URD 2022

-

MESSAGE FROM THE CHAIRMAN AND THE CHIEF EXECUTIVE OFFICER

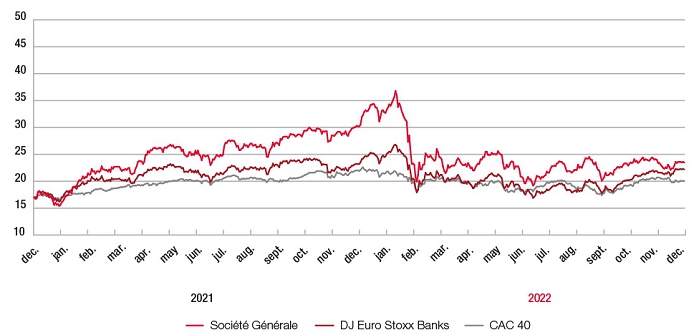

2022 marked a decisive stage in the transformation and development of Societe Generale. The Group succeeded in posting a record underlying performance while adapting quickly and effectively to a complex and uncertain environment. We have also achieved key strategic milestones, creating value for the future of our Group.

Excellent performance of our businesses

In 2022, the Group’s business lines demonstrated once again their ability to deliver very good commercial performance in a demanding environment. Our revenues are growing strongly, reaching a historical level of more than EUR 28 billion, with record performances from our Financing & Advisory and Market activities and from our subsidiary ALD; strong growth in Private Banking and International Retail Banking; and solid performance in our French Retail Banking activities.

The commercial momentum was accompanied by a sharp improvement in the cost/income ratio thanks to firm control over our costs and risks, resulting in a record underlying net income.

Faced with the outbreak of the war in Ukraine at the beginning of the year, we managed our exit from Russia by selling our Russian activities with no significant capital impact. Overall, we strengthened our CET1 capital ratio to 13.5%, well above the regulatory requirement.

Significant strategic progress

2022 also saw the roll-out of major strategic projects that underpin ambitious goals for the Group’s future.

We continued to flawlessly execute ongoing strategic initiatives, in line with our commitments. The legal merger of the Societe Generale and Crédit du Nord retail networks, effective 1 January 2023, marks both the culmination of a long process of collective effort and the fresh momentum that we are bringing to French Retail Banking under the new brand SG. Built on a new relationship model, SG will be more accessible and responsive to its 10 million customers, with a local presence in all the regions of France, as well as a bank that stands for expertise and responsibility. Boursorama significantly consolidated its leading position in online banking in France by welcoming a record number of new clients: 1.4 million over the year, for a total of 4.7 million at the end of 2022. We also successfully pursued our strategic roadmap in Global Banking and Investor Solutions, our developments in International Retail Banking in Europe and Africa, as well as in bancassurance, while drawing on the steady progress of our digital transformation to serve our clients and improve our operational efficiency.

This year, we also launched highly ambitious new development projects in mobility, with ALD’s planned acquisition of LeasePlan, as well as in the equity research and execution activities, with the project to create the Bernstein joint venture, which will enable us to position ourselves among the world leaders in these areas.

New CSR ambition

Our Group also puts Corporate Social Responsibility at the heart of its strategic roadmap. Leveraging from the concrete achievements made over the last years, we defined in 2022 our new CSR ambition with the aim of accelerating the decarbonisation of our business portfolios, as a priority in the energy sector, acting for biodiversity and having a positive local impact. Our objective is to integrate CSR at the centre of our businesses’ roadmaps and in the Bank’s management, roll out CSR training programmes for all Group staff and allow them to proactively support our clients in a fair environmental and social transition. We have set a target to dedicate EUR 300 billion in sustainable financing between 2022 and 2025; at the end of 2022, we had already exceeded EUR 100 billion. We also act in line with our commitment to being a responsible employer, in particular through the implementation of our diversity and inclusion initiatives. Numerous awards and extra-financial rankings attest to the Group’s proactive approach on the various dimensions of our CSR ambitions, placing us among the global banking leaders in the field.

2023, a year of transition

After simplifying our business model, embarking on profound transformations, and investing in profitable growth businesses over the last few years, we continue to execute our roadmap with discipline. Most of our major strategic projects will come to fruition in 2023, and the year will also see a transition at the top management of the Group. At the Annual General Meeting of 23 May 2023, we will invite our shareholders to elect Slawomir Krupa as Board member, and he will then be appointed Chief Executive Officer. This transition has been carefully prepared, under the aegis of the Board of Directors and its Nomination and Corporate Governance Committee. Slawomir Krupa, drawing on his remarkable international career within the Group, has all the skills to lead Societe Generale with determination and success towards the next stages of its development.

The year 2023 will additionally be a year of transition from a financial perspective, with revenues expected to decline in French Retail Banking, given the specificities of the French market facing a sharp increase in interest rates. It is also the final year of contributing to the establishment of the European Single Resolution Fund, which had an important negative impact on our books. Building on the commercial momentum of our business lines and the soundness of our balance sheet, we are confident in the 2024-2025 outlook and in the Group’s ability to reap the benefits of ongoing initiatives, and confirm the financial targets set for 2025. In an environment that is still highly uncertain, with many structural challenges facing our societies, the Group is attentive to the expectations of its various stakeholders and remains resolutely committed to putting its corporate purpose into action to build together, with our clients, a better and sustainable future.

The Group is attentive to the expectations of its various stakeholders and remains resolutely committed to putting its corporate purpose into action to build together, with our clients, a better and sustainable future.

-

1.1 HISTORY

On 4 May 1864, Napoleon III signed Societe Generale’s founding decree. Founded by a group of industrialists and financiers driven by the ideals of progress, the Bank’s mission has always been “to promote the development of trade and industry in France”.

Since its beginnings, Societe Generale has worked to modernise the economy, following the model of a diversified bank at the cutting edge of financial innovation. Its retail banking branch network grew rapidly throughout the French territory, increasing from 46 to 1,500 branches between 1870 and 1940. During the interwar period, the Bank became the leading French credit institution in terms of deposits.

At the same time, Societe Generale began to build its international reach by financing infrastructure essential to the economic development of a number of countries in Latin America, Europe and North Africa. This expansion was accompanied by the establishment of an International Retail Banking network. In 1871, the Bank opened its London branch. On the eve of World War I, Societe Generale had a presence in 14 countries, either directly or through one of its subsidiaries. This network was then expanded by opening branches in New York, Buenos Aires, Abidjan and Dakar, and by acquiring stakes in financial institutions in Central Europe.

Societe Generale was nationalised by law on 2 December 1945 and played an active role in financing the reconstruction of France. The Bank thrived during the prosperous post-war decades and contributed to the increased use of banking techniques by launching innovative products for businesses, including medium-term discountable credit and lease financing agreements, for which it held the position of market leader.

Societe Generale demonstrated its ability to adapt to a new environment by taking advantage of the banking reforms that followed the French Debré laws of 1966-1967. While continuing to support the businesses it partnered, the Group lost no time in focusing its business on individual clients. In this way, it supported the emergence of a consumer society by diversifying the credit and savings products it offered private households.

In June 1987, Societe Generale was privatised with a successful stock market launch and shares offered to Group staff. The Group developed a universal banking strategy, in particular through its Corporate and Investment Banking activities, to support the worldwide development of its customers. In France, it expanded its networks by founding Fimatex in 1995, which later became Boursorama, now France’s leading online bank, and by acquiring Crédit du Nord in 1997. Internationally, it established itself in Central and Eastern Europe through Komerční banka in the Czech Republic and BRD in Romania while consolidating its growth in Africa in Morocco, Côte d’Ivoire Senegal and Cameroon, among other countries. Building on the professionalism of its teams and the relationship of confidence developed with its clients, the Bank continues its process of transformation by adopting a sustainable growth strategy driven by its core values of team spirit, innovation, responsibility and commitment.

In January 2023, the Group announced the creation of its new retail bank in France, SG, following the merger of its two retail banking networks in France, Societe Generale and Crédit du Nord, in order to offer its customers greater proximity, responsiveness, expertise and responsibility.

Today, the Group has more than 117,000 members of staff(1) active in 66 countries. Firmly focused on the future by helping clients bring their projects to life, Societe Generale is committed to the two major revolutions of digital technology and environmental transition and social change to support its clients, have a positive impact on the world and embody the bank of the 21st century. Drawing on nearly 160 years of expertise at the service of its clients and the sustainable development of economies, the Societe Generale Group defined its purpose as “Building together, with our clients, a better and sustainable future through responsible and innovative financial solutions”.

-

1.2 PROFILE OF SOCIETE GENERALE

Societe Generale is one of the leading European financial services groups. Based on a diversified and integrated banking model, the Group combines financial strength and proven expertise in innovation with a strategy of sustainable growth. Committed to the positive transformations of the world’s societies and economies, Societe Generale and its teams seek to build, day after day, together with its clients, a better and sustainable future through responsible and innovative financial solutions.

Active in the real economy for over 150 years, anchored solidly in Europe and connected to the rest of the world, Societe Generale employs over 117,000 members of staff(1) in 66 countries and supports on a daily basis 25 million individual clients, businesses and institutional investors(2) around the world by offering a wide range of advisory services and tailored financial solutions. The Group is built on three complementary core businesses:

■French Retail Banking, with the SG bank, resulting from the merger of the two Societe Generale and Crédit du Nord networks, and Boursorama. Each offers a full range of financial services with omnichannel products at the cutting edge of digital innovation;

■International Retail Banking, Insurance and Financial Services, with networks in Africa, Central and Eastern Europe and specialised businesses that are leaders in their markets;

■Global Banking and Investor Solutions, which offers recognised expertise, key international locations and integrated solutions.

Societe Generale follows a strategy of responsible growth, fully integrating its CSR engagements and commitments to all its stakeholders: clients, staff, investors, suppliers, regulators, supervisors and representatives from civil society. The Group seeks to respect the cultures and environment of all the countries where it operates.

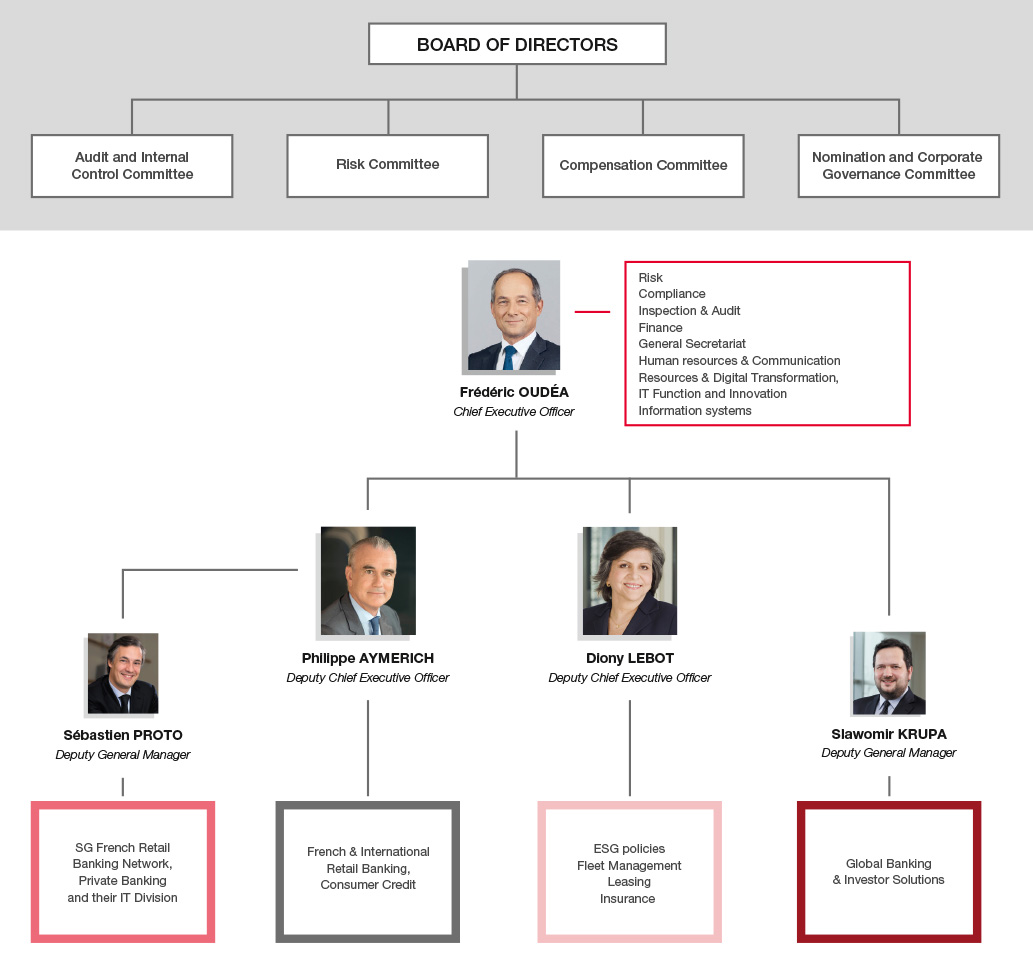

The Group has an agile organisation based on 14 Business Units (business lines and regions) and 10 Service Units (support and control functions) to encourage innovation and synergies, and best meet the evolving requirements and behaviours of its clients. In a European banking sector undergoing radical industrial change, the Group enters a new phase of its development and transformation.

Additional information on the Group’s organisation and key figures is provided below and on pages 10 and following.

Societe Generale is included in the principal socially responsible investment indices: DJSI Europe, FTSE4Good (Global and Europe), Bloomberg Gender-Equality Index, Refinitiv Diversity and Inclusion Index, Euronext Vigeo (Europe and Eurozone), STOXX Global ESG Leaders indices and MSCI Low Carbon Leaders Index (World and Europe).

Results (In EURm)

2022

2021

2020

2019

2018

Net banking income

28,059

25,798

22,113

24,671

25,205

o.w. French Retail Banking

8,839

7,777

7,315

7,746

7,860

o.w. International Retail Banking and Financial Services

9,122

8,117

7,524

8,373

8,317

o.w. Global Banking and Investor Solutions

10,082

9,530

7,613

8,704

8,846

o.w. Corporate Centre

16

374

(339)

(152)

182

Gross operating income

9,429

8,208

5,399

6,944

7,274

Cost/income ratio

66.4%

68.2%

75.6%

71.9%

71.1%

Operating income

7,782

7,508

2,093

5,666

6,269

Group net income

2,018

5,641

(258)

3,248

3,864

Equity (In EURbn)

Group shareholders’ equity

66.5

65.1

61.7

63.5

61.0

Total consolidated equity

72.8

70.9

67.0

68.6

65.8

ROE after tax

2.6%

9.6%

-1.7%

5.0%

7.1%

Total Capital Ratio(1)

19.2%

18.7%

18.9%

18.3%

16.5%

Loans and deposits (In EURbn)

Customer loans(2)

496

488

440

430

421

Customer deposits(3)

524

502

451

410

399

(1)Figures based on CRR2/CRD5 rules, excluding IFRS 9 phasing for 2020, 2021 and 2022.

(2)Net customer loan outstandings, including lease financing, excluding assets and securities purchased under resale agreements.

(3)Excluding assets and securities sold under repurchase agreements.

Note: figures as published for the respective financial years. Definitions and potential adjustments presented in methodological notes on pages 41 to 45.

-

1.3 A STRATEGY OF PROFITABLE AND SUSTAINABLE DEVELOPMENT, BASED ON A DIVERSIFIED AND INTEGRATED BANKING MODEL

The Societe Generale Group has built a solid diversified banking model suited to the needs of its 25 million corporate, institutional and individual clients. It is structured around three complementary and diversified businesses, all benefiting from strong market positions:

In the Retail Banking businesses, the Group focuses on development in European markets selected for their growth potential (France, the Czech Republic and Romania) and Africa where it has an historic presence, refined understanding of the markets and top-tier positions. In International Financial Services, Societe Generale relies on franchises benefiting from leadership positions worldwide. As part of the Group’s prime focus on developing its mobility franchises, it announced ALD’s plan to acquire LeasePlan. In the Global Banking and Investor Solutions businesses, the Group provides high value-added solutions to its clients in the EMEA region, the US and Asia. Focused on Europe yet boasting a global network, the Societe Generale Group capitalises on leadership positions driven by cross-business synergies to create value for stakeholders. The Group leverages its diversified model to meet the needs of its corporate and professional clients, as well as its individual clients.

2022 marked a decisive stage for the Group, which was able to deliver very strong commercial performances in all its businesses amid a complex and uncertain economic and financial environment, staying on track to meet its 2025 targets for profitable and sustainable growth. This positive momentum was borne out by solid commercial and financial performances across the board, driven by a record result in Financing & Adivisory, Global Markets and ALD, strong growth in International Retail Banking, Financial Services, and in Private Banking and a solid resilience from French Retail Banking. These performances bear out the Group’s extensive efforts over several years to strengthen the inherent quality of its businesses, improve operational efficiency and manage risk. It successfully passed key milestones in a number of other strategic projects, in particular:

■completion on 1 January 2023 of the legal merger between Societe Generale and Crédit du Nord, thereby creating a single retail banking entity serving 10 million individual, professional and corporate clients. The operational merger of the two French branch networks will take place over the first half of 2023 with the IT migration of all Crédit du Nord clients to Societe Generale’s system;

■accelerated growth of online bank Boursorama, taking the total client base to 4.7 million, including the 315,000 clients that were onboarded following the partnership agreement signed with ING in 2022;

■further development in ALD’s long-term rental business which is due to close the deal to acquire LeasePlan in the first half of 2023, notably subject to receiving the remaining approvals and the performance of other standard conditions precedent. Looking to the medium term, the combined entity is poised to become world leader in sustainable mobility solutions;

■consolidating the Group’s cash equities activity following the announcement of plans to form a joint venture combining Societe Generale’s and Bernstein Research Services’ equity research and execution platforms to create a leading global franchise.

The Group also finalised in May 2022 the effective and orderly withdrawal from Russia following the disposal of Rosbank and its Russian insurance subsidiaries.

The Group continued to pursue its selective scarce resource allocation strategy and its focus on achieving the optimal region/offer/client mix, and confirmed its strong resolve to keep costs firmly under control. The adjustments it has made are designed to mark out high-margin growth businesses that enjoy strong commercial franchises and create value for the Group.

Organic growth will continue to be accelerated by unlocking internal synergies not only within each business but also between businesses. This will entail greater cooperation between Private Banking and the Retail Banking networks, cooperation along the entire Investor Services chain, cooperation between the Insurance business and the French and International Retail Banking networks, and cooperation between regions and Global Transaction Banking’s activities, among others.

One of the Group’s priorities is to push further ahead with its commercial development, focusing on quality of service, added value and innovation to ensure client satisfaction. Its goal is to become a trusted partner for its clients, making sound use of its digital capabilities to provide them with responsible and innovative financial solutions. To this end, the Group is pursuing various digital transformation and operational efficiency initiatives.

Fully aware of its role in the functioning of the economy, the Group has placed specific strategic importance on its environmental, social and governance commitments.

Environmental and social issues represent society’s greatest challenges this century – challenges that have been accentuated by geopolitical tensions and the pandemic.

Profound societal change is called for, involving substantial adjustments to how we produce and consume. This will inevitably give rise to a number of difficulties and constraints, but Société Générale also sees business opportunities in these transformations by contributing to the financing of the fair and inclusive environmental transition. According to the International Energy Agency, achieving NZE by 2030 will call for almost USD 4,000 billion in investments each year, an unprecedented amount for such a limited timeframe.

If it is to meet its stakeholders’ expectations and help its clients address these challenges, the Group needs to press on with its own transformation, making environmental and social issues a key factor in its decision-making processes and offering its clients financing and investment solutions adapted to their new needs. With this in mind, Societe Generale is training its teams on the transition challenges specific to each sector and developing a more holistic approach to how it analyses both financial and non-financial risk. The Group wants to do more than simply offer financial advice. It has put together teams with expert knowledge of the issues relevant to its major corporate clients’ value chains and established international cross-business working groups to identify emerging ESG standards and come up with ways to meet them. And of course, to ensure the transition is fair and inclusive, the financial system also needs to take care of disadvantaged populations, offering them solutions suited to their situation.

Committed to supporting its clients, the Bank has made CSR a core component of all of its businesses, viewing it as an opportunity to innovate and become more sustainable. In response to this new environment and the challenges it brings, and in keeping with the Group’s values and what its stakeholders expect from it – based on the findings of the materiality survey carried out in 2021 (see Chapter 5, page 336) – Societe Generale has reaffirmed its CSR ambition for 2025, placing the focus on four main priorities.

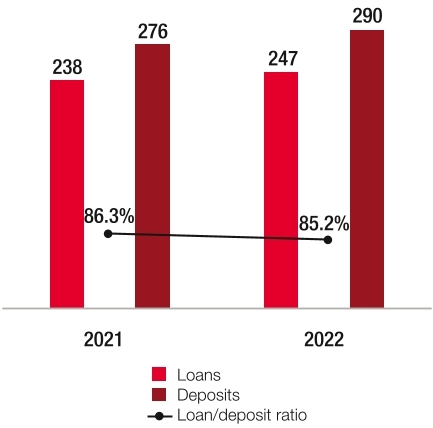

The Group has upped its commitments to keep pace with its ongoing transformation: a EUR 300 billion contribution to sustainable finance by 2025, a 50% reduction in its CO2 emissions by 2030 (compared with 2019 levels) and ESG training for all staff.

Through its geographic presence, the diversity of its businesses and its responsible engagement, Societe Generale also contributes towards the UN’s Sustainable Development Goals (SDGs) (for more information, see https://www.un.org/sustainabledevelopment/sustainable-development-goals/). This can be clearly seen in the four core themes of its CSR ambition:

Core themes of the Group’s CSR ambition

SDG

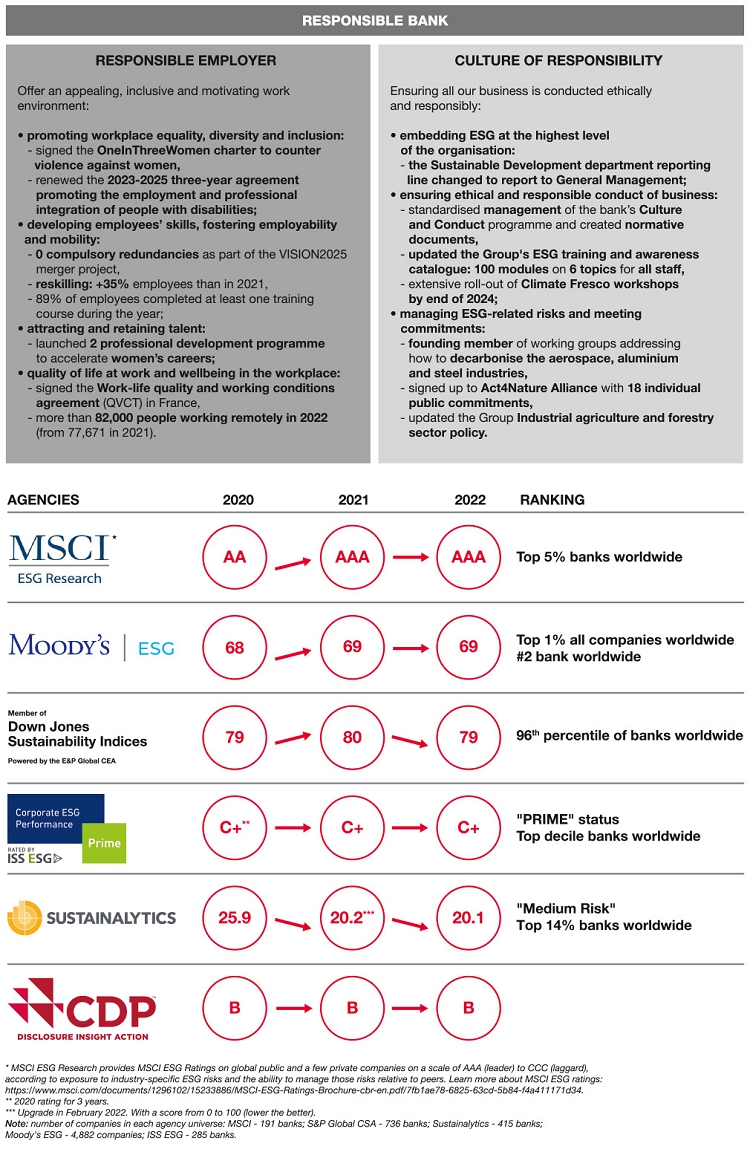

Responsible employer

Monitoring quality of working life and the diversity and professional development of its teams is crucial to encouraging employee engagement within the Group and optimising performances. Societe Generale has undertaken to move the Group forward with five Human Resources priorities: Corporate Culture and Ethics Principles, Professions and Skills, Diversity and Inclusion, Performance and Compensation, Occupational Health and Safety (see “Being a responsible employer”, page 293).

Culture of responsibility

This involves the Group factoring in ESG concerns at the very highest levels of governance, rolling out a robust E&S risk management framework, holding itself to account on its commitments in terms of human rights, the climate and biodiversity and ensuring it operates ethically and responsibly in all aspects of its business (see Chapter 5, page 314).

Supporting the environmental transition

By assisting clients in transitioning to greener practices through innovative solutions tailored to their evolving needs, Societe Generale is also doing its part to help preserve biodiversity and develop the circular economy while simultaneously aligning its portfolios with a net-zero trajectory.

Making a positive impact on local communities

This means supporting societal and economic change at a local level, contributing to infrastructure financing and assisting local organisations, SMEs and entrepreneurs, leading the field in sustainable mobility and developing socially inclusive services.

■

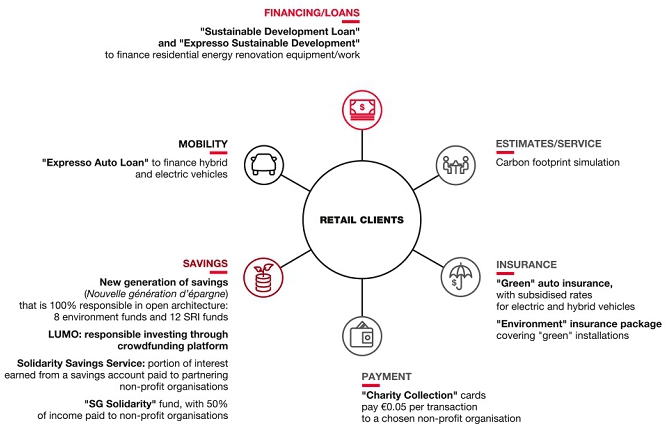

■in Retail Banking and Insurance, this means developing a sustainable and socially responsible range of products and services, backed up a stronger regional presence, with local teams of ESG specialists for SMEs and networks of experts on hand to advise clients;

■in Financing and Investment Banking, it means assisting clients in their transition, rethinking how its specialist teams work and freeing them up to devise inventive financing solutions for investments to decarbonise the economy, capitalising on its extensive sector expertise and its partnerships with a broad range of industrial and institutional clients;

■in Mobility, it means being at the cutting-edge of the transition to encourage and support clients looking to switch to more sustainable mobility solutions and cementing its partnerships with key players in the e-mobility sector.

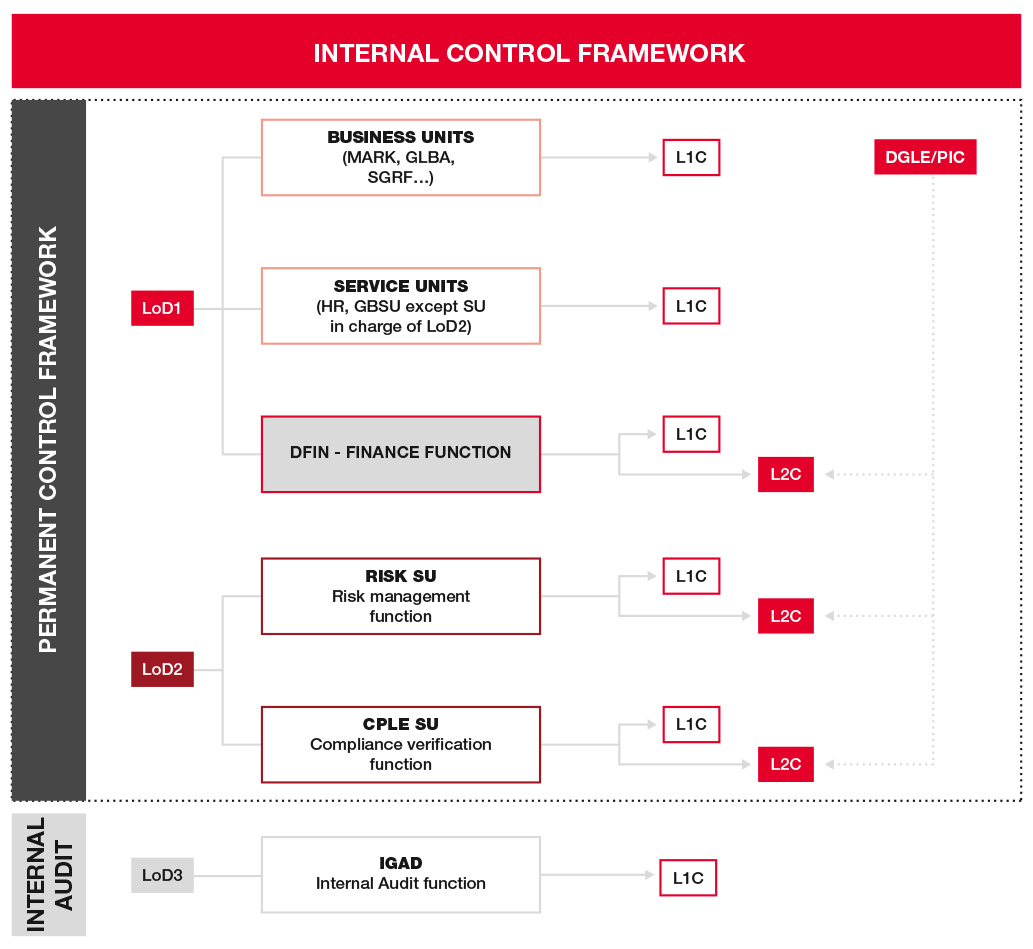

Societe Generale continues to foster a group-wide culture of responsibility and to strengthen its internal control framework, especially its Compliance operations, to meet the banking industry’s highest standards. It has also completed the rollout of its Culture & Conduct programme, embedding rules of conduct and strong shared values throughout the entire organisation.

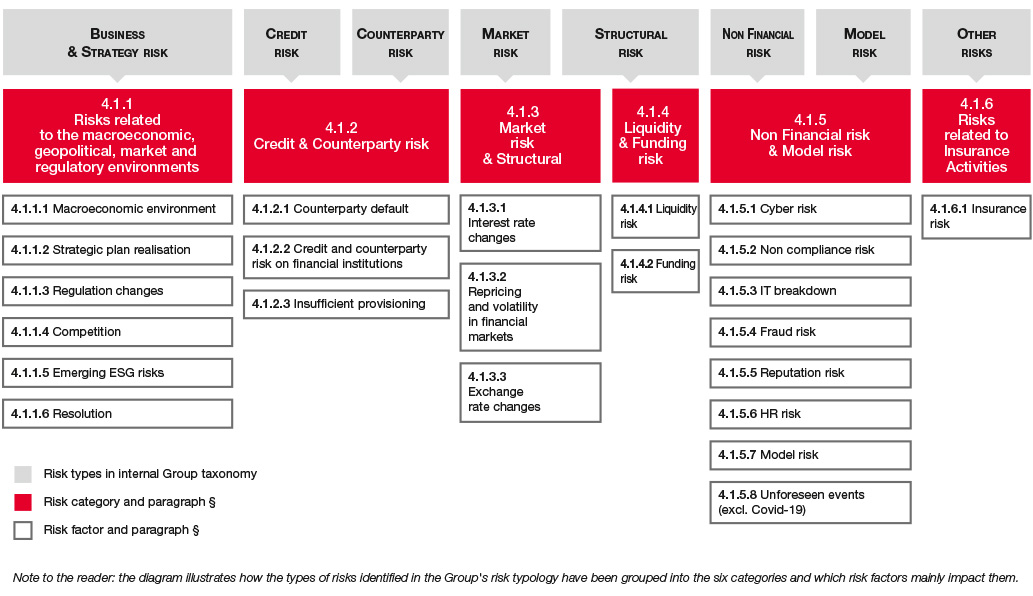

Last, the Group is determined to press ahead with its stringent and disciplined approach to capital allocation and risk management – maintaining credit portfolio quality, keeping up its efforts on operational risk control and compliance.

In line with its strategy of fully addressing its clients’ needs and taking into account the new, more demanding regulatory environment, the Group’s focus will remain on optimising its consumption of scarce capital and liquidity resources and maintaining a highly disciplined approach to costs and risk management.

In 2022, the Board of Directors of Societe Generale decided to propose Slawomir Krupa as director to shareholders to replace Frédéric Oudéa at the General Meeting on 23 May 2023. Once elected, Slawomir Krupa will be appointed Chief Executive Officer by the Board of Directors.

■an underlying(1) cost to income ratio of between 66% and 68%, excluding the Single Resolution Fund;

Looking further out, the Group is fully on track to achieving its strategic milestones and has set targets for profitable and sustainable growth out to 2025 with:

■average annual revenue growth of 3% or greater over the 2021-2025 period by focusing on growth in the most profitable businesses;

■an improved cost to income ratio equal to or lower than 62% in 2025 and ROTE of 10% based on a targeted CET1 ratio of 12% in 2025;

■disciplined management of scarce resources, in addition to keeping a tight rein on risks, will help strengthen and improve the quality of the Bank’s balance sheet;

The Board of Directors decided its distribution policy which corresponds to an equivalent of EUR 2.25 per share(2). A cash dividend of EUR 1.70 will be proposed at the General Meeting of Shareholders on 23 May 2023. The dividend will be detached on 30 May 2023 and paid out on 1 June 2023.

The Group is also planning to launch a share buyback programme for a total of arond EUR 440 million, i.e., equivalent to EUR 0.55 per share. The rollout of the programme is subject to the usual approval by the ECB.

In light of the strong financial performance in 2022 and an exceptional year, this distribution level fairly remunerates shareholders and further strengthens the Group CET1 ratio.

The French Retail Banking business has made sweeping changes to its model in response to rapidly evolving client behaviours and demand for ever greater convenience, expertise and customised products and services. The pace of this transformation has picked up since 2020, with two major strategic initiatives: the merger of Crédit du Nord and Societe Generale, and moves to ramp up growth at Boursorama. These initiatives are designed to cement the Group’s winning combination of a fully online banking model coupled with a network banking model offering both digital and human expertise – a combination that stands out in the French market.

The Group saw the Crédit du Nord-Societe Generale merger through to completion in 2022, with 1 January 2023 marking its legal entry into effect. The resulting new retail banking entity has been branded SG. The IT migration of all Crédit du Nord branches to Societe Generale’s system is scheduled for the first half of 2023, with branch mergers and back office changes due to take place progressively as of the second half of 2023 and through to 2025.

SG aims to become a leading banking partner for its 10 million clients within the French market and has set its sights on being among the Top 3 French banks for client satisfaction.

It has introduced a new relationship model, designed to improve the quality of service it provides to its individual, professional and corporate clients and establish SG as a leading operator in the French market for savings, insurance and first-rate solutions addressing corporates and professionals alike.

■a bank with a greater regional presence. The vast majority of decisions will be taken at regional level, and increasingly in branches and business centres directly. All clients will benefit from a denser branch network, reflecting the strategy of emphasising French Retail Banking’s local roots through 11 regional brands grouped under the national SG umbrella;

■an expertise-centric bank, offering services even more tailored to the specific needs of its different types of client. For example, it will set up a private banking entity, assign each professional client a dedicated client relationship manager to handle both their personal and professional banking needs, and appoint more specialists throughout France to assist on savings and insurance matters and to offer its professional and corporate clients Financing and Advisory services;

■an accessible and responsive bank, with streamlined processes to speed up decision-making and reduce response times to customer queries, state-of-the-art digital services enabling clients to perform their day-to-day banking transactions remotely and securely, and a mobile app through which clients can subscribe to a wide range of products and services;

■a responsible bank that makes CSR the linchpin of its new model, adjusting how it is organised and its product and service range to strengthen its positive impact on its clients and local communities. More specifically, each region will have a dedicated CSR consultancy team to help SG step up its financing of the environmental transition and become a major player in the economic and social development of local regions and their ecosystems.

From a financial perspective, the merger will unlock considerable cost synergies. The cost to income ratio of Franch Retail Banking is expected to range between 67% and 69% in 2025 and the return on normative equity (RONE) under Basel IV is targeted at around 10% in 2025.

■maximising the potential of its integrated bancassurance model by anticipating changes in the life-insurance market and taking advantage of strong client take-up potential for personal protection and non-life insurance;

■increasing business among corporate and professional clients by providing strategic advisory services and comprehensive solutions;

■leveraging the expertise available in Private Banking to satisfy the expectations of high-net-worth clients in the French networks.

In Wealth Management, Private Banking is moving forward with its strategy of operating in open architecture, distributing savings solutions to clients throughout its network. By offering investment and asset management solutions through partnerships with external asset managers, Societe Generale gives its savers access to the best investment expertise in France and internationally, while at the same time responding to their growing demand for socially responsible investment. The Wealth & Investment Solutions business within Private Banking focuses primarily on structuring savings, asset management and investment solutions for the Group’s private banking and retail banking networks, as well as providing structured asset management solutions for its Global Markets clients.

Last, the Group continues to support the development of its online bank. Boursorama offers its clients a broad and diversified range of online banking services, an efficient model and an unbroken 15-year record as the lowest-cost bank on the market(1), resulting in excellent client satisfaction and recommendation scores.

Over 2022, Boursorama increased its lead on the French market, acquiring more than 1.4 million net new clients, bringing its total client base to over 4.7 million by the end of the year. It also finalised its partnership agreement with ING, resulting in around two-thirds of ING’s eligible clients transferring to Boursorama, bringing with them some EUR 9 billion in outstandings (half of which was in life-insurance savings).

The Group has confirmed its goal of onboarding an increasing number of clients at Boursorama and has set a target of more than 5.5 million customers by end-2023.

International Retail Banking and Financial Services is a profitable growth driver for the Group thanks to its leading positions in high-potential markets, its operational efficiency and digital transformation initiatives, and its ability to unlock synergies with other Group activities. These businesses have undergone a major transformation over the last few years to fully refocus the portfolio, introduce a more optimised model and improve the underlying risk profile. This last point has been illustrated by their orderly pull-out from Russia in response to the worsening conflict in Ukraine. As the conflict escalated, the Group decided to divest Rosbank and its Russian insurance subsidiaries – a transaction completed in May 2022.

International Retail Banking activities are mainly located in regions outside the eurozone. They benefit from positive long-term growth fundamentals and the current uptick in interest rates, despite the prevailing economic uncertainty in those regions due to high inflation. This uncertainty has not affected the Group’s plans for its international banking activities – it intends to press on with its strategy of consolidating leadership positions and pursuing responsible growth in Europe and Africa. Its capacity to meet client needs, coupled with its innovative, unique and efficient platforms, will serve it well in this undertaking:

■in Europe, the pandemic sharply accentuated underlying trends, confirming the strategic vision of the Group’s target retail banking model, as well as the relevance of the transformation plans undertaken, which place special emphasis on ramping up digital transformation. Accordingly, the Group intends to put the finishing touches to its omnichannel banking model in the Czech Republic with its KB Change 2025 strategic plan and consolidate its franchise status in Romania as one of the country’s three leading banks. And now that interest rates are heading back up, retail banking activities in Europe will follow the same upward trajectory, becoming strong growth drivers for the Group. The Group also intends to tap into the full potential of its consumer finance activities in Europe through both its own retail banking networks and its specialist subsidiaries both in France and abroad;

■in Africa, the Group plans to take advantage of the continent’s strong potential for economic growth and bank account penetration by building on its leading positions.

As part of the Grow with Africa programme developed in partnership with a panel of international and local partners, Societe Generale has announced several sustainable growth initiatives to foster positive transformation across the continent. Accordingly, the Group is concentrating on providing multidimensional support to African SMEs, funding infrastructure, supporting the energy transition and developing innovative financing solutions.

Financial Services and Insurance enjoy competitive positions and strong profitability, in particular with ALD and Insurance, both of which benefit from robust growth potential. All Financial Services and Insurance businesses are continuing to roll out their programmes to innovate and transform their operational model:

■in Insurance, the Group plans to accelerate the rollout of both its bancassurance model – across all retail banking markets and all segments (life insurance, personal protection and non-life insurance) – and its digital strategy. The aim is to enhance its product range and client experience within an integrated omnichannel framework while diversifying its business models and growth drivers through a strategy of innovation and partnerships. This growth strategy goes hand in hand with greater commitments to responsible finance at SG Assurances;

■in Operational Vehicle Leasing and Fleet Management, the Group is poised to create a global leader in sustainable mobility solutions by acquiring LeasePlan. The resulting new entity would be No. 1 worldwide, excluding captives and financial leasing companies. Representing a total fleet of 3.3 million(2) vehicles at end-September 2022 and with operations in over 40 countries, it would leverage highly complementary expertise and prospective synergies, factors that would serve it well when developing new activities and services in a mobility sector undergoing radical change. Its considerable investment capacity and unparalleled know-how would enable the new entity to take full advantage of the market’s strong growth, which is being driven by a number of confirmed trends: the shift from ownership to leasing, the transition towards sustainable mobility solutions, and the sector’s digital transformation. Having boosted its investment capacities and unmatched expertise, ALD has positioned itself at the heart of this changing world of mobility, asserting its global leadership to become a fully integrated player in sustainable mobility solutions with the rollout of its Move 2025 strategic plan and the proposed acquisition of LeasePlan. To this end, ALD forged ahead with its active innovation and digitalisation strategy over the year;

(2)Adjusted for disposals as part of ALD’s proposed acquisition of LeasePlan and for the impact of the LeasePlan USA disposal.

■and last, in Vendor and Equipment Finance, the Group plans to build on its leadership position in its top-tier markets in Europe to increase revenue and improve profitability, against a backdrop of higher financing costs as a result of climbing interest rates. It plans to draw on its service quality, capacity for innovation, product expertise and dedicated teams to retain its preferred partner status with vendors and clients alike.

Societe Generale also plans to continue moving forward with its strategy of unlocking synergies between the activities of the various businesses in this division and elsewhere within the Group, with Private Banking and the regional Corporate and Investment Banking platforms, by developing its commercial banking services such as trade finance, cash management, payment services and factoring, and by further developing its bancassurance model.

In 2022, Global Banking and Investor Solutions (GBIS) pushed further ahead with initiatives rolled out since 2021 with respect to its five strategic pillars - balancing its business mix, bringing down its profitability threshold, reducing its idiosyncratic risk profile, increasing its share of CSR-native businesses and expanding the reach of its digitalisation.

Global Banking and Investor Solutions stands on strong foundations: it has built up a solid and stable diversified client base, high value-added product franchises and and recognised sector expertise backed by a global network. GBIS serves the financing and investment requirements of large and diversified client base spanning corporates, financial institutions and public-sector entities. Having undergone considerable transformation in recent years – reducing its breakeven point, de-risking the Global Markets business and adjusting the balance between its businesses – GBIS is now focused on delivering value to all its stakeholders through sustainable and profitable growth.

Its growth strategy reflects where the opportunities for economic growth currently reside, i.e., increased financing needs for infrastructure and the energy transition, greater investment in private debt and the growing demand for savings solutions. At the same time, Global Banking and Investor Solutions is gradually and methodically recalibrating its businesses, particularly Global Markets and Financing and Advisory, making targeted capital allocations to growth initiatives for particular client segments, businesses and regions. In particular, the plans to form a joint venture in cash equities with AllianceBernstein, announced in November 2022, will bring further diversification to the Group’s investment banking activities and offer its large clients premier strategic expertise and insights.

■reducing costs to improve operating leverage without business attrition and in keeping with its long-term commitment to disciplined cost control;

■adopting stringent management of both market and credit risks – notably against a backdrop of weaker market risk appetite – and prudent management of its counterparty risk, aiming to maintain a healthy diversification of all risk categories across its businesses.

The uncertainty unleashed by the war in Ukraine continues to run rife and is fuelling supply chain disruptions in both goods and services, especially for energy and foodstuffs. In Europe, gas supply problems may continue even beyond 2023, with knock-on effects on electricity prices. A harsh winter and a decision by Russia to completely shut off the gas taps could make gas rationing a reality.

The coming quarters should see the remaining pandemic-related restrictions in China gradually lifted. Worldwide, the pandemic risk persists, however, necessitating investment in prevention and vaccines. But in emerging countries, this investment is likely to fall short of requirements, meaning that pandemic-related risks will continue to weigh on the global growth outlook.

Economic activity has slowed due to inflation and the resulting cost-of-living crisis, as well as economic policy tightening. Job markets and household savings are nonetheless holding up well in the more advanced economies, which should enable them to avoid slipping into deep recession. Technical recessions, on the other hand, are to be expected in both the US and Germany over 2023. We are likely to see a greater number of bankruptcy filings under the combined effects of the economic slowdown, tightening of financial conditions and higher debt levels.

Looking beyond 2023, rising interest rates will hamper the recovery. Although rates appear to have peaked, the lag effects of monetary tightening will continue to feed through to the economy. Financial conditions will also be affected by central banks continuing (the case of the Fed) or starting (the case of the ECB) to shrink their balance sheets.

In light of this, the Group’s baseline scenario is for global growth of 2.2% in 2023 after 3.1% in 2022. Looking forward beyond 2023, recovery will continue to be damped by a higher interest environment.

The 2022 regulatory landscape was marked by the specific measures taken in response to Russia’s invasion of Ukraine: successive waves of unprecedented sanctions, aid packages for refugees and companies affected by the war, and debate over how to reform hard-hit European energy markets.

■The European Commission has temporarily lifted certain restrictions on State aid, freeing up member states to bolster their economies with targeted measures. In France, the financial support measures implemented for businesses during the pandemic have been adapted to help with the economic fallout from the war: new government-backed “Resilience” loans were introduced, the recovery loan scheme was extended and thought is being given to fuel subsidies. Unlike Germany and its Nordic neighbours, however, France has not introduced an ad hoc government-backed mechanism for utilities experiencing difficulties in paying down soaring margin calls on energy derivatives markets. In response to the shockwaves that rocked energy derivatives markets in the spring and summer of 2022, the European authorities are looking into what can be done to make trading and clearing on these markets more stable and resilient going forward.

■The European Commission (EC), the European Central Bank (ECB) in its capacity as prudential supervisor, the European Banking Authority (EBA) and the French High Council for Financial Stability (HCSF) had all used the flexibility afforded them under prudential regulations to take action to preserve the liquidity and solvency of banks during the Covid-19 pandemic. They are now phasing out these measures, despite the ongoing conflict in Ukraine. Given that borrowing levels remain strong, the the HCSF decided on 7 April 2022 to start normalising its countercyclical capital buffer rate for French banks, raising it from 0% to 0.5% from 7 April 2023.

In addition to these measures prompted by the prevailing economic conditions, progress was also made in 2022 on a number of structural regulatory projects designed to strengthen the prudential framework, support environmental and digital transitions, protect consumers and develop European capital markets:

■significant headway was made in negotiations on the CRD6/CRR3 proposal implementing the Basel Accords. A final compromise text is expected during Q1 2023. The European Council’s position leaves the main thrust of the Commission’s proposal unchanged and rubber-stamps certain measures advocated by the banking sector. Although the European Parliament’s position is less clear (the rapporteur is in favour of sticking to a strict transposition of the Basel Accords), the final compromise text is unlikely to fundamentally differ from the Commission’s proposal.

Uncertainty prevails over the timetable for rolling out this reform in the main non-EU jurisdictions, which is not expected to coincide with the Basel timetable of 1 January 2025;

■despite outward enthusiasm for getting the ball rolling again on finalising plans for a banking union, there was no breakthrough in the talks between European finance ministers in the first half of 2022. Instead, they discussed how to reform the crisis management framework and tasked the European Commission to come up with proposals. The Commission has announced that it will publish draft legislation to harmonise and extend the EU’s resolution framework in Q1 2023;

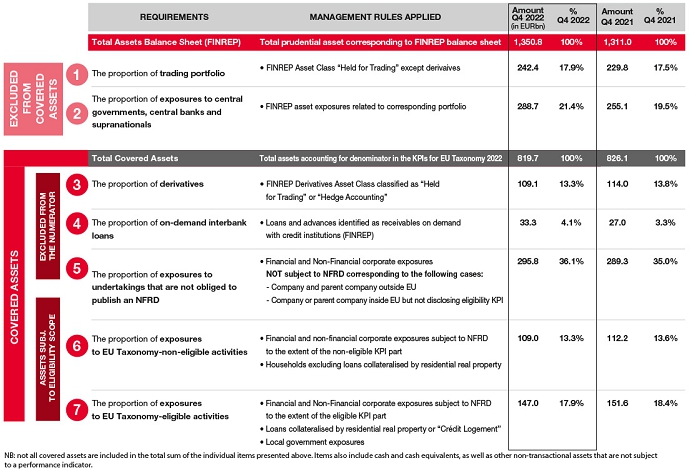

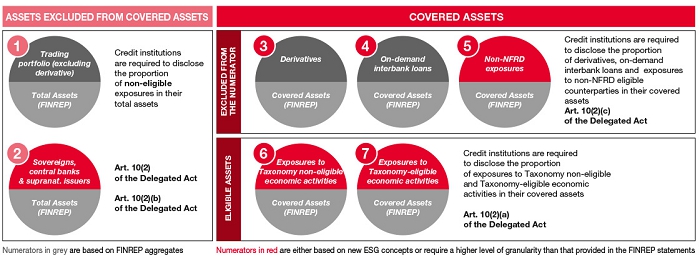

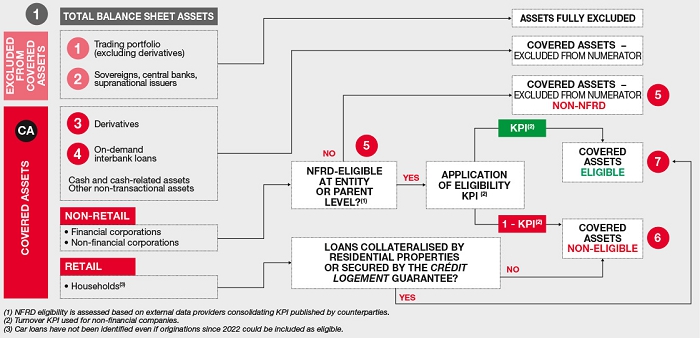

■over the course of 2022, the EU added to its regulatory arsenal designed to redirect capital flows towards more sustainable activities and make the financial system more resistant to climate risks. Major new legislation was passed, such as the Corporate Sustainability Reporting Directive, which will enter into effect as from 2024; the European Financial Reporting Advisory Group (EFRAG) has already issued its initial proposals for reporting standards. Negotiations on the proposed Corporate Sustainability Due Diligence Directive kicked off in 2022 and will continue throughout 2023. Eligibility reporting under the EU’s Green Taxonomy began in 2022, ahead of alignment reporting, which will become mandatory for non-financial corporates as from 2023 and for firms in the financial sector as of 2024.

The EU also introduced requirements for banks to be more thorough in addressing their exposure to climate and sustainability risks and more transparent about disclosing ESG risks in their prudential publications. The ECB conducted climate stress tests in 2022 and the Commission now includes ESG risks when reviewing the prudential framework. Starting in 2023, credit institutions will have to publish detailed information on their exposure to climate risks. The European Parliament made the prudential treatment of significant GHG-emitting assets part of the CRD6/CRR3 proposal implementing the Basel Accords, pre-empting the conclusions of the European Banking Authority (EBA) on the issue, expected in 2023.

With other national and international initiatives fast multiplying, the question of how the EU’s legislation will interact with measures introduced outside its borders is more relevant than ever. The EU will want to reassert its role as pioneer in the field and avoid any distortion of competition with non-EU operators;

■digital transformation remained high on the regulatory agenda. Work continued on the legislation proposed in 2021: progress was made on the digital finance action plan and an agreement was reached on the Markets in Crypto-Assets (MiCA) Regulation (which will give rise to various Level 2 measures) in June 2022, and on the Digital Operations Resilience Act (DORA), designed to strengthen cybersecurity and the monitoring of outsourced services, in May. Headway was also made in discussions on initiatives concerning artificial intelligence, digital identity and the free movement of data.

In the wake of its targeted consultation, the Commission is expected to soon announce proposals on open finance, which will feed into fundamental discussions surrounding payments and retail banking (such as on the European Payment Initiative and how to generalise instant payments faster). The PSD2 evaluation and the ECB’s proposal for a central bank digital currency – both slated for the first half of 2023 – will be key steps in this respect;

■consumer issues also commanded considerable attention both in France and at European level. The European Parliament and Council reached agreement on a revised Consumer Credit Directive at the beginning of December, heralding change for the small consumer loan market. And as part of the Commission’s push for structural reform in the retail investment product market, the first half of 2023 should bring revised versions of MiFID, IDD and the PRIIPs Regulations. In the midst of a cost-of-living crisis, the European Parliament’s debates on bank charges and measures to support the economy brought forth legislative proposals and commitments from those banks whose impacts remain in check. In France, the Lemoine Act of February 2022 on loan insurance reform entered into effect, although it is still premature to say how its two key measures (freedom to switch to a new insurer at any time and partial scrapping of the medical questionnaire) will affect the market;

■and lastly, post-Brexit, the Commission is keen to return to the matter of the Capital Markets Union (CMU), picking up the debate based on the proposal outlined in the 2020 action plan. Initially focused on deepening and integrating European markets, CMU is now also seen as a way to ensure Europe’s financial autonomy. This has become increasingly important – the pandemic and the situation in Ukraine have shone a light on how the EU’s lack of autonomy leaves it vulnerable, as noted in the Commission’s strategic autonomy plan, published in January 2021, and the associated conclusions from the Council in April 2022. Accordingly, we have seen legislative proposals and discussions in Parliament and the Council on revisions to the Markets in Financial Instruments Regulation (MiFIR), the Alternative Investment Fund Managers (AIFM) Directive and the European Long Term Investment Funds (ELTIF) Regulation, as well as to the European Single Access Point (ESAP) for financial and non-financial information about EU companies and the European withholding tax framework, with a view to simplifying and harmonising the existing complex processes – seen as a significant disincentive to cross-border investment. In a press release issued on 7 December 2022, the Commission also put forward a series of new proposals to further develop the CMU. These proposals centred on three areas:

-ensuring “safe, robust and attractive” clearing to encourage market participants to start using EU-based clearing houses for their euro-denominated products (revision of EMIR),

-

1.4 THE GROUP’S CORE BUSINESSES

1.4.1 FRENCH RETAIL BANKING

French Retail Banking (RBDF) offers a wide range of products and services suited to the needs of a diversified base of individual and professional clients, businesses, non-profit associations and local authorities. It leverages on synergies with the Group’s specialised businesses, in particular the Insurance, the Private Banking or the Corporate & Investment Banking businesses. Accordingly, French Retail Banking distributes insurance products of Sogecap and Sogessur, subsidiaries which are part of the International Retail Banking and Financial Services’ division.

Relying on the know-how of its teams and an efficient multichannel network, the pooling of best practices, and the optimisation and digitalisation of processes, Retail Banking France combines the strength of three complementary brands: Societe Generale (a leading French bank that has housed Private Banking since January 2022) and Crédit du Nord (a group of regional banks) which are pushing further ahead with a transformational project to merge their networks, and Boursorama Banque, a key online banking operator.

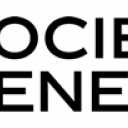

In 2022, average life insurance outstandings reached EUR 120 billion, compared with EUR 119 billion in 2021.

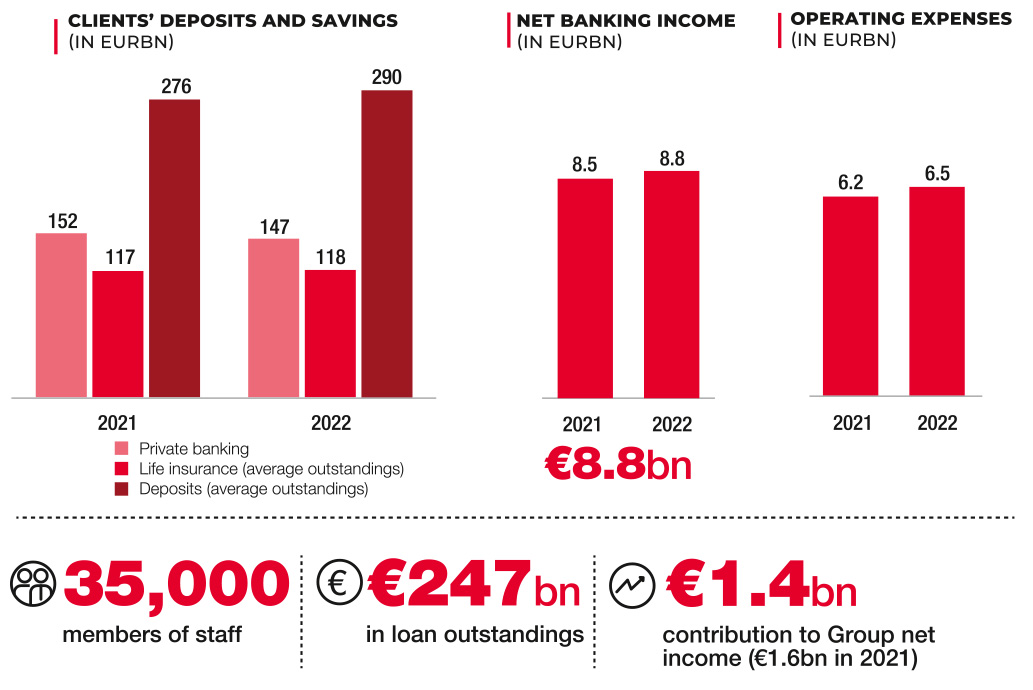

The networks continue to support the economy and support their clients with their financing projects. Average loan outstandings of the networks rose from EUR 238 billion in 2021 to EUR 247 billion in 2022. At the same time and in a context of an intense competition, deposit collection generated a loan-to-deposit ratio of 85.2% in 2022, down 1.1 points compared to 2021.

The Societe Generale network offers solutions tailored to the needs of its 6.7 million individual clients as well as almost 420,000 professional clients, non-profit associations and corporate clients, representing EUR 180 billion in outstanding deposits and EUR 159 billion in outstanding loans in 2022.

■approximately 1,200 main branches located mainly in urban areas where a large proportion of national wealth is concentrated;

■an exhaustive and diversified range of products and services, ranging from savings vehicles and asset management solutions to corporate finance and payment means;

■a comprehensive and innovative omnichannel system spanning internet, mobile, telephone and service platforms.

Societe Generale continued to expand its network and increase its service offering in 2022 in response to its clients’ requirements and with a view to enhancing customer satisfaction. These efforts focused notably on promoting the increased use of electronic signatures for professionals and in the short-term credit and MLT credit markets. Societe Generale broadened its commercial offering dedicated to TPEs and modified its lending services (on the application and decision for MLT loans), supported by training sessions and a change management programme.

Last, Societe Generale has made sustainable development the linchpin of its strategy by not only ensuring that its direct environmental impact is controlled through actions to reduce its waste and carbon footprint but by also developing an offer to support its clients in their own energy transition: in 2022, Societe Generale and Crédit du Nord launched a comprehensive support framework for companies, SMEs, associations and local authorities to enable them to develop a more sustainable model. They furnish new advisory and financing solutions in conjunction with top-name partners. Irrespective of their profile, the Bank also offers to measure clients’ greenhouse gas emissions, in partnership with Carbo.

The Crédit du Nord group consists of nine regional banks – Courtois, Kolb, Laydernier, Nuger, Rhône-Alpes, Société Marseillaise de Crédit, Tarneaud, Société de Banque Monaco and Crédit du Nord – and an investment services provider, the brokerage firm Gilbert Dupont.

Crédit du Nord entities are characterised by a large degree of autonomy in managing their activities, which is chiefly expressed by rapid decision-making and responsiveness to client demands.

The quality and strength of the results of the Crédit du Nord group have been recognised by the market and are confirmed by the long-term A- rating attributed by Fitch.

Crédit du Nord serves 1.6 million individual clients(1), 210,200 professional clients and non-profit associations and 46,400 corporate and institutional clients. In 2022, its average outstanding deposits totalled EUR 58 billion, compared with EUR 57 billion in 2021, while average loan outstandings stood at EUR 55 billion, compared with EUR 52 billion in 2021.

In December 2020, Société Générale and Crédit du Nord expressed their intention to merge their two networks to create a new retail bank with the aim of serving 10 million clients and ranking among the Top 3 for customer satisfaction.

■a bank anchored locally throughout 11 regions: decisions will be predominantly taken at regional level and on an increasing basis directly in agencies and business centres;

■a bank that gears itself more to the specific needs of each client category: a bank that offers expertise, with resources increasingly focused on the specific requirements of the various client categories, notably with the introduction of a wealth management bank, across-the-board presence of a dedicated advisor for professional clients - covering both their personal and professional banking needs - and a wider array of savings, insurance, and professional and corporate solutions experts throughout France to deal with the full scope of their financing and advisory concerns;

■a responsible bank: CSR issues are the linchpin of the new model which aims to expand the positive impact for clients and local communities through new choices regarding offers and organisation, particularly the introduction of CSR advisory teams in each region, enabling SG to accelerate financing for the environmental transition and to be a springboard for the development of France’s regions and its ecosystems from both an economic and social standpoint.

■social framework: in February 2022, the Societe Generale Group signed a unanimous agreement with all trade union representative organisations on employment and skills as part of the planned creation of the new retail bank in France resulting from the merger of the Societe Generale and Crédit du Nord networks;

■brand strategy: in April 2022, the Societe Generale Group unveiled the brand strategy of the new retail bank in France which underscored its local ties, showcasing a national SG brand rounded off by a number of regional brands: SG Crédit du Nord, SG Grand Est, SG Laydernier, SG Auvergne Rhône Alpes, SG SMC, SG Courtois, SG Sud Ouest, SG Tarneaud, SG Grand Ouest and, in Ile-de-France and in Corsica, SG Société Générale.

On 1 January 2023, Societe Generale Group carried out the legal merger of its two French Societe Generale and Crédit du Nord retail banking networks. SG will henceforth become the Group’s new retail bank in France.

Crédit du Nord’s IT system will initially be migrated in two stages to Societe Generale’s information system during the first quarter of 2023. Agency pooling will commence in the second half of 2023 and the initial phase will involve 150 batchings (30%). Some 80% of the link-ups will be performed by the end of 2024, with the remaining 20% finalised by the end of 2025.

Boursorama is a subsidiary of Societe Generale and a pioneer and leader in France for its three main businesses: online banking, brokerage and online financial information at boursorama.com, ranked No. 1 for economic and stock market news. An online bank accessible to all, without any revenue or financial wealth prerequisites, Boursorama’s promise is the same as it was when it was first created, i.e. simplify clients’ lives at the most competitive price and furnish the best service possible to boost their purchasing power.

At end-2022, Boursorama served nearly 4.7 million clients – a 41% increase in the space of a year alone. This rapid growth has been matched by an increase of more than EUR 15 billion in the bank’s outstandings over the period (over EUR 66 billion at end-December 2022, including EUR 16 billion in loans, EUR 13 billion in current accounts and EUR 37 billion in savings and share securities) which demonstrates the appeal of its fully online model based on client independence and a comprehensive range of 43 banking products and services, rounded out by 1,000 functionalities with automated processes.

The year 2022 was dominated by the i) a record client acquisition with 1.5 million new clients, on top of a substantial 20% drop in the client acquisition cost, ii) the successful integration of ING’s former clients (around 300,000 new clients and almost EUR 9 billion in outstandings, of which half covers life insurance savings, and iii) over and above its successful regular banking offer, it is committed to clients, providing a wide range of products and services, such as:

■stock exchange products: the success of BoursoMarkets, the new zero-brokerage-fee trading offering encompassing over 40,000 products (e.g., volumes traded on warrants/certificates have doubled since 2021 in a shrinking market) and the launch of bespoke employee share plans;

■savings products: the success of Matla, the market’s least expensive retirement savings plan (outstandings have tripled since 2021), and the launch of new asset classes with real estate crowdfunding, private equity and EMTNs;

■loan products: the launch of the 100% online MyLombard loan and the expansion of the cli€ small loan (production has tripled since 2021);

■insurance products: success of the comprehensive range of insurance products (loans and property and casualty) with over 830,000 contracts at end-2022, up 40% compared with end-2021;

■acceleration of non-banking products (BAAP platform, The Corner, which generated EUR 150 million in revenue in 2022, which is thrice the amount for 2021.

Boursorama was voted the least expensive bank for the 15th consecutive year (source: Le Monde/Panorabanque 2022), best bank for students and young working adults (Selectra 2022) and France’s preferred bank for digital banking (source: Opinionway 2022). The online bank was ranked No. 1 on app stores, with a rating of 4.9/5 on iOS and 4.8/5 on GooglePlay. It boasts a Net Promoter Score of +35 for the sector (source: Bain and Company, January 2022).

Launched over 20 years ago, its online portal, www.boursorama.com, is consistently ranked the No. 1 website for financial and receives 50 million visits a month (Source ACPM – September 2022).

Boursorama generally attracts young clients – the average age is 35 – who are city dwellers, who work and who are financially stable. The average client outstanding is over EUR 15,000 (savings and loans). The acquisition of private banking clients continues to rise despite the rapid acceleration in growth. Boursorama has also pursued optimisation efforts and registered a decrease of almost 20% of IT costs per client and a 30% increase in the number of clients by employees.

Societe Generale Private Banking has an extensive foothold in Europe and offers global financial engineering and wealth management solutions, in addition to global expertise in structured products, hedge funds, mutual funds, private equity funds and real estate investment solutions. It also offers clients access to the capital markets.

Since January 2014 and in conjunction with the French Retail Banking core business, Societe Generale Private Banking has extensively modified its relationship banking model in France by extending its services to all individual customers with more than EUR 500,000 in their accounts. These customers reap the benefit of close-hand service provided by 80 regional franchises and the know-how of Private Banking’s expert teams.

Societe Generale Private Banking’s offering is available from three main centres: SGPB France, SGPB Europe (Luxembourg, Monaco and Switzerland) and Kleinwort Hambros (London, Jersey, Guernsey and Gibraltar). At the end of 2022, Private Banking held EUR 147 billion in assets under management.

Following the disposal of Lyxor at the end of 2021, the decision was made to house the following wealth management subsidiaries in Societe Generale Private Banking: SG 29 Haussmann(1) (France) et SGPWM(2) (Luxembourg) and to also combine in its ranks Global Markets’ structured fund activity, in addition to a number of UCITS/bonds supervisory and selection teams. Societe Generale Private Banking took advantage of the occasion to create a fourth Wealth Investment Services centre of expertise, bringing together these management and structuring skills (Investment Management Services) with the Market Solutions teams, thereby becoming a genuine one-stop shop that houses unique expertise within the Group to design investment and open-architecture solutions.

Societe Generale Private Banking was singled out for eight prizes at the 2022 Global Private Banking Innovations Awards.

Kleinwort Hambros was awarded the Excellence in Employee Engagement prize at the 2022 Private Banker International Global Wealth Awards.

(1)SG 29 Haussmann is a management company approved and regulated by the AMF (Autorité des marchés financiers – the French financial services authority). Its remit is to provide portfolio management services either as funds or by way of discretionary asset management, and manages in particular the assets of client portfolios of SG private banking clients, mainly for the benefit of clients of the Private Bank and clients of the Societe Generale network. It has multi-management expertise in structured management, equities, fixed income and alternative management. Since 1 November 2021, SG 29 has also integrated structured Global Markets’ structured fund management business (SIS).

-

2.2 GROUP ACTIVITY AND RESULTS

Information followed by an asterisk (*) is indicated as adjusted for changes in Group structure and at constant exchange rates.

(In EURm)

2022

2021

Change

Net banking income

28,059

25,798

8.8%

9.7%*

Underlying net banking income

28,059

25,681

+9.3%

+10.2%*

Operating expenses

(18,630)

(17,590)

+5.9%

+7.5%*

Underlying operating expenses

(17,991)

(17,211)

+4.5%

+6.1%*

Gross operating income

9,429

8,208

14.9%

14.4%*

Underlying gross operating income

10,068

8,470

18.9%

18.4%*

Net cost of risk

(1,647)

(700)

x 2.4

93.0%*

Operating income

7,782

7,508

3.6%

5.3%*

Underlying operating income

8,421

7,770

8.4%

10.1%*

Net income from companies accounted for by the equity method

15

6

x 2.5

x 2.5*

Net profits or losses from other assets

(3,290)

635

n/s

n/s

Impairment losses on goodwill

0

(114)

100.0%

-100.0%*

Income tax

(1,560)

(1,697)

-8.1%

-5.8%*

Net income

2,947

6,338

-53.5%

-53.2%*

o.w. noncontrolling interests

929

697

33.3%

32.3%*

Group net income

2,018

5,641

-64.2%

-64.0%*

Underlying group net income

5,616

5,264

+6.7%

+7.9%*

Cost-to-income ratio

66.4%

68.2%

Average allocated capital(1)

55,164

52,634

ROTE

2.9%

11.7%

Underlying ROTE

9.6%

10.2%

(1)Amounts restated compared with the financial statements published in 2020 (See Note1.7 of the financial statements).

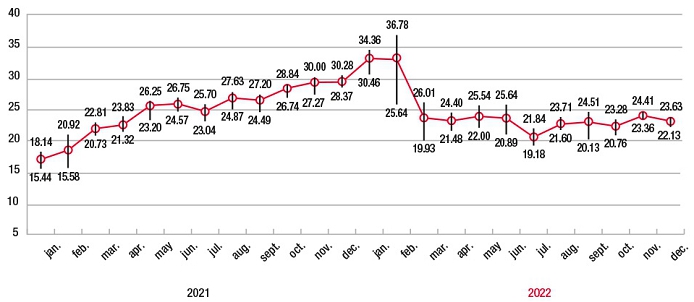

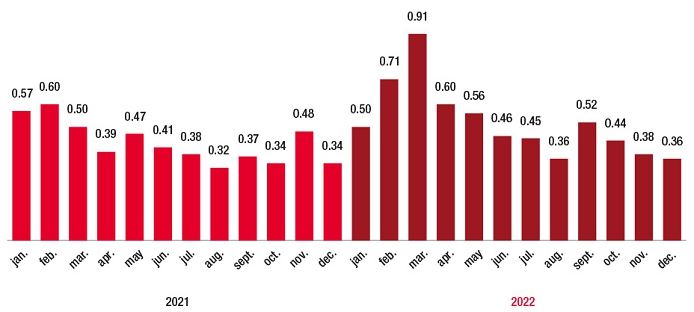

Underlying net banking income grew strongly in 2022 at +9.3% (+10.2%*) vs. 2021, driven by historical highs in Financing & Advisory, Global Markets and ALD, sharp growth in Private Banking and International Retail Banking and a solid performance by French Retail Banking.

French Retail Banking revenues grew +4.1% vs. 2021 fuelled notably by robust service fee growth and a very solid showing by Private Banking.

International Retail Banking & Financial Services’ revenues rose +12.4% (+17.9%*) vs. 2021, driven by a record performance at ALD and strong growth at International Retail Banking whose revenues grew +11.5%* vs. 2021. Financial Services’ net banking income was significantly higher by +35.8%* vs. 2021, while Insurance net banking income increased by +6.5%* vs. 2021.

Global Banking & Investor Solutions’ revenues were up +14.3% (+12.9%*) vs. 2021. Global Markets & Investor Services’ revenues posted an +18.7% increase in revenues (14.1%*) vs. 2021, while Financing & Advisory activities increased by +15.2% (+10.7%*) vs. 2021.

In 2022, operating expenses totalled EUR 18,630 million on a reported basis and EUR 17,991 million on an underlying basis (restated for transformation costs), i.e., an increase of +4.5% vs. 2021 (on an underlying basis).

The rise can be mainly attributed to the EUR 864 million contribution to the Single Resolution Fund, which increased by EUR 278 million, currency effects, notably in US dollars, and a rise in the variable components of employee remuneration associated with higher revenues.

Underlying gross operating income increased by +18.9% to EUR 10,068 million in 2022, while the underlying cost to income ratio (excluding the Single Resolution Fund) posted a 3.4 point improvement to 61.0% (vs. 64.4% in 2021).

Excluding the Single Resolution Fund, the underlying cost to income ratio is expected to range between 66% and 68% in 2023, based notably on normalised revenues in Global Markets.

Over the full year, the cost of risk amounted to 28 basis points, landing below the guidance of between 30 and 35 basis points.

Offshore exposure to Russia was reduced to EUR 1.8 billion of EAD (Exposure At Default) at 31 December 2022, i.e., a decrease of around -45% since 31 December 2021. Exposure at risk on this portfolio is estimated at less than EUR 0.6 billion, compared with less than EUR 1 billion for the previous quarter. Total associated provisions stood at EUR 427 million at end-December 2022. Moreover, at end-December 2022, the Group’s residual exposure to Rosbank amounted to less than EUR 0.1 billion, corresponding mainly to guarantees and letters of credit.

The Group’s provisions on performing loans amounted to EUR 3,769 million at end-December, an increase of EUR 414 million in 2022.

The non-performing loans ratio amounted to 2.8%(1) at 31 December 2022, down 10 basis points vs. 31 December 2021. The gross coverage ratio on doubtful loans for the Group stood at 48%(2) at 31 December 2022.

Operating income totalled EUR 7,782 million in 2022 compared with EUR 7,508 million in 2021. Underlying operating income came to EUR 8,421 million compared with EUR 7,770 million in 2021.

-

2.3 ACTIVITY AND RESULTS OF THE CORE BUSINESSES

2.3.1 RESULTS BY CORE BUSINESSES

French Retail

Banking

International

Retail Banking

and Financial

Services

Global Banking

and Investor

Solutions

Corporate

Centre

Group

(In EURm)

2022

2021

2022

2021

2022

2021

2022

2021

2022

2021

Net banking income

8,839

8,489

9,122

8,117

10,082

8,818

16

374

28,059

25,798

Operating expenses

(6,473)

(6,248)

(4,334)

(4,203)

(6,634)

(6,250)

(1,189)

(889)

(18,630)

(17,590)

Gross operating income

2,366

2,241

4,788

3,914

3,448

2,568

(1,173)

(515)

9,429

8,208

Net cost of risk

(483)

(125)

(705)

(504)

(421)

(65)

(38)

(6)

(1,647)

(700)

Operating income

1,883

2,116

4,083

3,410

3,027

2,503

(1,211)

(521)

7,782

7,508

Net income from companies accounted for by the equity method

8

1

1

0

6

4

0

1

15

6

Net profits or losses from other assets

57

23

11

18

6

(9)

(3,364)

603

(3,290)

635

Impairment losses on goodwill

-

-

-

-

-

-

-

(114)

-

(114)

Income tax

(504)

(592)

(996)

(840)

(576)

(452)

516

187

(1,560)

(1,697)

Net income

1,444

1,548

3,099

2,588

2,463

2,046

(4,059)

156

2,947

6,338

o.w. non-controlling interests

(1)

(2)

723

506

36

28

171

165

929

697

Group net income

1,445

1,550

2,376

2,082

2,427

2,018

(4,230)

(9)

2,018

5,641

Cost-to-income ratio

73.2%

73.6%

47.5%

51.8%

65.8%

70.9%

66.4%

68.2%

Average allocated capital(1)

12,417

12,009

10,619

10,246

14,916

14,055

17,213

16,323

55,164

52,634

RONE (businesses)/ROTE (Group)

11.6%

12.9%

22.4%

20.3%

16.3%

14.4%

2.9%

11.7%

(1)Amounts restated compared with the financial statements published in 2020 (See Note1.7 of the financial statements).

-

2.4 EXTRA-FINANCIAL REPORT

Societe Generale applies a comprehensive approach to incorporating CSR considerations into its range of products and services. In addition to this broad framework, Societe Generale’s Corporate Social Responsibility efforts are concentrated in two main areas: the environmental transition and contributing to local communities. As a long-standing leader in energy, the Group has made the energy transition a priority in support for its clients. Societe Generale also plays a major role in economic development and has put sustainable development of local communities as the No. 2 priority in its action plans.

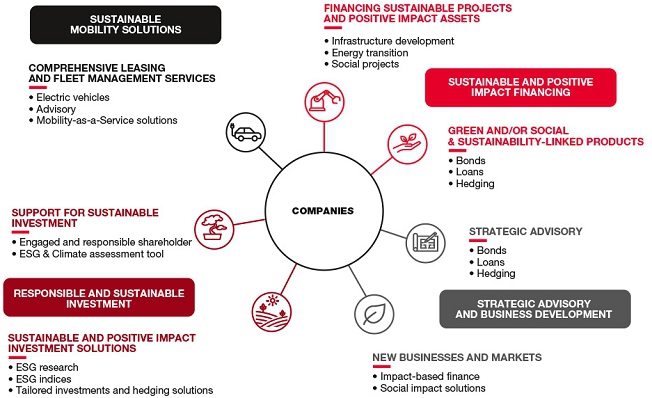

The Bank strives to help its clients on their pathway to a just, green and inclusive transition, in line with its own commitments. Sustainability is an integral part of the products and services offered to all the Group’s clients and extends not only to financing and investment products, but also to financial services. By placing sustainability high on the agenda, the Group aims to meet the increasing demand from stakeholders around the world, whether clients, corporates, investors or individuals, for banking with a positive impact on the economy and society overall.

To monitor its positive impact and support for its clients, the Group developed a standard several years ago to measure the distribution of its Sustainable and Positive Impact Finance offer – SPIF* (see Glossary, page 688) products for lending to the economy and companies, together with a range of Sustainable and Positive Investment (SPI* (see Glossary, page 688). The SPIF and SPI standards and the data collection scope have been revised to reflect changes in the Group. These amendments are presented in the Methodology note, page 354.

Above and beyond its commitment to clients, the Group is determined to set the example in how it conducts its business to be an exemplary financial company. In other words, Societe Generale aims to be a responsible employer and to act ethically and responsibly at all times.

To make the changes needed in today’s rapidly-changing environment, the Group launched “Building Together”, a programme to reinvent our businesses. The three core themes are:

1.rethinking the Bank’s businesses: we are revamping our teams’ missions to develop solutions to support clients as they transition their businesses to more sustainable models;

2.implementing the transformation: systematically building ESG into all the Group’s strategic decisions, management tools and processes and applying them to the business lines;

To underpin this approach, a specific programme was introduced to step up operational implementation of the transformation: ESG by Design. Its main aims are to:

■augment ESG factors in existing processes (e.g. know your client, granting loans, design/structure of new products, IT architecture, etc.);

■ensure compliance with the Group’s regulatory obligations and voluntary commitments by developing the processes and tools needed to manage them, with a particular focus on integrating climate and environmental risks into the Group’s risk management;

■increase operational efficiency by expanding ESG reporting across the Board and building the infrastructure to shorten the time to produce ESG data, while minimising cost and ensuring high data quality.

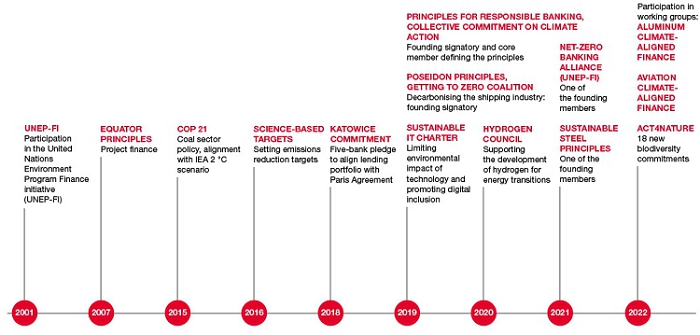

2.4.1 DRIVERS OF POSITIVE TRANSFORMATION

The environmental transition and contributing to local communities are the Group’s two top strategic priorities for 2025 and the springboard for our positive transformation efforts. Societe Generale’s actions are aimed at ensuring the sustainability of its own business activities and at helping clients move towards a greener and more sustainable future.

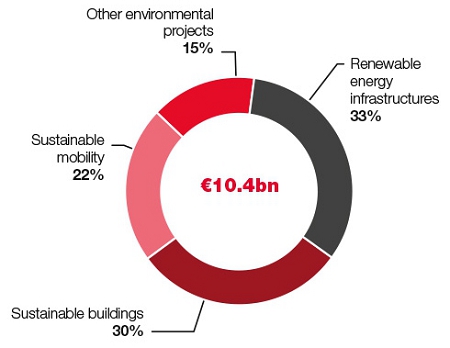

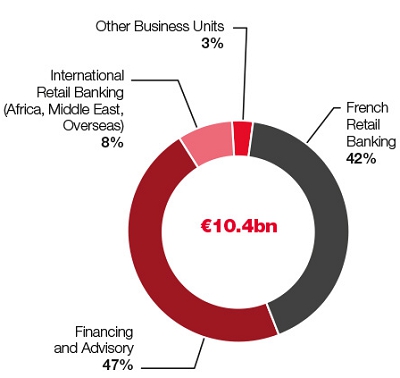

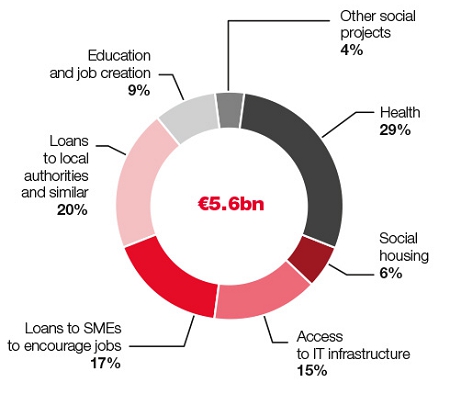

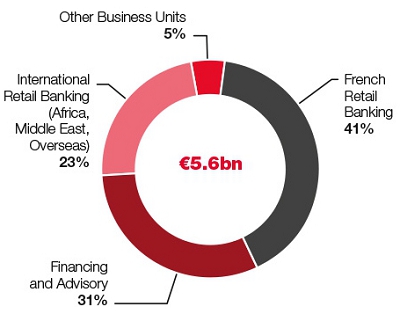

Building on an improved product offering, and having achieved our target contribution to the energy transition ahead of schedule (EUR 157 billion at the end of 2021 vs. an initial target of EUR 120 billion in the period 2019–2023), Societe Generale has set a new target of a EUR 300 billion contribution to sustainable finance (SPIF) between 2022 and 2025, applicable to all business lines for both environmental and social issues. The Group’s contribution at end-2022 was EUR 100 billion, or one-third of the target.