PILLAR 3 2022

-

1 GROUP CONCISE RISK STATEMENT

As part of setting its Risk Appetite, Societe Generale seeks a sustainable development based on a diversified and balanced banking model with a strong European foothold and a global presence targeted on a few areas of strong business expertise. The Group also aims to maintain long-term relationships with its customers built on well-earned trust, and to respond responsibly to the expectations of all of its stakeholders. At 31 December 2022, the indicators of the Group’s risk appetite in terms of solvency, earnings, market risk, cost of risk and non performing loans rate were within the risk appetite levels defined by the Group. They have not reached the tolerance thresholds defined by the Board.

-

1.1 FINANCIAL STRENGTH PROFILE

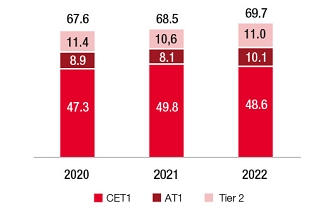

The Group seeks sustainable profitability, relying on a robust financial strength profile, consistent with its diversified banking model. In terms of financial ratios, the Group calibrates its objectives to ensure a sufficient margin of safety in relation to regulatory requirements. As of 31 December 2022, the Group’s CET1 ratio stood at 13.5% compared to 13.7% at the end of 2021, well above the regulatory requirement of 9.35% (“MDA” threshold - Maximum Distributable Amount, calculated at end of Decembre 2022).

The solvency and leverage prudential ratios, as well as the amounts of regulatory capital and RWA featured here take into account the IFRS 9 phasing (fully-loaded CET1 ratio of 13.34% at end 2022, the phasing effect being +17 bps) and the effects of the ECB’s Covid-19 transitional measures ending on 31 December 2022.

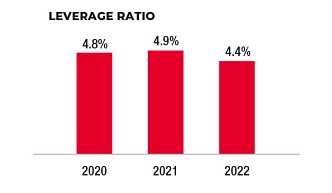

As of 31 December 2022, the Group’s leverage ratio stood at 4.4%, taking into account an amount of Tier 1 capital of EUR 58.7 billion compared to a leverage exposure of EUR 1,345 billion. euros (compared to 4.9% as of 31 December 2021, with EUR 57.9 billion and EUR 1,190 billion respectively).

In addition, as of 31 December 2022, the Group has a TLAC (Total Loss Absorbing Capacity) ratio of 33.64% of weighted exposures (compared to 31.1% as of 31 December 2021, for a regulatory requirement of 21.66% at the end of 2022).

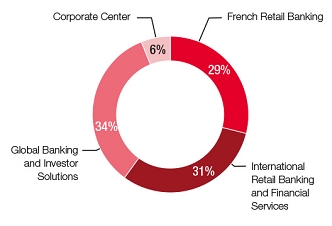

Regarding its risk profile, the Group has a balanced distribution of risk-weighted exposures (RWA) between its Global Banking and Investor Solutions divisions (34% as of 31 December 2022), Retail Banking and International Financial Services (31% as of 31 December 2022), Retail Banking in France (29% as of 31 December 2022) and Corporate Center (6% as of 31 December 2022). In terms of change, the Group’s weighted exposures stood at EUR 360.5 billion as of 31 December 2022 compared to EUR 363.4 billion as of 31 December 2021, a decrease of -1%.

Concerning the internal economic approach of the ICAAP, the rate of coverage of the Group’s internal capital requirement by the internal capital the end of 2022 is greater than 100%.

(In EURbn)

Credit and

counterparty credit

Market

Operational

Total 31.12.2022

French Retail Banking

101.0

0

5.1

106.1

International Retail Banking and Financial Services

105.6

0.2

4.6

110.4

Global Banking and Investor Solutions

82.1

12.6

29.0

123.7

Corporate Centre

12.1

0.9

7.4

20.3

Group

300.7

13.7

46.0

360.5

(In EURbn)

Credit and

counterparty credit

Market

Operational

Total 31.12.2021

French Retail Banking

91.8

0.1

3.7

95.5

International Retail Banking and Financial Services

112.1

0.1

5.5

117.7

Global Banking and Investor Solutions

89.3

11.5

30.3

131.2

Corporate Centre

11.7

0.0

7.3

19.0

Group

304.9

11.6

46.8

363.4

In addition, the Group presents its unconsolidated structured entities in Note 2.4 of the financial statements of the 2023 Universal Registration Document. Intra-group transactions are governed by a credit granting process respecting different levels of delegation within the Business Units, the Risk Department and the Finance Department. The entities’ structural risk management and oversight systems are also submitted to the Finance Department and the Risk Department.

-

1.2 CREDIT RISK AND COUNTERPARTY CREDIT RISK

Weighted exposures for credit risk and counterparty risk represent the Group’s main risk with an amount of risk-weighted exposures (RWA) of EUR 300.7 billion as of 31 December 2022, i.e. 83% of the total RWAs. These weighted exposures decreased by -1.4% compared to 31 December 2021 and are mainly based on the internal model approach (67% of credit and counterparty risk RWA). This decrease is mainly due to a methodology effect (-8 billion euros), a perimeter effect (-6 billion euros) related to the sale of Rosbank, and a volume effect (-4.4 billion euros) partially offset by a model effect update (+7.8 billion euros), a downgrade of assets quality (+3.9 billion euros) and a foreign exchange effect (+2.6 billion euros).

The credit portfolio presents a diversified profile. As of 31 December 2022, exposure to credit and counterparty risk represented an amount of EAD of 1,119 billion euros, up (+4%) compared to the end of 2021, driven in particular by the increase of ” Sovereigns”exposures. The breakdown of the portfolio between main customer categories is balanced: Sovereigns (29%), Corporates (32%), Retail customers (20%), Institutions (9%) and Others (10%).

In terms of geographic breakdown of the portfolio, exposure to emerging countries remains limited: the Group’s exposure is 70% in Western Europe (including 48% in France) and 14% in over North America. In sectoral terms, only the Financial Activities sector represents 7% of the Group’s Corporate exposures, followed by the Real Estate Activities and Business Services sectors.

With regard more specifically to counterparty risk, exposure represents an amount of EAD of 160 billion euros, increased (+11%) compared to the end of 2021, linked to the significant increase in exposure to Sovereigns.

As of 31 December 2022, EAD’s exposure to Russia represented 2.2 billion euros (exc. Private Banking) mainly made up of operations set up as part of the financing activities of Global Banking and Investor Solutions.

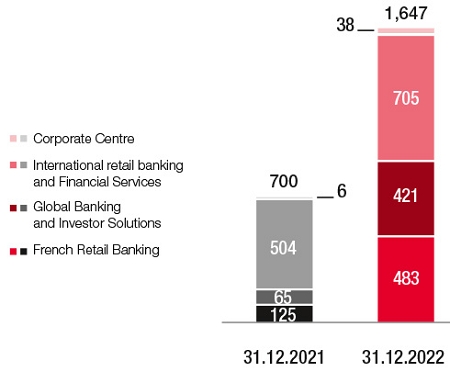

The Group’s net cost of risk in 2022 is EUR 1,647 million, up by 135% compared to 2021. This higher cost of risk compared to a low 2021 reference base is composed by a cost of risk which remains low on defaulted outstandings (stage 3), 17 bp compared to 18 bp in 2021, and provisions on sound outstandings (stage 1/stage 2) of 12 bp in order to maintain a prudent provisioning policy in an environment marked by economic prospects less favorable and in particular the rise in inflation and interest rates.

The cost of risk (expressed in basis points on the average of outstandings at the beginning of the period for the four quarters preceding the closing, including operating leases) thus stands at 28 basis points for the year 2022 compared to 13 basis points in 2021.

■In French Retail Banking, the cost of risk is up to 20 basis points in 2022 compared to 5 basis points in 2021. This NCR includes an allocation of 4 bps on sound outstandings (compared to the stage 1/stage 2 recovery of -7bp in 2021).

■At 52 basis points in 2022 (compared to 38 basis points in 2021), the cost of risk of the International Retail Banking and Financial Services division increased despite a lower NCR on defaulted outstandings (internship 3) due to an allocation of 15 base points on stage 1/stage 2.

■The cost of risk for Global Banking and Investor Solutions posted a level of 23 basis points (compared to 4 basis points in 2021), reflecting a sharp rise in the cost of risk on performing loans (stage 1/ stage 2) at 20 bp, while the NCR on defaulted outstandings remains very moderate (4 bp against 7 bp in 2021).

Within the meaning of Template 1 of Pillar 3 on ESG risks concerning transition risk, exposures towards sectors that highly contribute to climate change(1) (based on the NACE codes provided by the EBA) represent 177 billion euros of gross carrying amount.

(1)In accordance with the Commission delegated regulation EU) 2020/1818 supplementing regulation (EU) 2016/1011 as regards minimum standards for EU Climate Transition Benchmarks and EU Paris-aligned Benchmarks -Climate Benchmark Standards Regulation - Recital 6: Sectors listed in Sections A to H and Section L of Annex I to Regulation (EC) No 1893/2006.

(In EURbn)

31.12.2022

31.12.2021

Group gross doubtful loans ratio(1)

2.8%

2.9%

Doubtful loans (Stage 3)

15.9

16.5

Stage 3 Provisions

7.7

8.4

Group gross doubtful loans coverage ratio

48%

51%

(1)Customer loans and advances, deposits at banks and loans due from banks, finance leases, excluding loans and advances classified as held for sale, cash balances at central banks and other demand deposits, in accordance with the EBA/ITS/2019/02 Implementing Technical Standards amending Commission Implementing Regulation (EU) No 680/2014 with regard to the reporting of financial information (FINREP). The NPL rate calculation was modified in order to exclude from the gross exposure in the denominator the net accounting value of the tangible assets for operating lease. Performing and non-performing loans include loans at fair value through profit or loss which are not eligible to IFRS 9 provisioning and so not split by stage. Historical data restated.

-

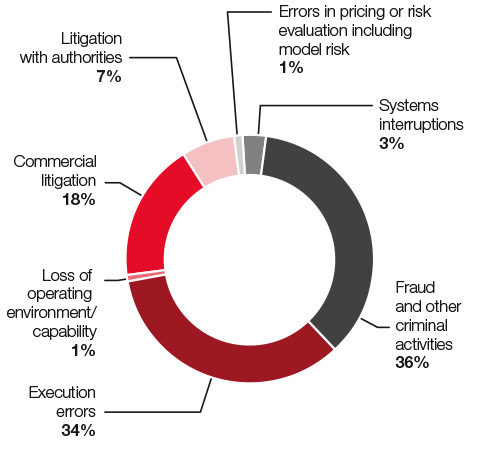

1.3 OPERATIONAL RISK

As of 31 December 2022, operational risk-weighted exposures represented EUR 46 billion, or 13% of the Group’s RWA, down -2% compared to the end of 2021 (EUR 46.8 billion). These weighted exposures are mainly determined using the internal model (97% of the total). The total amount of exposures weighted assets decreases in 2022 (-0.8 billion euros, i.e. -1.7%) mainly due to the disposal of activities in Russia.

-

1.4 MARKET RISK

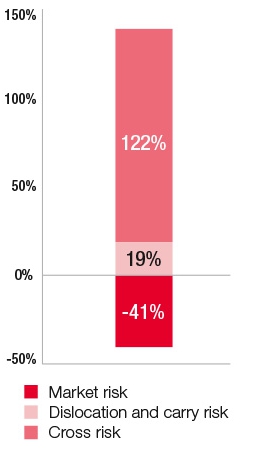

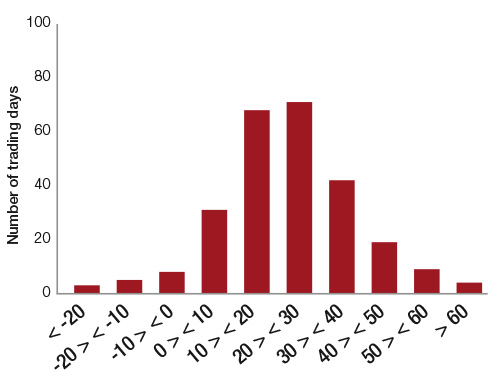

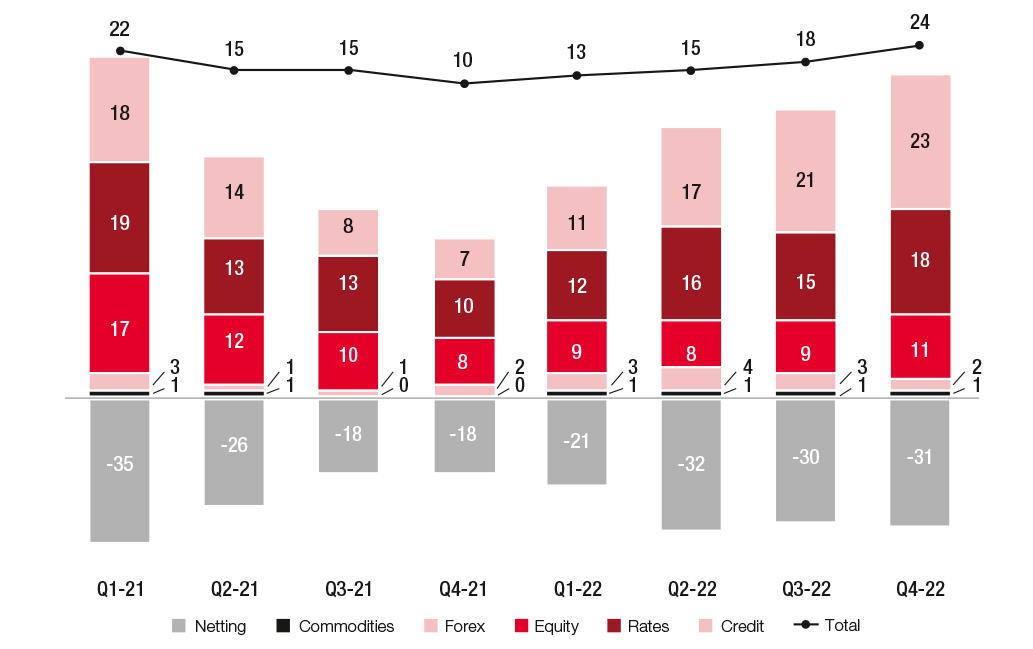

Market risk-weighted exposures are mainly determined using internal models (86% of the total at the end of 2022). These weighted exposures amounted to EUR 13.7 billion at the end of 2022, i.e. 3.8% of the Group’s total RWA, up +18% compared to the end of 2021 (EUR 11.6 billion).

Capital requirements for market risk increased in 2022. This increase is reflected in the VaR and the risks calculated under the standard approach:

-

1.5 STRUCTURAL RISK - LIQUIDITY

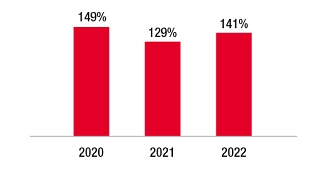

The LCR (Liquidity Coverage Ratio) ratio stood at 141% at the end of 2022 (compared to 129% at the end of 2021), corresponding to excess liquidity of EUR 74 billion (compared to EUR 51 billion at the end of 2021), compared to a regulatory requirement of 100%. The increase in the LCR of Société Générale between end of 2021 and end of 2022 reflects a precautionary and anticipatory stance, whereby Société Générale has increased its term deposits in the money market and anticipated a portion of its 2023 funding plan. This was driven by (i) favorable market conditions at the end of the year, (ii) the new context of positive interest rates, that may reduce deposits from corporate clients to monetary supports; (iii) anticipating the reduction in liquidity generated by the end of the TLTRO.

Liquidity reserves amounted to EUR 279 billion as of 31 December 2022 (compared to EUR 229 billion as of 31 December 2021). This variation is mainly due to an increase in HQLA securities available for sale on the market (after discount), partially offset by an increase in central bank deposits (excluding mandatory reserves).

-

1.6 STRUCTURAL RISK - RATES

In a parallel schock scenario where the interest rate increase, the impact of the changes of EVE (economic value of equity) in 2022 is -2,900 EUR million and 375 EUR million on interest margin. On the contrary, in a parallel schock scenario where the interest rate decrease, the impact of the changes of EVE (economic value of equity) in 2022 is 1,011 EUR million and -1,102 EUR million on interest margin.

(In EURm)

31.12.2021

Changes of the economic value

of equity (EVE)

Changes of the net interest income

(NII)

Supervisory shock scenarios*

1

Parallel up

(6,784)

240

2

Parallel down

(2,683)

(219)

3

Steepener

463

4

Flattener

(4,033)

5

Short rates up

(3,643)

6

Short rates down

79

*The above 6 shock scenarios are detailed in appendix 3 of the EBA/GL/2018/02 regulation (refer to EBA BS 2018 XXX Proposed final revised IRRBB Guidelines.docx (europa.eu)).

-

1.7 SIGNIFICANT OPERATIONS IN 2022

In 2022, the Group finalized the sale of Rosbank in Russia in the context of the russo-ukrainian crisis and the net income was around -3 billion euros. Furthermore, some important milestones have been reached concerning the merger of the retail network in France, in accordance to the schedule, and lead to the legal merger of retail network of Société Générale and Crédit du Nord on January, 1st. The new SG retail bank is launched. Partnership between Société Générale and ING has been finalised, pushing further ahead Boursorama (new clients +1.4 million clients reaching 4.7 million clients at end of 2022). The planned acquisition of LeasePlan by ALD in the mobility sector and Bernstein joint venture deal for our Equities business will create global leaders.

-

1.8 KEY FIGURES

(In EURm)

31.12.2022

30.09.2022

30.06.2022

31.03.2022

31.12.2021

AVAILABLE OWN FUNDS (AMOUNTS)

1

Common Equity Tier 1 (CET1) capital

48,639

47,614

47,254

48,211

49,835

2

Tier 1 capital

58,727

57,053

56,024

56,443

57,907

3

Total capital

69,724

69,444

67,835

66,990

68,487

RISK-WEIGHTED EXPOSURE AMOUNTS

4

Total risk-weighted assets

360,465

371,645

367,637

376,636

363,371

CAPITAL RATIO (AS A PERCENTAGE OF RISK-WEIGHTED AMOUNTS)

5

Common Equity Tier 1 ratio (%)

13.49%

12.81%

12.85%

12.80%

13.71%

6

Tier 1 ratio (%)

16.29%

15.35%

15.24%

14.99%

15.94%

7

Total capital ratio (%)

19.34%

18.69%

18.45%

17.79%

18.85%

ADDITIONAL OWN FUNDS REQUIREMENTS TO ADDRESS RISKS OTHER THAN THE RISK OF EXCESSIVE LEVERAGE (AS A PERCENTAGE OF RISK-WEIGHTED EXPOSURE AMOUNT)(1)

EU 7a

Additional own funds requirements to address risks other than the risk of excessive leverage (%)

2.12%

2.12%

2.12%

2.12%

1.75%

EU 7b

of which to be made up of CET1 capital (%)

1.19%

1.19%

1.19%

1.19%

0.98%

EU 7c

of which to be made up of Tier 1 capital (%)

1.59%

1.59%

1.59%

1.59%

1.31%

EU 7d

Total SREP own funds requirements (%)

10.12%

10.12%

10.12%

10.12%

9.75%

COMBINED BUFFER REQUIREMENT (AS A PERCENTAGE OF RISK-WEIGHTED EXPOSURE AMOUNT)

8

Capital conservation buffer (%)

2.50%

2.50%

2.50%

2.50%

2.50%

EU 8a

Conservation buffer due to macro-prudential or systemic risk identified at the level of a Member State (%)

-

-

-

-

-

9

Institution-specific countercyclical capital buffer (%)

0.16%

0.08%

0.05%

0.04%

0.04%

EU 9a

Systemic risk buffer (%)

-

-

-

-

-

10

Global Systemically Important Institution buffer (%)

1.00%

1.00%

1.00%

1.00%

1.00%

EU 10a

Other Systemically Important Institution buffer

-

-

-

-

-

11

Combined buffer requirement (%)

3.66%

3.58%

3.55%

3.54%

3.54%

EU 11a

Overall capital requirements (%)

13.78%

13.70%

13.67%

13.66%

13.29%

12

CET1 available after meeting the total SREP

own funds requirements (%)7.80%

7.12%

7.16%

7.11%

8.23%

LEVERAGE RATIO

13

Leverage ratio total exposure measure(2)

1,344,870

1,392.918

1,382,334

1,319,813

1,189,253

14

Leverage ratio

4.37%

4.10%

4.05%

4.28%

4.87%

ADDITIONAL OWN FUNDS REQUIREMENTS TO ADDRESS RISK OF EXCESSIVE LEVERAGE

(AS A PERCENTAGE OF LEVERAGE RATIO TOTAL EXPOSURE EXPOSURE AMOUNT)EU 14a

Additional own funds requirements to address

the risk of excessive leverage (%)-

-

-

-

-

EU 14b

of which to be made up of CET1 capital (%)

-

-

-

-

-

EU 14c

Total SREP leverage ratio requirements (%)(3)

3.00%

3.00%

3.00%

3.09%

3.09%

LEVERAGE RATIO BUFFER AND OVERALL LEVERAGE RATIO

EU 14d

Leverage ratio buffer requirement (%)

-

-

-

-

-

EU 14e

Overall leverage ratio requirements (%)(3)

3.00%

3.00%

3.00%

3.09%

3.09%

LIQUIDITY COVERAGE RATIO

15

Total high-quality liquid assets (HQLA)

(Weighted value – average)246,749

242,177

238,136

235,333

229,464

EU 16a

Cash outflows – Total weighted value

413,693

434,078

420,815

409,590

395,120

EU 16b

Cash inflows – Total weighted value

233,039

258,705

245,812

235,158

226,434

16

Total net cash outflows (adjusted value)

174,670

175.377

175,003

174,432

168,687

17

Liquidity coverage ratio (%)

141.41%

138.05%

136.00%

134.72%

135.95%

NET STABLE FUNDING RATIO

18

Total available stable funding

617,491

617,615

615,879

629,042

619,442

19

Total required stable funding

543,549

548,457

549,492

561,828

561,043

20

NSFR ratio (%)

113.60%

112.61%

112.08%

111.96%

110.41%

(1)The own funds requirement applicable to Societe Generale group in relation to Pillar 2 reaches 2.12% (of which 1.19% in CET1) until 31/12/2022 resulting in a total SREP own funds requirements of 10.12%.

(2)Over the whole historical period considered, the measurement of the leverage exposure has been taking into account the option to exempt temporarily some central bank exposures in accordance with the European regulation.

(3)The leverage ratio requirement applicable to Societe Generale group is 3.09% (enhancement of the initial regulatory requirement of 3% in relation to the abovementioned central bank exemption) until 3/31/2022 and then 3% effective 6/30/2022.

(in EURm)

TLAC

31.12.2022

30.09.2022

30.06.2022

31.03.2022

31.12.2021

OWN FUNDS AND ELIGIBLE LIABILITIES, RATIOS AND COMPONENTS(1)

1

Own funds and eligible liabilities

121,249

119,337

116,539

114,436

113,098

2

Total RWA of the Group

360,465

371,645

367,637

376,636

363,371

3

Own funds and eligible liabilities as a percentage of RWA

33.64%

32.11%

31.70%

30.38%

31.12%

4

Total exposure measure of the Group

1,344,870

1,392,918

1,382,334

1,319,813

1,189,253

5

Own funds and eligible liabilities as percentage of the total exposure measure

9.02%

8.57%

8.43%

8.67%

9.51%

6a

Does the subordination exemption in Article 72b(4) of the CRR apply? (5% exemption)

No

No

No

No

No

6b

Pro-memo item: Aggregate amount of permitted non-subordinated eligible liabilities in-struments

If the subordination discretion as per Article 72b(3) CRR is applied (max 3.5% exemption)11,430

9,287

9,023

7,114

6,921

6c

Pro-memo item: If a capped subordination exemption applies under Article 72b (3) CRR, the amount of funding issued that ranks pari passu

with excluded liabilities and that is recognised under row 1, divided by funding issued that ranks pari passu with excluded Liabilities and that would be recognised under row 1 if no cap was applied (%)100.00%

100.00%

100.00%

100.00%

100.00%

(1)With IFRS 9 phasing effect taken into account over the whole historical period considered.

As at 31 December 2022, the Group presents a TLAC ratio of 33.64% of risk-weighted assets (RWA) with the option of Senior preferred debt limited to 3.5% of RWA (the ratio being 30.47% without this option) for a regulatory requirement of 21.66%, and of 9.02% of the leverage exposure for a regulatory requirement of 6.75%.

-

2.1 RISK FACTORS BY CATEGORY

This section identifies the main risk factors that the Group estimates could have a significant effect on its business, profitability, solvency or access to financing.

As part of its internal risk management, Societe Generale has updated its risk typology. For the purposes of this section, these different types of risks have been grouped into six main categories (4.1 to 4.1.6), in accordance with Article 16 of the Regulation (EU) 2017/1129, also known as “Prospectus 3” regulation of 14 June 2017, according to the main risk factors that the Group believes could impact the risk categories. Risk factors are presented based on an evaluation of their materiality, with the most material risks indicated first within each category.

The diagram below illustrates how the categories of risks identified in the risk typology have been grouped into the six categories and which risk factors principally impact them.

2.1.1 RISKS RELATED TO THE MACROECONOMIC, GEOPOLITICAL, MARKET AND REGULATORY ENVIRONMENTS

2.1.1.1 The global economic and financial context, geopolitical tensions, as well as the market environment in which the Group operates, may adversely affect its activities, financial position and results of operations.

As a global financial institution, the Group’s activities are sensitive to changes in financial markets and economic conditions generally in Europe, the United States and elsewhere around the world. The Group generates 49% of its business in France (in terms of net banking income for the financial year ended 31 December 2022), 32% in Europe, 7% in the Americas and 12% in the rest of the world. The Group could face significant deteriorations in market and economic conditions resulting from, in particular, crises affecting capital or credit markets, liquidity constraints, regional or global recessions and fluctuations in commodity prices (notably oil and natural gas). Other factors could explain such deteriorations, such as variations in currency exchange rates or interest rates, inflation or deflation, rating downgrades, restructuring or defaults of sovereign or private debt, or adverse geopolitical events (including acts of terrorism and military conflicts). In addition, the Covid-19 crisis continues to have an impact mainly in China, where the so-called “Zero Covid” policy has begun to be relaxed. Such events, which can develop quickly and whose effects may not have been anticipated and hedged, could affect the Group’s operating environment for short or extended periods and have a material adverse effect on its financial position, cost of risk and results of operations.

The economic and financial environment is exposed to intensifying geopolitical risks. The war in Ukraine which began in February 2022 has led to high tensions between Russia and Western countries, with significant impacts on global growth, energy and raw materials prices, as well as on a humanitarian level. The economic and financial sanctions imposed by a large number of countries, particularly in Europe and the United States, against Russia and Belarus could significantly affect operators with direct or indirect links to Russia, with a material impact on the Group’s risks (credit and counterparty, market, reputation, compliance, legal, operational, etc.). The Group will continue to analyse in real time the global impact of this crisis and to take all necessary measures to comply with applicable regulations.

In Asia, US-China relations are fraught with trade tensions and the risk of technological fractures.

After a long period of low interest rates, the current inflationary environment is leading the major central banks to raise rates. The entire economy will need to adapt to a context of higher interest rates. In addition to the impact on the valuation of equities, interest rate-sensitive sectors such as real estate will have to adjust. The US Federal Reserve and the European Central Bank (ECB) are expected to continue to tighten monetary conditions in the first half of 2023 before taking a break as inflation recedes according to our predictions. In the meantime, inflation in the US and Europe continues to impact the price of services, food and energy.

This crisis could generate strong volatility on the financial markets and a significant drop in the price of certain financial assets, potentially leading to payment defaults, with consequences that are difficult to anticipate for the Group. In France, after the long period of low interest rates which fostered an upturn of the housing market, a reversal of activity in this area could have an adverse effect on the Group’s asset value and on business, by decreasing demand for loans and resulting in higher rates of non-performing loans. More generally, the higher interest rates environment in a context where public and private debts have tended to increase is an additional source of risk.

Considering the uncertainty generated by this situation, both in terms of duration and scale, these disruptions could persist throughout 2023 and have a significant impact on the activity and profitability of certain Group counterparties.

Against the backdrop of the continuing war in Ukraine, the reduction in Russian gas imports and the introduction of an embargo on Russian oil on 5 December 2022, the European energy sector is facing a more difficult and uncertain situation. Gas prices have risen and remain highly volatile. A total halt in Russian gas supplies combined with a post-Covid-19 economic recovery in China could lead to a further spike in gas prices, affecting European economic growth.

In the longer term, the energy transition to a “low-carbon economy” could adversely affect fossil energy producers, energy-intensive sectors of activity and the countries that depend on them.

With regard to financial markets, in the context of Brexit, the topic of non-equivalence of clearing houses (central counterparties, or CCPs) remains a point of vigilance, with possible impacts on financial stability, notably in Europe, and therefore on the Group’s business. In addition, capital markets (including foreign exchange activity) and securities trading activities in emerging markets may be more volatile than those in developed markets and may also be vulnerable to certain specific risks, such as political instability and currency volatility. These elements could negatively impact the Group’s activity and results of operations.

On the mobility market, due to the shortage of new car supply, demand for used vehicles has risen, pushing up resale prices sharply. As a result, ALD has recorded a historically high result on used vehicle sales for the past year. The Group is exposed to a potential loss in a financial year from (i) resale of vehicles related to leases which expire during the period whose resale value is lower than their net carrying amount and (ii) additional impairment during the lease period if residual value drops below contractual residual value. Future sales and estimated losses are impacted by external factors such as macroeconomic conditions, government policies, tax and environmental regulations, consumer preferences, new vehicle prices, etc. The Group anticipates for 2023 that supply chains may not return to normal immediately, which could support the resale prices of used vehicles.

The Group’s results are therefore exposed to the economic, financial, political and geopolitical conditions of the main markets in which the Group operates.

2.1.1.2 The Group’s failure to achieve its strategic and financial objectives disclosed to the market could have an adverse effect on its business, results of operations and the value of its financial instruments.

The Group is fully on track to achieving its strategic milestones and has set targets for profitable and sustainable growth out to 2025 with:

■average annual revenue growth of 3% or greater over the 2021-2025 period by focusing on growth in the most profitable businesses;

■an improved cost to income ratio equal to or lower than 62% in 2025 and ROTE of 10% based on a targeted CET1 ratio of 12% in 2025;

■disciplined management of scarce resources, in addition to keeping a tight rein on risks, will help strengthen and improve the quality of the Bank’s balance sheet;

More precisely, the Group’s “Vision 2025” project anticipates the merger between the Retail Banking network of Societe Generale in France and Crédit du Nord. Although this project has been designed to achieve controlled execution, the merger could have a short-term material adverse effect on the Group’s business, financial position and costs. System reconciliations could undergo delays, thereby postponing part of the expected merger benefits. The project could lead to some staff departures, requiring replacements and training efforts which could potentially generate additional costs. The merger could also lead to the departure of some of the Group’s customers, resulting in loss of revenue. The legal and regulatory aspects of the transaction could prompt delays and additional costs.

Following ALD’s announcement on 6 January 2022 of its plan to acquire LeasePlan, Societe Generale and ALD announced on 22 April 2022 the signing of a framework agreement, with the aim of creating a global leader in mobility solutions. The acquisition is subject to receiving certain regulatory approvals and to the performance of other standard conditions precedent.

The Group also announced in November 2022 the signing of a letter of intent with AllianceBernstein to combine the equity research and execution businesses in a joint venture to create a leading global franchise in these activities. This announcement was followed by the signature of an acquisition agreement in early February 2023.

The conclusion of final agreements on these strategic transactions depends on several stakeholders and, accordingly, is subject to a degree of uncertainty. The inability to close on the transactions would not have an immediate impact on the Group’s activity, but could potentially weigh on the share price, at least temporarily.

Societe Generale has placed Environmental, Social and Governance (ESG) at the heart of its strategy in order to contribute to positive transformations in the environment and the development of local regions. In this respect, the Group has made a certain number of commitments (see Chapter 2, page 46 and following and Chapter 5, page 289 and following). Failure to comply with these commitments, and those that the Group may make in the future, could harm its reputation. Furthermore, the rollout of these commitments may have an impact on the Group’s business model. Last, failure to make specific commitments could also generate reputation and strategic risk.

The Group may face execution risk on these strategic projects, which are to be carried out simultaneously. Any difficulty encountered during the process of integrating the activities (particularly from a human resources standpoint) is likely to generate higher integration costs and lower-than-anticipated savings, synergies and benefits. Moreover, the process of integrating the acquired operational businesses into the Group could disrupt the operations of one or more of its subsidiaries and divert General Management’s attention, which could have a negative impact on the Group’s business and results.

2.1.1.3 The Group is subject to an extended regulatory framework in each of the countries in which it operates and changes to this regulatory framework could have a negative effect on the Group’s businesses, financial position and costs, as well as on the financial and economic environment in which it operates.

The Group is subject to the laws of the jurisdictions in which it operates. This includes French, European and US legislation as well as other local laws in light of the Group’s cross-border activities, among other factors. The application of existing laws and the implementation of future legislation require significant resources that could affect the Group’s performance. In addition, possible failure to compliance with laws could lead to fines, damage to the Group’s reputation, force the suspension of its operations or, in extreme cases, the withdrawal of operating licences.

■several regulatory changes are still likely to significantly alter the framework for Market activities: (i) the possible strengthening of transparency constraints related to the implementation of the new requirements and investor protection measures (review of MiFID II/MiFIR, IDD, ELTIF (European Long-Term Investment Fund Regulation)), (ii) the implementation of the fundamental review of the trading book, or FRTB, which may significantly increase requirements applicable to European banks and (iii) possible relocations of clearing activities could be requested, despite the European Commission’s decision of 8 February 2022 to extend the equivalence granted to UK central counterparties until 30 June 2025;

■new requirements resulting from the EU banking regulation reform proposal presented on 27 October 2021 by the European Commission. The reform consists of several legislative instruments to amend the directive on capital requirements (European Parliament and EU Council, Directive 2013/36/EU, 26 June 2013) as well as the regulation on capital requirements (CRR) (European Parliament and EU Council, regulation (EU) No. 575/2013, 26 June 2013);

■in the United States, the implementation of the Dodd-Frank Act has almost been finalised. The Securities and Exchange Commission’s (SEC) regulations relating to security-based swap dealers have been implemented and Societe Generale has been registered with the SEC as a Securities Based Swap Dealer;

■european measures aimed at restoring banks’ balance sheets, especially through active management of non-performing loans (“NPLs”), which are leading to a rise of prudential requirements and an adaptation of the Group’s strategy for managing NPLs. More generally, additional measures to define a framework of good practices for granting (e.g., loan origination orientations published by the European Banking Authority) and monitoring loans could also have an impact on the Group;

■the strengthening of data quality and protection requirements and a future strengthening of cyber-resilience requirements in relation to the adoption by the Council on 28 November 2022, which completes the legislative process, of the European directive and regulation package on digital operational resilience for the financial sector;

■the implementation of the European sustainable finance regulatory framework, with an increase in non-financial reporting obligations, enhanced inclusion of environmental, social and governance issues in risk management activities and the inclusion of such risks in the supervisory review and assessment process (Supervisory Review and Evaluation Process, or SREP);

■the strengthening of the crisis prevention and resolution regime set out in the Bank Recovery and Resolution Directive of 15 May 2014 (“BRRD”), as revised, which gives the Single Resolution Board (“SRB”) the power to initiate a resolution procedure towards a credit institution when the point of non-viability is considered reached. In this context, the SRB could, in order to limit the cost to the taxpayer, force some creditors and the shareholders of the Group to incur losses in priority. Should the resolution mechanism be triggered, the Group could, in particular, be forced to sell certain of its activities, modify the terms and conditions of the remuneration of its debt instruments, issue new debt instruments, accept a depreciation of its debt instruments or convert them into equity securities.

-the potential requirement at the European level to open more access to banking data to third-party service providers,

-new obligations arising from a package of proposed measures announced by the European Commission on 20 July 2021 aiming to strengthen the European supervisory framework around the fight against money laundering and terrorist financing, as well as the creation of a new European agency to fight money laundering;

■from 2023, new regulatory texts will enter into force concerning rate risk of Banking Book (stress on IM, caps on maturity of deposits flows, ...) and credit rate of banking portfolio. These new texts could constrain certain aspects of rate and credit risk monitoring.

The Group is also subject to complex tax rules in the countries where it operates. Changes in applicable tax rules, uncertainty regarding the interpretation of certain evolutions or their effects may have a negative impact on the Group’s business, financial position and costs.

Moreover, as an international bank that handles transactions with US persons, denominated in US dollars, or involving US financial institutions, the Group is subject to US regulations relating in particular to compliance with economic sanctions, the fight against corruption and market abuse. More generally, in the context of agreements with US and French authorities, the Group largely implemented, through a dedicated programme and a specific organisation, corrective actions to address identified deficiencies and strengthen its compliance programme. In the event of a failure to comply with relevant US regulations, or a breach of the Group’s commitments under these agreements, the Group could be exposed to the risk of (i) administrative sanctions, including fines, suspension of access to US markets, and even withdrawals of banking licences, (ii) criminal proceedings, and (iii) damage to its reputation.

2.1.1.4 Increased competition from banking and non-banking operators could have an adverse effect on the Group’s business and results, both in its French domestic market and internationally.

Due to its international activity, the Group faces intense competition in the international and local markets in which it operates, whether from banking or non-banking actors. As such, the Group is exposed to the risk of not being able to maintain or develop its market share in its various activities. This competition may also lead to pressure on margins, which would be detrimental to the profitability of the Group’s activities.

Consolidation in the financial services industry could result in the competitors benefiting from greater capital, resources and an ability to offer a broader range of financial services. In France and in the other main markets where the Group operates, the presence of major domestic banking and financial actors, as well as new market participants (notably neo-banks and online financial services providers), has increased competition for virtually all products and services offered by the Group. New market participants such as “fintechs” and new services that are automated, scalable and based on new technologies (such as blockchain) are developing rapidly and are fundamentally changing the relationship between consumers and financial services providers, as well as the function of traditional retail bank networks. Competition with these new actors could be exacerbated by the emergence of substitutes for central bank currency (crypto-currencies, digital central bank currency, etc.), which themselves carry risks.

Moreover, competition is also enhanced by the emergence of non-banking actors that, in some cases, may benefit from a regulatory framework that is more flexible and in particular less demanding in terms of equity capital requirements.

To address these challenges, the Group has implemented a strategy, in particular with regard to the development of digital technologies and the establishment of commercial or equity partnerships with these new actors (such as Lumo, the platform offering green investments, or Shine, the neobank for professionals). In this context, additional investments may be necessary for the Group to be able to offer new innovative services and to be competitive with these new actors. This intensification of competition could, however, adversely affect the Group’s business and results, both on the French market and internationally.

2.1.1.5 Environmental, social and governance (ESG) risks, in particular related to climate change, could have an impact on the Group’s activities, results and financial situation in the short-, medium- and long-term.

Environmental, social and governance (ESG) risks are defined as risks stemming from the current or prospective impacts of ESG factors on counterparties or invested assets of financial institutions. ESG risks are seen as aggravating factors to the traditional categories of risks (credit risks, counterparty risks, market risks, structural risks (including liquidity and funding risks), operational risks, reputational risks, compliance risks and risks related to insurance activities) and are likely to impact the Group’s activities, results and financial position in the short, medium and long-term.

The Group is thus exposed to environmental risks, and in particular climate change risks through certain of its financing, investment and service activities. Concerning climate risks, a distinction is made between (i) physical risk, with a direct impact on entities, people and property stemming from climate change and the multiplication of extreme weather events; and (ii) transition risk, which results from the process of transitioning to a low-carbon economy, such as regulatory or technological disruptions or changes in consumer preferences.

The Group could be exposed to physical risk resulting from a deterioration in the credit quality of its counterparties whose activity could be negatively impacted by extreme climatic events or long-term gradual changes in climate, and through a decrease in the value of collateral received (particularly in the context of real estate financing in the absence of guarantee mechanisms provided by specialized financing companies).

Beyond the risks related to climate change, risks more generally related to environmental degradation (such as the risk of loss of biodiversity) are also aggravating factors to the Group’s risks. The Group could notably be exposed to credit risk on a portion of its portfolio, linked to lower profitability of some of its counterparties due, for example, to increasing legal and operating costs (for instance due to the implementation of new environmental standards).

In addition, the Group is exposed to social risks, related for example to non-compliance by some of its counterparties with labour rights or workplace health and safety issues, which may trigger or aggravate reputational and credit risks for the Group.

Similarly, risks relating to governance of the Group’s counterparties and stakeholders (suppliers, service providers, etc.), such as an inadequate management of environmental and social issues, could generate credit and reputational risks for the Group.

Beyond the risks related to its counterparties or invested assets, the Group could also be exposed to risks related to its own activities. Therefore, the Group is exposed to physical climate risk with respect to its ability to maintain its services in geographical areas impacted by extreme events (floods, etc.).

The Group also remains exposed to specific social and governance risks, relating for example to the operational cost of implementation of regulations related to labour laws and the management of its human resources.

All of these risks could have an impact on the Group’s business, results and reputation in the short-, medium- and long-term.

2.1.1.6 The Group is subject to regulations relating to resolution procedures, which could have an adverse effect on its business and the value of its financial instruments.

The BRRD and Regulation (EU) No. 806/2014 of the European Parliament and of the Council of the European Union of 15 July 2014 (the Single Resolution Mechanism, or “SRM”) define a European Union-wide framework for the recovery and resolution of credit institutions and investment firms. The BRRD provides the authorities with a set of tools to intervene early and quickly enough in an institution considered to be failing so as to ensure the continuity of the institution’s essential financial and economic functions while reducing the impact of the failure of an institution on the economy and the financial system (including the exposure of taxpayers to the consequences of the failure). Under the SRM Regulation, a centralized resolution authority is established and entrusted to the SRB and national resolution authorities.

The powers granted to the resolution authority under the BRRD and the SRM Regulations include write-down/conversion powers to ensure that capital instruments and eligible liabilities absorb the Group’s losses and recapitalize it in accordance with an established order of priority (the “Bail-in Tool”). Subject to certain exceptions, losses are borne first by the shareholders and then by the holders of additional Tier 1 and Tier 2 capital instruments, then by the non-preferred senior debt holders and finally by the senior preferred debt holders, all in the order of their claims in a normal insolvency proceeding. The conditions for resolution provided by the French Monetary and Financial Code implementing the BRRD are deemed to be met if: (i) the resolution authority or the competent supervisory authority determines that the institution is failing or likely to fail; (ii) there is no reasonable perspective that any measure other than a resolution measure could prevent the failure within a reasonable timeframe; and (iii) a resolution measure is necessary to achieve the resolutions’ objectives (in particular, ensuring the continuity of critical functions, avoiding a significant negative effect on the financial system, protecting public funds by minimizing the recourse to extraordinary public financial support, and protecting customers’ funds and assets) and the winding up of the institution under normal insolvency proceedings would not meet these objectives to the same extent.

The resolution authority could also, independently of a resolution measure or in combination with a resolution measure, proceed with the write-down or conversion of all or part of the Group’s capital instruments (including subordinated debt instruments) into equity if it determines that the Group will no longer be viable unless it exercises this write-down or conversion power or if the Group requires extraordinary public financial support (except where the extraordinary public financial support is provided in the form defined in Article L. 613-48 III, 3° of the French Monetary and Financial Code).

The Bail-in Tool could result in the write-down or conversion of capital instruments in whole or in part into ordinary shares or other ownership instruments.

In addition to the Bail-in Tool, the BRRD provides the resolution authority with broader powers to implement other resolution measures with respect to institutions that meet the resolution requirements, which may include (without limitation) the sale of the institution’s business segments, the establishment of a bridge institution, the split of assets, the replacement or substitution of the institution as debtor of debt securities, changing the terms of the debt securities (including changing the maturity and/or amount of interest payable and/or the imposition of a temporary suspension of payments), the dismissal of management, the appointment of a provisional administrator and the suspension of the listing and admission to trading of financial instruments.

Before taking any resolution action, including the implementation of the Bail-in Tool, or exercising the power to write down or convert relevant capital instruments, the resolution authority must ensure that a fair, prudent and realistic valuation of the institution’s assets and liabilities is made by a third party independent of any public authority.

The application of any measure under the French implementing provisions of the BRRD or any suggestion of such application to the Group could have a material adverse effect on the Group’s ability to meet its obligations under its financial instrument and, as a result, holders of these securities could lose their entire investment.

In addition, if the Group’s financial condition deteriorates, the existence of the Bail-in Tool or the exercise of write-down or conversion powers or any other resolution tool by the resolution authority (independently of or in combination with a resolution) if it determines that Societe Generale or the Group will no longer be viable could result in a more rapid decline in the value of the Group’s financial instruments than in the absence of such powers.

-

3.1 SUITABILITY OF RISK MANAGEMENT SYSTEMS

The Pillar 3 report, published under the responsibility of Societe Generale Group’s Senior Management, sets out, in accordance with the CRR regulation, the quantitative and qualitative information on Societe Generale’s capital, liquidity and risk management to ensure transparency in respect of the various market players. This information has been prepared in compliance with the internal control procedures approved by the Board of Directors in the course of the validation of the Group Risk Appetite Framework and Group Risk Appetite Statement, and are based, among other things, on the annual review, by General Management in the Group Internal Control Coordination Committee (GICCC) and by the Risk Committee of the Board of Directors, of Societe Generale's Risk division, particularly in its ability to exercise its role as the second line of defense for the entire Group.

-

3.2 RISK APPETITE

Risk appetite is defined as the level of risk that the Group is prepared to accept to achieve its strategic and financial goals.

The Group’s ambition is to push ahead with sustainable development based on a diversified and balanced banking model with a strong European anchor and a targeted global presence in selected areas of strong business expertise. The Group also wishes to maintain long-term relationships with its clients built on the mutual confidence deserved and to meet the expectations of all of its stakeholders by providing them with responsible and innovative financial solutions.

■an organisation with 14(1) Business Units offering various products and services to the Group’s clients in different geographic locations;

-a preponderance of retail banking activities in France and abroad, which currently represent more than 50% of risk weighted assets (“RWA”) of the Group,

-limitation of Business Unit Global Markets’ share in the RWA of the Group. In accordance with its client-focused development strategy, the Group ceased its trading activities for its own account(2) in 2019, and finalised its project to simplify the products processed in 2021,

-non-bank services activities, in particular Insurance and operating leasing activities are conducted in line with the business strategy; they demonstrate a disciplined risk profile and thus generate profitability compliant with the Group’s expectations;

-in Retail Banking, the Group focuses on international development (excluding Russia) where it benefits from a historical presence, extensive market knowledge and top-tier positions, in Retail Banking activities,

-as regards Global Banking and Investor Solutions, apart from historical establishments, the Group targets activities for which it can leverage international expertise;

■a targeted growth policy, favoring existing areas of expertise, the sound quality business fund and the search for synergies in the diversified banking model;

■a positive and sustainable contribution to the transformations of our economies, in particular with regard to the technological revolution, and economic, social and environmental transitions; CSR concerns are therefore at the heart of its strategy and the Group’s relationships with stakeholders (internal and external);

■a strong vigilance as regards its reputation, deemed by the Group to be a high-value asset which must be protected.

The Group seeks to achieve sustainable profitability, relying on a robust financial profile consistent with its diversified banking model, by:

■maintaining a rating allowing access to financial resources at a cost consistent with the development of the Group’s businesses and its competitive positioning;

-compliance with the financial conglomerate ratio which considers the combined solvency of the Group’s banking and insurance activities,

-a sufficient level of creditor protection consistent with a debt issuance program that is particularly hybrid consistent with the Group’s objectives in terms of rating and regulatory ratios such as Tier 1, TLAC (“Total Loss Absorbing Capacity”), MREL (“Minimum Required Eligible Liabilities”), and the leverage ratio;

(2)In accordance with French Banking Law, the few residual trading activities of the Group unrelated to clients were isolated in a dedicated subsidiary called Descartes Trading.

■ensuring resilience of its liabilities, which are calibrated by taking into account a survival horizon in a liquidity stress ratio, compliance with LCR (Liquidity Coverage Ratio) and NSFR (Net Stable Funding Ratio) regulatory ratios and the level of dependence on short-term fundings and the foreign exchange needs of the Group’s businesses, particularly in dollars;

Credit risk appetite is managed through a system of credit policies, risk limits and pricing policies.

When it takes on credit risk, the Group focuses on medium- and long-term client relationships, targeting both clients with which the Bank has an established relationship of trust and prospects representing profitable business development potential over the mid-term.

Acceptance of any credit commitment is based on in-depth client knowledge and a thorough understanding of the purpose of the transaction.

In particular, concerning the underwriting risk, the Group, mainly through GLBA, makes a “steadfast commitment” to transactions at a guaranteed price as debt financing arranger, prior to syndicating them to other banking syndicates and institutional investors. If market conditions deteriorate or markets close while the placement is under way, these transactions may create a major over-concentration risk (or losses, if the transaction placement requires selling below the initial price).

The Group limits the cumulative amount of approved underwriting or underwriting positions in order to limit its risk in the event of a prolonged closure of the debt markets.

In a credit transaction, risk acceptability is based first on the borrower’s ability to meet its commitments, in particular through the cash flows which will allow the repayment of the debt. For medium and long-term operations, the funding duration must remain compatible with the economic life of the financed asset and the visibility horizon of the borrower’s cash flow.

Security interests are sought to reduce the risk of loss in the event of a counterparty defaulting on its obligations, but may not, except in exceptional cases, constitute the sole justification for taking the risk. Security interests are assessed with prudent value haircuts and paying special attention to their actual enforceability.

Complex transactions or those with a specific risk profile are handled by specialised teams within the Group with the required skills and expertise.

The Group seeks risk diversification by controlling concentration risk and maintaining a risk allocation policy through risk sharing with other financial partners (banks or guarantors).

Counterparty ratings are a key criterion of the credit policy and serve as the basis for the credit approval authority grid used in both the commercial and risk functions. The rating framework relies on internal models. Special attention is paid to timely updating of ratings (which, in any event, are subject to annual review)(1).

The risk measure of the credit portfolio is based primarily on the Basel parameters that are used to calibrate the capital need. As such, the Group relies for the internal rating of counterparties on Balois models allowing the assessment of credit quality, supplemented for “non-retail” counterparties, by expert judgment. These measures are complemented by an internal stress-sized risk assessment, either at the global portfolio level or at the sub-portfolio level, linking risk measures and rating migration to macro-economic variables most often to say expert. In addition, the calculation of expected losses under the provisions of IFRS 9, used to determine the level of impairment on healthy outstandings, provides additional insight into assessing portfolio risk.

In consultation with the Risk Department, the businesses implement, most of the time, pricing policies that are differentiated according to the level of risk of counterparties and transactions. The purpose of pricing a transaction is to ensure acceptable profitability, in line with the objectives of ROE (Return on Equity) of the business or entity, after taking into account the cost of the risk of the transaction in question. The pricing of an operation can nevertheless be adapted in certain cases to take into account the overall profitability and the potential customer relationship development. The intrinsic profitability of products and customer segments is subject to periodic analysis in order to adapt to changes in the economic and competitive environment.

Proactive management of counterparties whose situation has deteriorated is key to containing the risk of final loss in the event of counterparty failure. As such, the Group has put in place rigorous procedures for monitoring non retail counterparties and/or for closer monitoring of retail counterparties whose risk profiles are deteriorating. In addition, the businesses and entities, in conjunction with the Risk and Finance Departments, and through collaborators specialising in recovery and litigation, work together to effectively protect the Bank’s interests in the event of default.

Concerning ESG risks (Environmental, Social & Governance), the assessment and management of the impact of ESG risk factors on credit risk is based in particular on the establishment of exclusion lists, portfolio alignment indicators (oil and gas and electricity production for example) and sensitivity analyses (in particular transition risk via the CCVI or Corporate Climate Vulnerability Index).

In general, credit granting policies must comply with the criteria defined within the framework of the Group’s Social and Environmental Responsibility (CSR) policy, which is broken down through:

■the general environmental and social principles and the sectoral and cross-cutting policies appended to them. Sector policies cover sectors considered potentially sensitive from an environmental, social or ethical point of view;

■the targets for alignment with the objectives of the Paris agreement, which the Group has set itself, starting with the sectors with the highest CO2 emissions;

■commitment to granting sustainable financing classified as Sustainable and Positive Impact Finance and to sustainability linked transactions.

Risks related to climate change (physical and transition risks), which are an aggravating factor in the types of risks facing the Bank must be taken into account in risk assessment processes. An assessment of climate vulnerability (particularly in terms of transition risk) must be provided by the Business Unit for certain specific sectors and may have an impact on the internal rating so that it incorporates the client’s adaptation strategy (See also section 4.13 “Environmental, social and governance risks” of this Universal Registration Document).

The future value of exposure to a counterparty as well as its credit quality are uncertain and variable over time, both of which are affected by changes in market parameters. Thus, counterparty credit risk management is based on a combination of several types of indicators:

■indicators of potential future exposures (potential future exposures, or PFE), aimed at measuring exposure to our counterparties:

-the Group controls idiosyncratic counterparty credit risks via a set of CVaR(1) limits. The CVaR measures the potential future exposure linked to the replacement risk in the event of default by one of the Group’s counterparties. The CVaR is calculated for a 99% confidence level and different time horizons, from one day until the maturity of the portfolio,

-in addition to the risk of a counterparty default, the CVA (Credit Valuation Adjustment) measures the adjustment of the value of our portfolio of derivatives and repos account the credit quality of our counterparties;

■the abovementioned indicators are supplemented by stress test impacts frameworks or on nominal ones in order to capture risks that are more difficult to measure:

-the more extreme correlation risks are measured via stress tests at different levels (wrong-way risk, stress monitoring at sector level, risk on collateralised financing activities and agency),

-the CVA risk is measured via a stress test in which representative market scenarios are applied, notably involving the credit spreads of our counterparties;

-the amount of collateral posted for each segment of a CCP: the initial posted margins, both for our principal and agency activities, and our contributions to CCP default funds,

-in addition, a stress test measures the impact linked to (i) the default of an average member on all segments of a CCP and (ii) the failure of a major member on a segment of a CCP;

■the Global Stress Test on market activities includes cross market-counterparty risks, it is described in more detail in the “Market risk” section;

■besides, a specific framework that has been set up aims to avoid individual concentration related to counterparty risk in market operations.

The Group’s market activities are carried out as part of a business development strategy primarily focused on meeting client requirements through a full range of products and solutions.

Market risk is managed through a set of limits for several indicators (such as stress tests, Value at Risk (VaR) and stressed Value at Risk (SVaR), “Sensitivity” and “Nominal” indicators). These indicators are governed by a series of limits proposed by the business lines and approved by the Risk Division during the course of a discussion-based process.

The choice of limits and their calibration reflect qualitatively and quantitatively the fixing of the Group’s appetite for market risks. A regular review of these frameworks also enables risks to be tightly controlled according to changing market conditions with, for example, a temporary reduction of limits in case of a deterioration. Warning thresholds are also in place to prevent the possible occurrence of overstays.

Limits are set at different sub-levels of the Group, thereby cascading down the Group’s risk appetite from an operational standpoint within its organisation.

Within these limits, the Global Stress Test limits on market activities and the Market Stress Test limits play a pivotal role in determining the Group’s market risk appetite; in fact, these indicators cover all operations and the main market risk factors as well as risks associated with a severe market crisis which helps limit the total amount of risk and takes account of any diversification effects.

Non-financial risks are defined as non-compliance risk, risk of inappropriate conduct, IT risk, cybersecurity risk, other operational risks, including operational risk associated with credit risk, market risk, model risk, liquidity and financing, structural and rate risk. These risks can lead to financial losses.

As a general rule, the Group has no appetite for operational risk or for non-compliance risk. Furthermore, the Group maintains a zero-tolerance policy on incidents severe enough to potentially inflict serious harm to its image, jeopardise its results or the trust displayed by customers and employees, disrupt the continuity of critical operations or call into question its strategic focus.

The Group underscores that it has is no or very low tolerance for operational risk involving the following:

■internal fraud: the Group does not tolerate unauthorised trading by its employees. The Group’s growth is founded on trust, as much between employees as between the Group and its employees. This implies respecting the Group’s principles at every level, such as exercising loyalty and integrity. The Group’s internal control system must be capable of preventing acts of major fraud;

■cybersecurity: the Group has zero tolerance for fraudulent intrusions, disruption of services, compromise of elements of its information system, in particular those which would lead to theft of assets or theft of customer data. The Bank aims to put in place effective means to prevent and detect this risk. It has a barometer that measures the degree of maturity of the cybersecurity controls deployed within its entities and the appropriate organisation to deal with any incidents;

■data leaks: trust is the main asset of the Societe Generale Group. Consequently the Group is committed to deploying the necessary resources and implementing controls to prevent, detect and remediate data leaks. It does not tolerate any leaks of its most sensitive information, in particular that of customer data;

(1)The CVaR economic indicator is built on the samemodeling assumptions as the regulatory Effective Expected Positive Exposure (EEPE) indicator used to calculate RWAs.

■business continuity: the Group relies heavily on its information systems to perform its operations and is therefore committed to deploying and maintaining the resilience of its information systems to ensure the continuity of its most essential services. The Group has very low tolerance for the risk of downtime in its information systems that perform essential functions, in particular systems directly accessible to customers or those enabling to conduct business on financial markets;

■outsourced services: the Group seeks to achieve a high degree of thoroughness in the control of its activities entrusted to external service providers. As such, the Group adheres to a strict policy of reviewing its providers the frequency of which depends on their level of risk;

■managerial continuity: the Group intends to ensure the managerial continuity of its organisation to avoid the risk of a long-term absence of a manager that would question the achievement of its strategic objectives, which might threaten team cohesion or disrupt the Group’s relationships with its stakeholders;

■physical security: the Societe Generale Group applies security standards to protect personnel, tangible and intangible assets in all the countries where it operates. The Group Security Department ensures the right level of protection against hazards and threats, in particular through security audits on a list of sites that it defines;

■execution errors: the Societe Generale Group has organized its day-to-day transaction processes and activities through procedures designed to promote efficiency and mitigate the risk of errors. Notwithstanding a robust framework of internal control systems, the risk of errors cannot be completely avoided. The Group has a low tolerance for execution errors that would result in very high impacts for the Bank or its clients.

The Group measures and strictly controls structural risks. The mechanism whereby rate risk, foreign exchange risk and the risk on pension/long-service obligations is controlled is based on sensitivity or stress limits which are broken down within the various businesses (entities and business lines).

There are four main types of risk: rate level risk, curve risk book, optional risk (arising from automatic options and behavioral options) and basis risk, related to the impact of relative changes in interest rates indices. The Group’s structural interest rate risk management primarily relies on the sensitivity of Net Present Value (“NPV”) of fixed-rate residual positions (excesses or shortfalls) to interest rate changes according to several interest rate scenarios. The limits are established either by the Board of Directors or by the Finance Committee, at the Business Unit/Service Unit and Group levels. Furthermore, the Group measures and controls the sensitivity of its net interest margin (“NIM”) on different horizons.

The Group’s policy in terms of structural exchange rate risks consists of limiting as much as possible the sensitivity of its CET1 capital ratio to changes in exchange rates, so that the impact on the CET1 ratio of an appreciation or a depreciation of all currencies against the euro does not exceed a certain threshold in terms of bp by summing the absolute values of the impact of each currency.

Regarding risks to pension and long-service obligations, which are the Bank’s long-term obligations towards its employees, the amount of the provision is monitored for risk on the basis of a specific stress test and an attributed limit. The risk management policy has two main objectives: reduce risk by moving from defined-benefit plans to defined-contribution plans and optimise asset risk allocation (between hedge assets and performance assets) where allowed by regulatory and tax constraints.

■compliance with regulatory liquidity ratios, with precautionary buffers: LCR (liquidity coverage ratio) ratios that reflect a stress situation and NSFR (net stable funding ratio);

■maintaining a liability structure to meet the Group’s regulatory constraints (Tier1, Total Capital, Leverage, TLAC, NSFR, MREL) and complying with rating agencies’ constraints to secure a minimum rating level;

■recourse to market financing: annual long-term issuance programs and a stock of moderate structured issues and short-term financing raised by supervised treasuries.

The Group is committed to defining and deploying internal standards to reduce model risk on the basis of key principles, including the creation of three independent lines of defence, the proportionality of due diligence according to each model’s level of risk inherent, the consideration of the models’ entire lifecycle and the appropriateness of the approaches within the Group.

A wrong design, implementation, use or a non rigorous models monitoring can have two mains unfavorable consequences: an under estimation of equity based of models validated by Regulators and/or financial losses.

Risk model appetite is defined for the perimeter of this group of models: credit risk IRB and IFRS 9, market and counterparty risk, market product valuation, ALM, trading model, compliance and granting.

The Group conducts Insurance activities (Life Insurance and Savings, Retirement savings, Property & Casualty Insurance, etc.) which exposes the Group to two major types of risks:

■risks related to financial markets (interest rate, credit and equity) and asset-liability management.

The Group has limited appetite for financial holdings, such as proprietary private equity transactions. The investments allowed are mainly related to:

■commercial support for the network through the private equity activity of the Societe Generale and Crédit du Nord network and certain subsidiaries abroad;

■taking stakes, either directly or through investment funds, in innovative companies via SG Ventures;

■the takeover of stakes in local companies: Euroclear, Crédit Logement, etc., which does not have limit.

-

3.3 RISK APPETITE – GENERAL FRAMEWORK

Risk appetite is determined at Group level and attributed to the businesses and subsidiaries. Monitoring of risk appetite is performed according to the principles described in the Risk Appetite Framework governance and implementation mechanism, which are summarised below.

-approves each year the Group Risk Appetite Statement and the Group Risk Appetite Framework, as well as the Group Risk Appetite Framework,

-approves in particular the main Group risk appetite indicators (Board of Directors indicators) validated beforehand by General Management,

-ensures that risk appetite is relevant to the Group’s strategic and financial objectives and its vision of the risks of the macro-economic and financial environment,

-reviews quarterly the risk appetite dashboards presented to it, and is informed of risk appetite overruns and remediation action plans,

-sets the compensation of corporate officers, sets out the principles of the remuneration policy applicable in the Group, especially for regulated persons whose activities may have a significant impact on the Group’s risk profile, and ensures that they are in line with risk management objectives.

-approves the document summarizing the Group’s risk appetite Statement and its Risk Appetite Framework based on the proposal of the Chief Risk Officer and the Chief Financial Officer,

-ensures that the risk appetite for the Group’s Business Units and eligible subsidiaries/branches is formalised and translated into frameworks consistent with the Group’s risk appetite,

-ensures internal communication of risk appetite and its transposition in the Universal Registration Document.

In addition, the main mission of the Risk Department is to draw up the document summarizing the Group’s risk appetite, as well as the implementation of a risk management, monitoring and control system.

The Finance Department contributes to setting this risk appetite in the framework of indicators under the responsibility of the Finance Committee (profitability, solvency, liquidity and structural risks).

The Compliance Department is also responsible for instructing the risk appetite setting for indicators falling within its scope.

The risk identification process is a key process of the Group risk-management framework. It is a Group-wide process to identify all risks that are or might be material. The approach is comprehensive and holistic: it covers all risk types(1) and all Group exposures.

In addition to the annual review of the Group’s risk taxonomy yearly reviewed and published in the SG Code, risk identification process is based on two pillars in order to ensure a complete and up-to-date view of all the material risks facing the Group:

■risk management governance and key Committees such as CORISQs or COFI (at Group or Business Unit level), COMCO and New Product Committees making it possible to monitor changes in the risk profile for all types of risk (credit, market, operational, etc.). In addition to monitoring well-identified risks, this governance can also generate a debate between risk experts and senior management on emerging risks. This debate is fueled by the latest market news, early warning signals, internal alerts, and more;

(1)Risks are classified on the basis of the Group’s risk taxonomy, which names and defines risk categories and their possible sub-categories.

■a series of exercises aimed at identifying additional risks, for example arising from changes in macroeconomic or sectoral conditions, financial markets, regulatory constraints, competitors or market pressure, business model (concentration effects) and changes in banking organisations. These additional identification exercises are also organised by risk types, but include some identification of cross-risk effects (e.g. credit and market or credit and operational). For a given type of risk, these exercises analyse and segment the Group’s exposure along several axes (Business Unit, activity, customer, product, region, etc.). The underlying risk factors are identified for the perimeters where this risk is assessed as being significant.

When a significant risk is identified, a risk management system, which may include a quantitative risk appetite (risk ceiling or threshold) or a risk policy, is implemented.

In addition, where possible, the risk factors underlying a significant risk are identified and combined in a dedicated scenario, and the associated loss is then quantified by means of a stress test (see also section “Risk quantification and stress test system”).

Within the Group, stress tests, a key attribute of risk management, contribute to the identification, measurement and management of risks, as well as to the assessment of the adequacy of capital and liquidity to the Group’s risk profile.

The purpose of the stress tests is to cover and quantify, resulting from the Risk Identification annual process, all the material risks to which the Group is exposed and to inform key management decisions. They thus assess what the behavior of a portfolio, an activity, an entity or the Group would be in a degraded business context. It is essential in building the forward-looking approach required for strategic/financial planning. In this context, they constitute a privileged measure of the resilience of the Group, its activities and its portfolios, and are an integral part of the process of developing risk appetite.

The Group stress testing framework combines stress tests in line with the stress testing taxonomy set by the EBA. Group-wide stress tests should cover all legal entities in the Group consolidation perimeter, subject to risk materiality.

■stress tests based on scenarios: application of historical and/or hypothetical conditions but which must remain plausible and in conjunction with the Economic and Sector Studies department, to a set of risk factors (interest rates, GDP, etc.);