-year agreement promoting the employment and professional integration of people with disabilities in France.

- -EUR 100 million budget allocated to reduce the gender pay gap.

- -Target of at least 35% women in senior leadership positions by 2026.

- •Ensure working conditions respect people’s private time

- -Signed the Work-life quality and working conditions agreement in France.

- -Signature of the new global agreement with UNI Global Union.

Promoting employee engagement and ability to make a difference

- •Close collaboration with networks of engaged employees that are the voice of employees : Prides&Allies, Mix&Win, WAY, DKdrés, S'engaGer.

- •3rd Move for Youth challenge in support of organisations (involving 20% of staff).

- •Organisation of solidarity days in support of C’est vous l’avenir, the Societe Generale Foundation.

Culture of responsibility

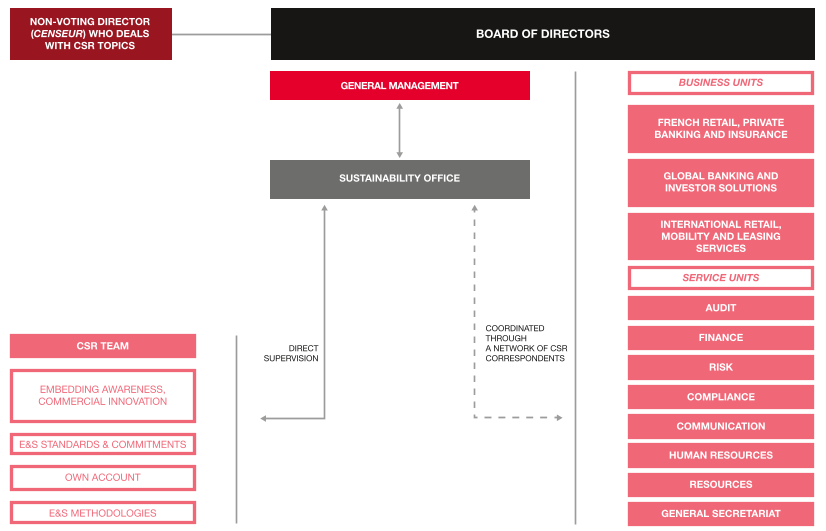

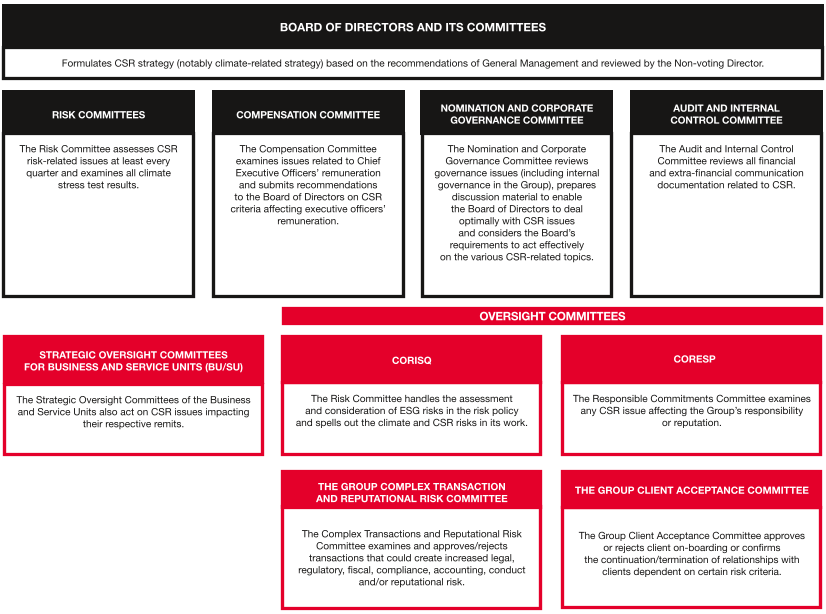

Embedding ESG at the highest level of the organisation

- •Sustainable Development Department reporting to General Management.

Creation of a Scientific Advisory Council to provide expert advice and long term vision on matters related to climate, nature, social issues and sustainable development.

Collaboration Framework Agreement signed with the International Finance Corporation (IFC) to make a stronger impact and contribute to the UN Sustainable Development Goals

Monitoring ethical and responsible business conduct

- •Continuation of Culture and Conduct initiatives.

- •The Group’s ESG training and awareness catalogue

- updated: 150 modules on 6 topics.

- •Extensive roll-out of Climate Fresk workshops by the end of 2024.

Managing ESG-related risks and meeting voluntary commitments

- •Founding member of international working groups on decarbonisation.

- •Oil & Gas and Thermal Power Stations sector policies updated.

The Group’s actions are guided by its corporate purpose which is “Building together, with our clients, a better and sustainable future through responsible and innovative financial solutions”.

In 2023, under the leadership of the new management team, Societe Generale placed its ESG goals firmly at the centre of its strategy. In its 2026 strategic plan, it announced a series of major initiatives to accelerate its contribution to the environmental transition and, more broadly, to the UN’s Sustainable Development Goals. It stated the Group’s ambition to be a rock-solid and sustainable top-tier bank, lead in ESG, and foster a culture of performance and accountability. ESG is an imperative and is included in the criteria used to manage the Group's activities.

In the second half of 2023, the Group announced it was stepping up the pace of decarbonisation across its businesses with the following measures:

- ■sharply accelerate steps to reduce exposure to the upstream oil and gas sector, together with a new absolute carbon emissions reduction target across the whole oil and gas value chain;

- ■new decarbonisation targets for the steel, automotive, cement, aluminium and commercial real estate sectors to contribute to the alignment of the Group's financing activities with Net Zero trajectories by 2050.

The Group also announced higher investment to develop innovative impact-generating solutions and partnerships to generate a bigger impact and develop as early as possible its positioning with emerging players and new markets:

- ■planned launch of a new EUR 1 billion transition investment fund that includes an equity investment of EUR 700 million. The fund aims to support transition actors, green technologies, nature-based solutions and impact-driven investments projects;

- ■continued development of key partnerships, such as with the International Finance Corporation, a member of the World Bank Group;

- ■planned establishment of an independent scientific advisory council to provide a long-term view and expert scientific opinions to inform strategy, with a focus on climate, nature, social questions and sustainable development.

Being a responsible employer and embedding a culture of responsibility are priorities for the Group. Launching its strategic plan, the Group announced:

- ■a new target of at least 35% of women in senior leadership roles (Top 250) by 2026;

- ■a EUR 100 million allocation to reduce the gender pay gap.

The core goals of the Group’s CSR policy break down into four strategic priorities. Two of these concern the Group's activities: supporting clients with their environmental transition and making a positive contribution to local communities. And two make up the very foundation of a responsible bank: being a responsible employer and nurturing a culture of responsibility and accountability across all our businesses.

The Group's aim is to contribute EUR 300 billion in sustainable financing over the period 2022-2025 in: sustainable bonds, Sustainable and Positive Impact Finance (SPIF), advisory mandates on SPIF transactions, Sustainability-linked loans, as well as financing and long-term leases of electric vehicles. All Group businesses are committed to working towards these goals to meet the environmental and social challenges of our time. The Group’s contribution at end-2023 towards achieving the target was more than EUR 250 billion.

To drive the positive changes we urgently need now the Group is pushing forward with its transformation through the internal “Building together” programme. This approach places all its business lines on a change trajectory and seeks to embed an ESG culture throughout the Group. The three core themes are:

- ■rethinking the Bank’s businesses: revamping the teams’ missions to develop solutions to support clients as they transition their businesses to more sustainable models;

- ■implementing the transformation: systematically building ESG into all the Group’s strategic decisions, management tools and processes and applying them to the business lines;

- ■deepening expertise through team training: Societe Generale has rolled out a specific CSR training programme.

This year brought out new players. The first was a new SG-branded retail bank in France, formed by the merger of the Societe Generale and Crédit du Nord networks. The new bank sets out to provide a comprehensive range of ESG solutions (savings, financing and advisory). The second new player was Ayvens, the new global mobility brand created from ALD’s acquisition of LeasePlan. It is positioned to become a global agent in the mobility ecosystem.

These new ESG-focused models, the announcement of the new strategic plan and the accelerated decarbonisation drive represent major changes. Together with an unprecedented training programme and our determination to ensure that all the Group’s businesses evolve to better support its clients, these advances position it to help set new standards and open up new possibilities. Building on its hallmark innovation and entrepreneurship, combined with its pioneering position in financing the energy transition, the Group is accelerating the number and pace of transformations and readying itself to meet the pressing challenges of water management, the circular economy, protecting and restoring nature.

Thanks to the transformation of its businesses, the Group is poised to seize a myriad of opportunities at a stage when existing clients require increasingly sophisticated solutions in their transition pathways and where new markets and operators are materialising in the economies.

2.4.1The environmental transition: accelerating decarbonisation and ACCOMPANYIng clients

For more than 20 years Societe Generale has financed renewable energy and positive impact finance as a founding member of the UNEP-FI Positive Impact Finance initiative. Having built up solid expertise, in 2023 the Bank stepped up measures to progressively align its portfolios, at the heart of which is the Group's support for clients to successfully make the transition to a low-carbon model.

Acutely aware that decarbonising is a global challenge that requires collective action, the Group is working with clients, peers and all its stakeholders to accelerate the transition and contribute to setting new standards.

To promote transparency and accountability, the Group takes part in many sector working groups to advance research and development in sustainable finance and decarbonisation. Through building partnerships and participating in alliances within expert bodies such as the Poseidon Principles, the Hydrogen Council or, more recently, in industries such as steel, aviation and aluminium, the Group aims to work towards the adoption of common standards and comparability between companies.

2.4.1.1Accelerating decarbonisation

Societe Generale Group takes a proactive approach to decarbonisation. Backed by a capacity for innovation and its teams’ industry-specific expertise, the Group is not only a driving force, but also has the ambition to be a leader in the green transition and sustainable development of our economies.

In 2020, Societe Generale co-published with a small group of banks a report on the application of the PACTA (Paris Agreement Capital Transition Assessment) methodology, developed by the 2Degrees Investing Initiative, to the credit portfolios of the banking sector. Societe Generale joined the UNEP-FI's Net Zero Banking Alliance (NZBA) as a founding member in April 2021 and has since undertaken, for the highest carbon emitting sectors defined by the NZBA, to align its financing portfolios with trajectories compatible with the goals of the Paris Agreement based on reference climate scenarios and science-based methodologies. The group has also undertaken to be transparent on the progress of these steps.

The Group’s portfolio alignment strategy is based on (i) prioritising reducing its absolute CO2 footprint in fossil fuels, and (ii) defining a trajectory to reduce the carbon intensity of its portfolios in other sectors.

2023 marked an important milestone with the announcement that the Group intends to accelerate its alignment efforts. Having largely completed its exit from thermal coal (target of zero exposure in 2030 in EU and OECD countries and by 2040 in the rest of the world) and hit its first reduction target ahead of time (-20% by 2025) for exposure to upstream oil and gas, the Group has set new targets aimed at aligning with benchmark 1.5 °C “low overshoot”(5) scenarios.

oil and gas targets

The Group announced a sharp acceleration in steps to reduce the Group’s exposure to the upstream oil and gas sector: an 80% reduction by 2030 (vs. 2019) with an intermediate target of 50% in 2025 stands out in the global banking world as one of the most ambitious targets.

The Bank has added a new target for a 70% absolute reduction in its carbon footprint across the entire oil and gas value chain by 2030 compared to 2019 levels (from a previous target of -30%). This is twice as ambitious as the IEA’s NZE (Net Zero Emissions) scenario.

The Group has also updated its Oil and Gas sector policy in line with the definition of these NZBA trajectories. Societe Generale will no longer provide financing and advisory services for new oil and gas field projects and is withdrawing from financing private pure players in upstream oil and gas. These exposures will be managed in run-off. At the same time, it is strengthening engagement with energy sector clients on their climate strategy.

New NZBA targets

Automotive sector: reduce the sector’s average carbon emissions intensity (carmakers, on their annual sales and over the vehicle’s useful life) to 90g of CO2 equivalent per km travelled per vehicle by 2030, vs. 2021 (184gCO2eq/v-km), a reduction of 51% in emissions intensity.

Steel sector: achieve a target alignment score of 0 by 2030(6), which equates to aligning the portfolio of steel manufacturers with the International Energy Aency’s Net Zero Emission (NZE) scenario trajectory.

Cement sector: reduce the carbon intensity of cement manufacture to 535kg of CO2 equivalent per tonne of cement by 2030, vs. 2022 (671kgCO2eq/t cement), a reduction of 20% in emissions intensity.

Commercial real estate: achieve target carbon intensity of 18kgCO2eq/sq.m in 2030 (based on the current composition of the Group’s portfolio) vs. 49kgCO2eq/sq. m in 2022, a reduction of 63% from 2022 levels.

Aluminium sector: reduce carbon emission intensity by -25% by 2030 vs. 2022, i.e., 6tCO2 e/t in 2030 vs. 8tCO2 e/t in 2022.

Maritime transport sector: achieve a Poseidon Principles target alignment score of 15% by 2030, which equates to a -43% reduction of carbon emission intensity (Annual Efficiency Ratio) relative to 2022.

Target for power generation

The Group maintains its objective of reducing carbon intensity in the electricity generation sector to 125 gCO2 per kWh by 2030 vs. 221 gCO2 per kWh in 2019, which equates to a 43% reduction.

Having at this stage set targets for nine sectors, the Group is continuing its work on other sectors, namely aviation, residential real estate and agriculture. In December 2023, the Bank published a “Climate and Alignment Report” (available in English only) outlining the progress of its work as a member of the Net Zero Banking Alliance: https://www.societegenerale.com/sites/default/files/documents/CSR/climate-and-alignment-report.pdf

2.4.1.2Accompanying clients in their environmental transition

Financing clients on their path to decarbonisation is a fundamental imperative that calls for unparalleled levels of investment. The International Energy Agency (IEA) estimates USD 100 trillion is needed in energy alone by 2050. Colossal investment is required to decarbonise our economies, often simultaneously across all value chains – which also calls for collective intelligence and co-construction.

The Group embeds the ESG dimension in the strategy of all its businesses and makes helping clients to achieve the transition a priority.

In a bid to speed up the pace of investment in the development of solutions and innovative partnerships to generate more positive impact, the Group announced in September 2023 that it was launching a EUR 1 billion transition investment fund that includes a EUR 700 million equity investment component. The fund aims to provide support for:

- ■green technologies and transition drivers;

- ■impact projects in line with the goal of contributing to the UN Sustainable Development Goals;

- ■solutions that are nature based and that help preserve biodiversity.

Rethinking the Bank’s businesses

The Group makes ESG a core part of strategy across all its businesses, with each one working on shaping its business model and putting together a range of products and services to meet new client needs.

Bit by bit, the Bank is expanding its offering to meet the requirements of clients of all sizes and to support them in their transition. These offers are available to all Group clients and include not only financing and investment products, but also financial services.

A programme in Global Banking & Investor Solutions aims to upgrade its offering, step up expertise in the teams, and work with clients to build innovative solutions tailored to their transition challenges. Involving more than 400 professionals, the programme promotes cross-sector collaboration to share expertise and develop a broader vision and more comprehensive insight into what clients are grappling with. It also intensifies the focus on new value chains and brings deeper understanding of emerging leaders’ business models. In 2023, programme outcomes included a methodology to assess the maturity of clients' transitions with a tool to identify emerging opportunities. Based on a sector analysis and a review of where the client is on the decarbonisation and transition pathway, the tool, which is currently being deployed, flags the opportunities created by the client’s transition.

The programme has delivered handsomely with major advisory and financing transactions in the electrical power sector (such as financing for the first cross-border electricity interconnection between Germany and the United Kingdom), the green energy sector (e-fuels in Chile and the US), and in low-carbon hydrogen and rare metals (with the world’s most economical and cleanest copper-nickel projects in Australia).

SG, the new retail bank in France, formed from merging the Societe Generale and Crédit du Nord banking networks, is a responsible bank strongly committed to ESG and helping its clients move forward with their transition. CSR is at the very heart of its business model to strengthen the positive and local impact it has on its clients. This is reflected in how the Bank is organised and the appointment of a Chief CSR Officer in each region.

Drawing from its deep pool of talent, the Group is positioned to offer support and expertise in CSR to its clients to shift to a low-carbon economy through partnerships with innovative providers.

2.4.1.3Building an ecosystem to seed innovation

Societe Generale is developing an ecosystem to seed innovation to grow its businesses and serve its clients. Firm in the knowledge that innovation is central to sustainable finance, the Group promotes the new, supporting cutting-edge companies in business incubators, investing in the champions of the future and cementing partnerships to offer bold and original solutions to its clients. The transition investment fund focused on the transition, nature and impact will further boost this capacity to identify and support innovative players and emerging champions.

The Group has a number of incubators, including the Global Markets Incubator (GMI). The GMI and the Capital Markets Division works with start-ups and entrepreneurs to turn their innovative ideas into market-ready solutions. The Incubator has also upped its support for Fintechs. In 2023, it doubled the number of incubees and accepted the first intake of start-ups focused on sustainability. The ultimate aim is to deliver on its commitments and expand the offering to corporate clients, financial institutions and private investors who stand to benefit from these novel solutions tailored to their ESG objectives. The incubator spurs progress towards tackling sustainability imperatives and rounds out the Group’s offering with the products and services developed by the start-ups.

In France, the retail banking incubator for impact start-ups, SG Planète A, continued to scale up. It welcomed its third intake in the Lille-based incubator this year.

By supporting low-carbon champions and new technologies, the Group is breaking new ground. It made major new investments in 2023.

The Bank took a stake in the capital of EIT InnoEnergy. The aim of this strategic partnership is to help new industrial champions grow and to accelerate the energy transition by supporting the current 200 portfolio start-ups, which include names like Verkor, GravitHy, Holosolis and FertigHy. Societe Generale will provide access to its full range of financing and advisory services and to its own ecosystem of clients and investors.

Another key investment in 2023 was in Polestar, the only private debt fund in Europe dedicated to the circular economy. Polestar provides debt finance to innovative mid-sized Dutch companies to build their first recycling plants for organic, plastic, chemical, textile, metal and other forms of waste.

The Group joined the pool of investors in Partech which is launching its first growth impact fund (target: EUR 300 million). The fund plans to invest in around 15 European champions. The objective is to help them scale up innovative climate and social solutions.

Finally, the Group also took a stake in namR, an innovator in making data work for the green transition of buildings and regions, and Quarnot, a pioneer in heat recovery from data centres. These investments are part of the Group’s existing policy of forging partnerships with pioneering and innovative players.

2.4.1.4Help preserve biodiversity

Helping to protect biodiversity is part of the Group's commitment to the environmental transition. A member of the Act4Nature international* alliance, it updated its specific and measurable biodiversity objectives for the Group.

The Group is a member of several international alliances: the Taskforce for Nature-related Financial Disclosures, the Science-Based Targets Network and the Finance for Biodiversity Pledge. This engagement ensures we continuously deepen our understanding of nature-based issues and contribute to enhancing expertise in the area by collaborating on best practices.

In 2023, the Group completed an initial exercise to map the sectors it finances by the severity of their impacts and dependencies. It also developed an indicator of financial vulnerability based on an assessment of nature-based physical and transition risks. Following on from these two exercises, the Group started a process to assess nature-based impacts, dependencies and risks, which will be expanded in the near term. The Group's commitments to biodiversity are also set out in Group sector policies that specify exclusions to protect nature. In addition, a biodiversity component is now part of the client environmental and social assessment. The Group’s objective is to have conducted an assessment of all Corporate and Investment Banking clients by the end of 2024. Biodiversity factors have also been added to the E&S Interview Guide for SMEs. And to ensure everyone can put these initiatives to good use, a training programme is available with targeted modules.

Societe Generale champions innovation in this area. One example is the SG incubator’s support for REGROW, a start-up working to make agriculture more sustainable and resilient.

Last but not least, nature-based solutions form part of the EUR 1 billion transition investment fund announced in 2023.

- •Accelerating decarbonisation

-

2.5Significant new products or services

2.5.1Societe Generale Assurances and Tikehau Capital launch an innovative investment solution contributing to the reduction of greenhouse gas emissions

Press release, 7 February 2023

Societe Generale Assurances and Tikehau Capital, alternative asset manager, announce a partnership for the launch of SG Tikehau Dette Privée. This unit-linked support, unprecedented on the French market, offers individual investors the opportunity to finance selected French and European unlisted companies while supporting the reduction of their greenhouse gas emissions.

An alternative source of financing to traditional bank loans and bond issuances on the financial markets, private debt is a source of financing increasingly used by unlisted companies to support their growth. Initially reserved for institutional investors, this investment strategy is now accessible to individual investors through this innovative support.

The support makes it possible to invest in the debt of French and European SMEs and medium-sized companies with a strong territorial footprint, to support them in their development (growth, acquisition, international deployment, etc.).

By only financing companies making a commitment to reduce their greenhouse gas emissions, SG Tikehau Dette Privée presents an ambitious low-carbon strategy, aligned with the objectives set by the Paris Climate Agreement(7).

- ■each financed company must commit to a decarbonisation trajectory based on the SBTi(8) reference methodology proposing a concrete application of the Paris Agreement.

Throughout the financing period, an independent audit will annually assess compliance with this trajectory and, depending on the results, will adjust the financing conditions granted to the Company.

Distributed today by Societe Generale Private Banking France, this Article 8 Unit of Account (SFDR)(9) will be available for 24 months on Life Insurance policies insured by Societe Generale Assurances. SG Tikehau Dette Privée is an FCPR(10) offering easy access to institutional quality assets from EUR 5,000 with a risk level of 4 out of 7 (SRI(11)). Its lifespan is ten years, but the capital invested in unit-linked support is available at any time thanks to liquidity provided by Societe Generale Assurances.

“We are very pleased with this partnership with Societe Generale, which underlines our pioneering position in private debt and sustainable financing. It is essential that the asset management sector plays its role in directing French savings towards the financing of companies and the real economy. Contributing to the achievement of the objectives set by the Paris Agreement is a priority of our roadmap: it is important for Tikehau Capital to take part in the launch of innovative solutions promoting the reduction of greenhouse gas emissions by companies while providing them with financing to support their growth” says Antoine Flamarion, co-founder of Tikehau Capital.

“Relying on the expertise of Tikehau Capital, Societe Generale Assurances continues to enrich its savings offer. This innovative and liquid investment solution will allow our clients to invest in a selection of around fifty companies and marks a new stage in our desire to democratise access to real assets. The launch of this unique support is, moreover, a new illustration of our desire to take concrete action in favor of ecological transition and regional development. Our development ambitions are strong, given the resolutely committed positioning of this offer in favor of reducing greenhouse gas emissions” adds Philippe Perret, Chief Executive Officer of Societe Generale Assurances.

-

2.6Analysis of the consolidated balance sheet

Assets

(In EUR m)

31.12.2023

31.12.2022 R

Cash, due from central banks

223,048

207,013

Financial assets at fair value through profit or loss

495,882

427,151

Hedging derivatives

10,585

32,971

Financial assets at fair value through other comprehensive income

90,894

92,960

Securities at amortised cost

28,147

26,143

Due from banks at amortised cost

77,879

68,171

Customer loans at amortised cost

485,449

506,635

Revaluation differences on portfolios hedged against interest rate risk

(433)

(2,262)

Insurance and reinsurance contracts assets

459

353

Tax assets

4,717

4,484

Other assets

69,765

82,315

Non-current assets held for sale

1,763

1,081

Investments accounted for using the equity method

227

146

Tangible and intangible fixed assets

60,714

33,958

Goodwill

4,949

3,781

Total

1,554,045

1,484,900

-

2.7Financial policy

The objective of the Group’s financial policy is to optimise the use of shareholders’ equity in order to maximise short- and long-term return for shareholders, while maintaining a level of capital ratios (Common Equity Tier 1, Tier 1 and Total Capital ratios) consistent with the market status of Societe Generale and the Group’s target rating.

Since 2010, the Group has launched a major realignment programme, strengthening capital and focusing on the rigorous management of scarce resources (capital and liquidity) and proactive risk management in order to apply the regulatory changes related to the implementation of new Basel 3 regulations.

2.7.1Group shareholders’ equity

Group shareholders’ equity totalled EUR 66.0 billion at 31 December 2023. Net asset value per share was EUR 71.45 and net tangible asset value per share was EUR 62.71 using the new methodology disclosed in Chapter 2 of this Universal Registration Document, on page 2.3.6.